Universal Health Services, Inc. (UHS) is a leading healthcare services company that owns and operates a broad network of acute care hospitals, behavioral health facilities, outpatient centers and related healthcare services. Headquartered in King of Prussia, Pennsylvania, UHS provides a wide range of medical and psychiatric care, aiming to deliver high-quality patient services through its Acute Care Hospital and Behavioral Health Care segments. UHS’ market cap is around $12.7 billion.

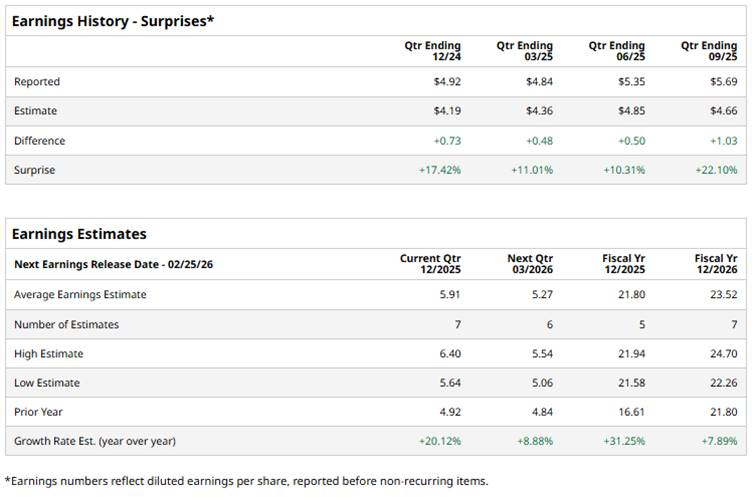

It is expected to announce its fiscal Q4 earnings results soon. Ahead of this event, analysts predict the company will report a profit of $5.91 per share, up 20.1% from $4.92 per share in the year-ago quarter. The company has surpassed Wall Street’s earnings estimates in each of the last four quarters.

For fiscal 2025, analysts expect UHS to report an EPS of $21.80, up 31.3% from $16.61 in fiscal 2024. Its EPS is likely to rise 7.9% annually to $23.52 in fiscal year 2026.

Over the past 52 weeks, shares have surged 8.2%, compared to the S&P 500 Index’s ($SPX) 13.3% gains and the State Street Health Care Select Sector SPDR ETF’s (XLV) 10.9% returns over the same period.

Over the past 52 weeks, Universal Health Services’ stock has demonstrated modest growth, driven largely by consistent earnings beats, fueled by strong patient demand and increased revenue in both acute care and behavioral health segments.

In Q3 2025, UHS reported an adjusted EPS of $5.69, representing a 53.4% year-over-year (YOY) increase and exceeding consensus estimates. Total net revenues for the quarter were about $4.5 billion, up 13.4% YOY. Within this, the Acute Care segment saw robust growth, with same-facility net revenues rising about 12.8%. The Behavioral Health segment also contributed positively, with same-facility net revenues up around 9.3%.

Analysts’ consensus view on UHS is fairly bullish, with a “Moderate Buy” rating overall. Among 20 analysts covering the stock, eight recommend “Strong Buy,” one gives a “Moderate Buy,” 10 suggest “Hold,” while one advises a “Moderate Sell.” UHS’ average analyst price target of $250.41 indicates a premium of 25.3% from the prevailing price levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart