With a market cap of around $38 billion, Crown Castle Inc. (CCI) owns and operates a nationwide communications infrastructure portfolio, including approximately 40,000 cell towers and 90,000 route miles of fiber across major U.S. markets. This extensive network connects cities and communities to essential wireless service, data, and technology, enabling the flow of information, ideas, and innovation to businesses and people nationwide.

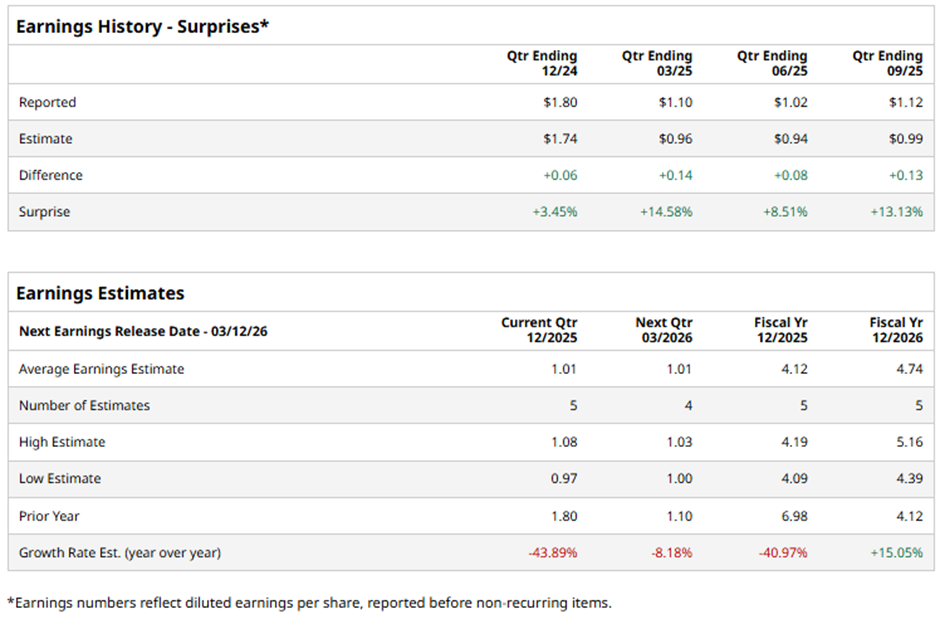

The wireless tower operator is expected to announce its fiscal Q4 2025 results soon. Ahead of the event, analysts forecast CCI to report an AFFO of $1.01 per share, down 43.9% from $1.80 per share in the year-ago quarter. However, it has consistently surpassed Wall Street's bottom-line estimates in the last four quarterly reports.

For fiscal 2025, analysts predict the Houston, Texas-based company to post AFFO of $4.12 per share, a decrease of nearly 41% from $6.98 per share in fiscal 2024. Nevertheless, AFFO is projected to increase 15.1% year-over-year to $4.74 per share in fiscal 2026.

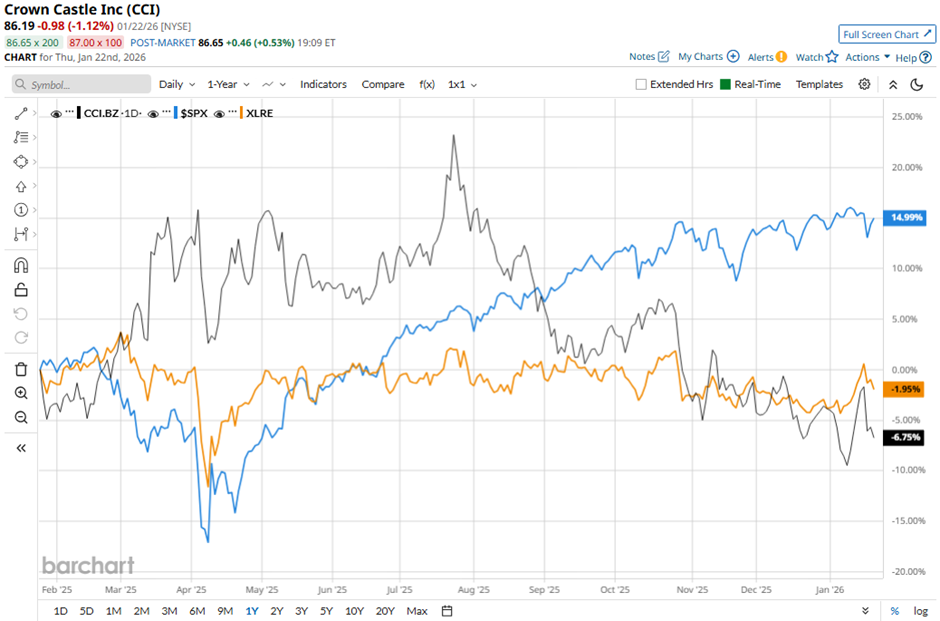

CCI stock has declined 2.5% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 13.6% gain and the State Street Real Estate Select Sector SPDR ETF's (XLRE) marginal return over the same time frame.

Shares of Crown Castle recovered marginally following its Q3 2025 results on Oct. 22. The company reported AFFO of $1.12 per share and revenue of $1.07 billion, beating estimates. Additionally, it raised its annual site rental revenue forecast to $4.01 billion - $4.05 billion, signaling steady demand from major carriers upgrading to 5G.

Analysts' consensus rating on CCI stock is cautiously optimistic overall, with a "Moderate Buy" rating. Among 19 analysts covering the stock, 10 recommend a "Strong Buy," one has a "Moderate Buy" rating, and eight give a "Hold" rating. This configuration is less bullish than three months ago, with 12 analysts suggesting a "Strong Buy."

The average analyst price target for Crown Castle is $108.39, suggesting a potential upside of 25.8% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart