With a market cap of $51.1 billion, Electronic Arts Inc. (EA) is a global video game company that develops, publishes, and delivers games, content, and live services across consoles, PCs, and mobile platforms. The company is known for major franchises such as EA SPORTS Madden NFL, EA SPORTS College Football, The Sims, Apex Legends, and Battlefield.

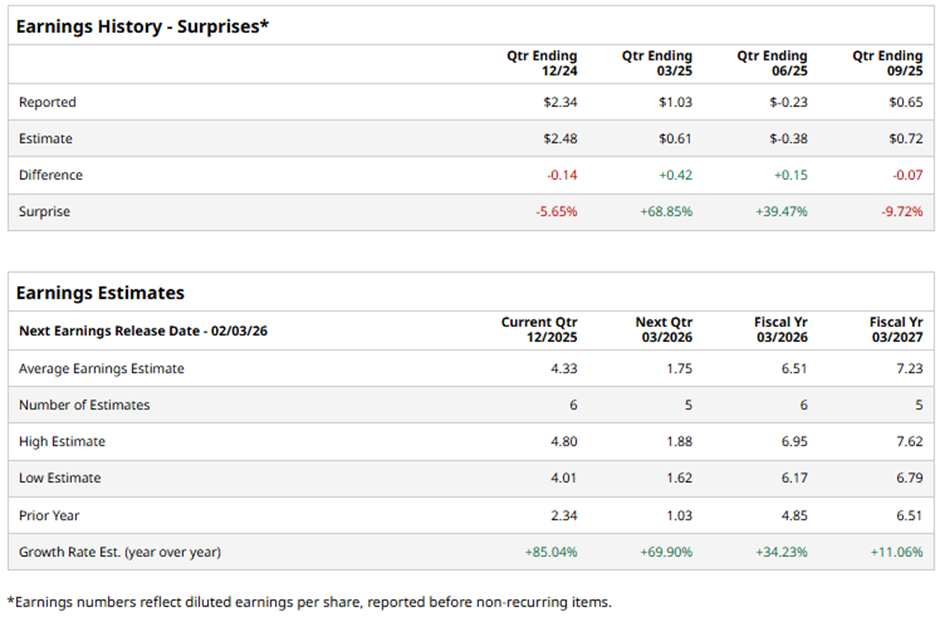

The Redwood City, California-based company is scheduled to release its fiscal Q3 2026 results soon. Ahead of this event, analysts expect Electronic Arts to post a profit of $4.33 per share, an 85% surge from $2.34 per share in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in two of the last four quarters while missing on two other occasions.

For fiscal 2026, analysts predict the video game maker to report EPS of $6.51, up 34.2% from $4.85 in fiscal 2025.

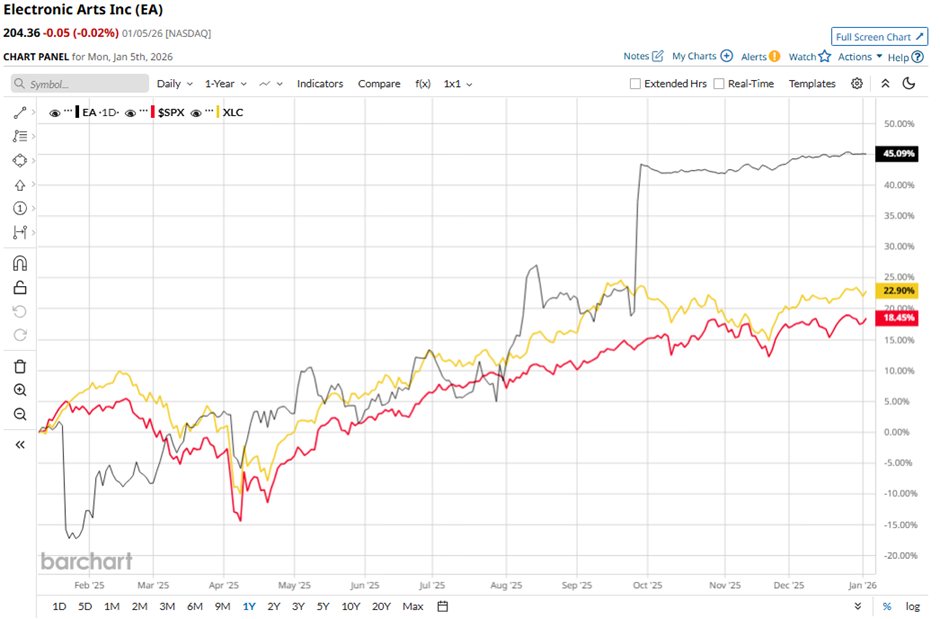

EA stock has climbed 39.7% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 16.2% gain and the State Street Communication Services Select Sector SPDR ETF's (XLC) 20.3% increase over the same period.

Shares of Electronic Arts fell marginally following its Q2 2026 results on Oct. 28 as overall performance declined year-over-year, with net bookings down 13% to $1.82 billion and total net revenue falling to $1.84 billion, largely due to the exceptionally strong College Football 25 launch in the prior-year quarter. Profitability also weakened, with net income dropping to $137 million and EPS declining to $0.54, despite growth in Madden NFL 26 and Apex Legends.

Analysts' consensus view on EA stock is cautious, with a "Hold" rating. Out of 24 analysts covering the stock, three recommend a "Strong Buy," one has a "Moderate Buy," 19 give a "Hold" rating, and one suggests a "Strong Sell." As of writing, the stock is trading above the average analyst price target of $203.10.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart