Apple Inc. (AAPL) is a multinational technology company headquartered in California, known globally for its innovative consumer electronics, software, and digital services, including the iPhone, Mac, iPad, Apple Watch, and a suite of platforms like the App Store and iCloud. Apple’s market cap sits at around $3.9 trillion, making it one of the most valuable companies in the world.

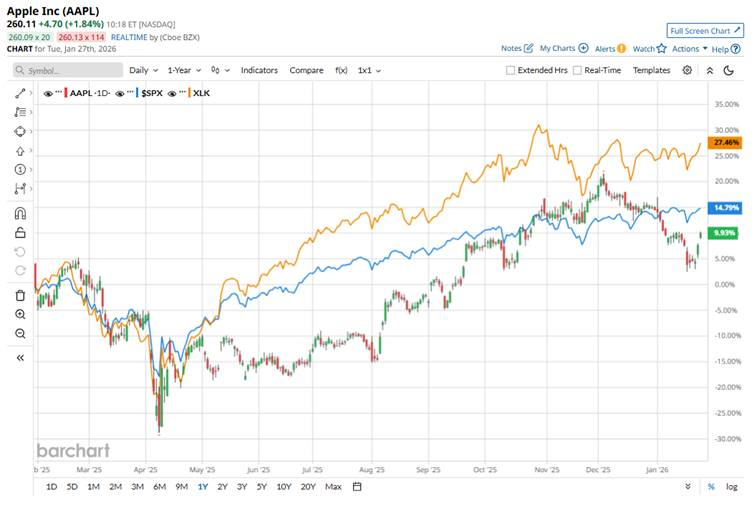

Shares of the tech giant have lagged behind the broader market over the past year. The stock has returned 13.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied around 16%. Over the past six months, AAPL has gained 22.3%, while the SPX is up 9.2%.

Zooming in further, Apple stock has also underperformed the State Street Technology Select Sector SPDR ETF’s (XLK) 29.9% rise over the past 52 weeks.

Apple’s share price has weakened in early 2026 amid a mix of profit-taking and sector rotation. Moreover, despite strong iPhone 17 sales, the stock fell due to fears of lower global smartphone demand later in 2026, rising component costs, and potential for significant executive turnover. Furthermore, intense competition in the AI space, along with macro risks, has dampened sentiment.

For the current fiscal year ending in September 2026, analysts expect AAPL’s EPS to grow 9.5% year-over-year to $8.17. The company’s earnings surprise history is promising as it has topped the consensus estimates in each of the last four quarters.

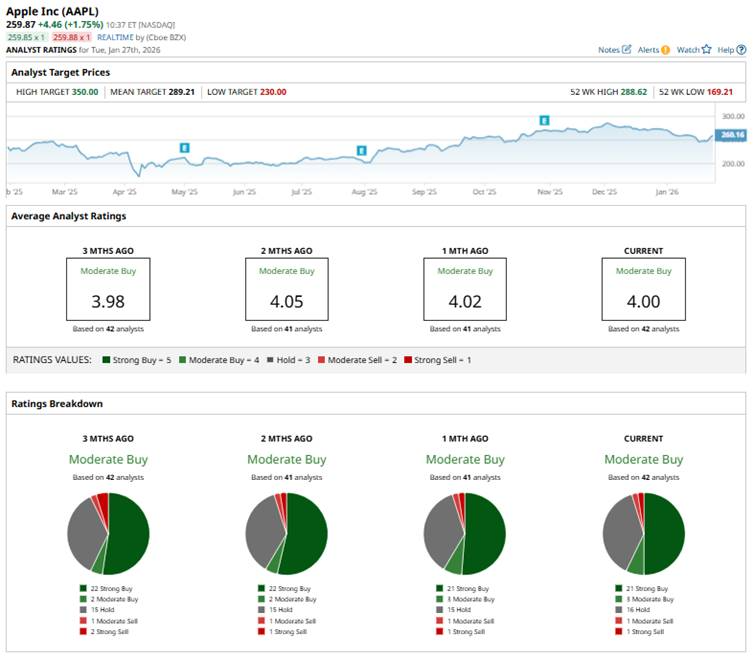

Among the 42 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 21 “Strong Buy” ratings, three “Moderate Buys,” 16 “Holds,” one “Moderate Sell,” and one “Strong Sell.”

This configuration is slightly less bullish than two months ago, when there were 22 analysts suggesting a “Strong Buy” rating.

Recently, JPMorgan raised Apple’s price target to $315 from $305 and reaffirmed its “Overweight” rating, citing upside from strong iPhone 17 demand.

The mean price target of $289.21 represents a premium of 13.2% to current levels. The Street-high price target of $350 implies a potential upside of 37%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Raytheon's Strong Free Cash Flow and FCF Margin Could Push RTX Stock Higher

- SoFi Is Poised to Report Strong Q4 Results. Is a Share-Price Rebound in SOFI Stock's Future?

- Dear Amazon Stock Fans, More Layoffs Are Coming This Week

- Bullish Price Surprise: Is Lands’ End’s Licensing JV the Beginning of the End or a New Beginning?