The semiconductor sector is hot again as artificial intelligence (AI) and industrial automation drive demand. Investors are increasingly rotating back into chipmakers that benefit from long product cycles and mission-critical applications rather than short-term consumer trends.

Analog Devices (ADI), a leader in analog and mixed-signal chips, has emerged as a clear beneficiary of this shift, and has surged on strong end-market trends. After the company's recent earnings beats, analysts have turned markedly bullish. Stifel Nicolaus raised its ADI price target to $330, calling out ADI stock as a leader in analog and Edge AI, areas the firm expects to gain importance in 2026. More bullishly, KeyBanc now carries a Street-high $375 target on ADI for 2026.

These lofty targets, coupled with ADI’s near-record share price, have sparked questions about the stock’s upside and underlying fundamentals. Analog Devices' exposure to industrial, medical, and AI-driven applications strengthens the bull case.

Bridging the Physical and Digital Worlds

Analog Devices is a leading semiconductor company that literally bridges the physical and digital worlds. Its differentiated chips combine precision analog sensing with digital processing and software to enable powerful on-device computing at the edge.

Over the past year, Analog Devices has paired that foundational strength with strategic moves to shore up supply and accelerate AI/edge capabilities. Back in October, the firm announced a collaboration to sell its Penang, Malaysia manufacturing plant to ASE (ASX) while securing a long-term supply agreement and co-investment in the site’s capabilities, a deal designed to bolster supply-chain resilience.

Similarly, Analog Devices released CodeFusion Studio 2.0 in November, an open-source AI development platform aimed at simplifying on-device AI deployment. Together with investor roadshows and conference appearances, these initiatives underscore the company's push into automation, AI and edge computing — long-term growth areas that complement ADI's near-term momentum.

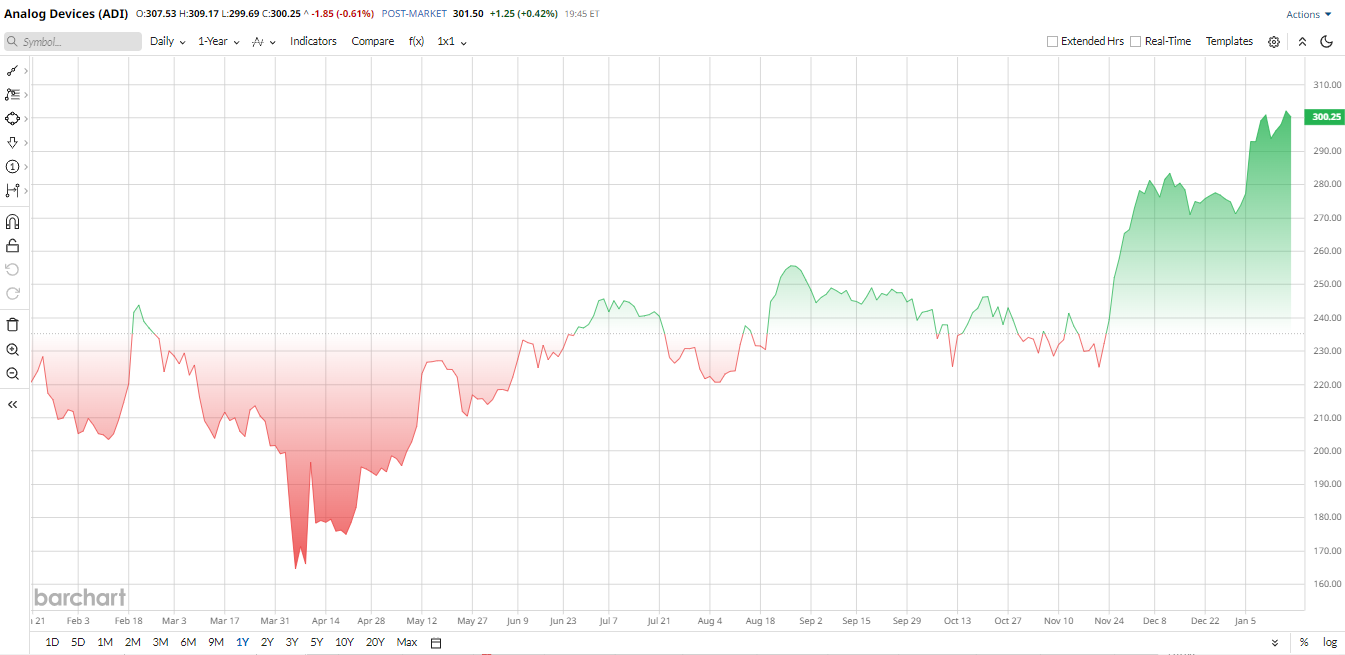

That momentum has shown up in the stock. ADI stock rallied strongly in 2025, rising roughly 40% and reaching near 52-week highs after consecutive third-quarter and Q4 beats. Technicals also look strong. The share price sits well above key moving averages, with the 50-day reflecting sustained market momentum.

At the same time, traditional valuation metrics show that ADI is richly priced. The forward price-to-earnings (P/E) ratio sits near 30 times versus typical semiconductor peers in the 25 range. That premium largely reflects the firm’s high margins and robust cash flow, but it also implies lofty forward expectations.

Q4 Results and Outlook

Two months ago, ADI reported fiscal Q4 2025 results that easily topped analysts' expectations. Revenue landed at $3.08 billion, up 26% year-over-year (YOY). Growth was broad-based, and management noted that all end markets grew, led by the Communications and Industrial segments.

Operating income jumped to $945 million, with a health 30.7% margin, reflecting a strong mix. Meanwhile, EPS came in at about $2.26, up roughly 35% YOY.

On the balance sheet, free cash flow (FCF) remained very healthy. Analog Devices generated about $4.8 billion in operating cash flow and $4.3 billion of FCF in fiscal 2025, equal to 39% of revenue. At the end of Q3, cash and equivalents were $2.5 billion.

Looking ahead, for Q1 fiscal 2026, ADI guided for roughly $3.1 billion in revenue, plus or minus $100 million, and adjusted EPS of $2.29. No full-year 2026 guidance was given, but analysts expect continued expansion. The current consensus as tracked by Barchart pegs fiscal 2026 EPS to be around $10.01.

CEO Vincent Roche emphasized confidence in the company's model amid the report. “These results reflect the strength and resilience of our business model," said Roche. “We remain firmly confident in our ability to deliver sustained, long-term value.” In other words, management believes the recent earnings momentum is sustainable given the secular AI and industrial trends.

Analysts Lift Price Targets for ADI Stock

Analysts have been broadly upbeat after Analog’s November earnings beat, with several firms raising targets on expectations of sustained strength in industrial and AI-related markets. Stifel reiterated a “Buy” rating and set a 2026 target of $330, while KeyBanc is most bullish with an “Overweight” raitng and a $375 target. Analysts see ADI stock as a key beneficiary of rising Edge AI adoption, where on-device intelligence is gaining traction across industrial and medical applications.

The firms also highlighted ADI’s diversified exposure across industrial, communications, and healthcare end markets, which helps cushion the business from swings in consumer demand. Long product cycles and mission-critical designs are viewed as supporting more stable revenue visibility over time. In addition, Stifel noted that ADI’s differentiated analog and mixed-signal solutions allow for stronger pricing power, helping sustain margins.

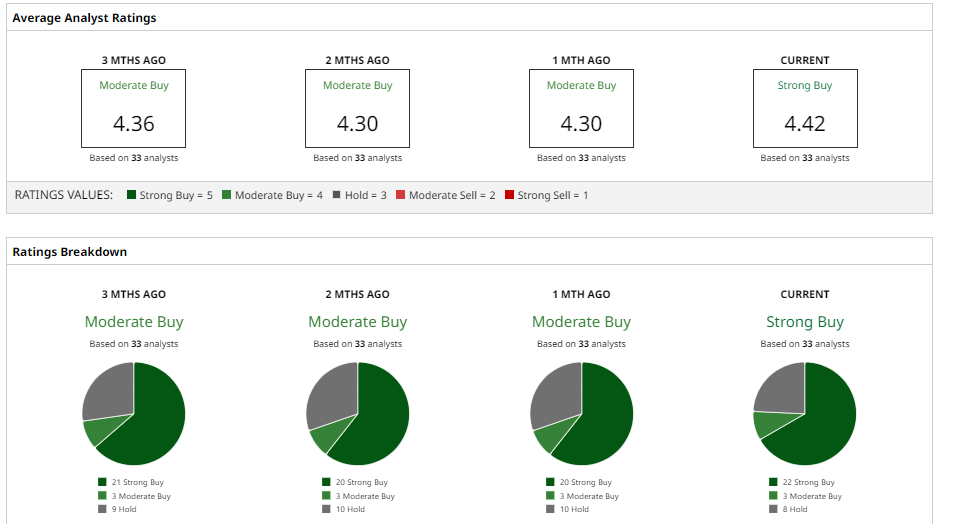

Overall, the Street consensus for ADI stock is a “Strong Buy,” although the average price target of $307.21 sits near the stock’s current level. That raises the bar for Analog Devices to deliver on growth.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart