Roku (ROKU) stock has been trending higher. Shares of the TV streaming platform provider have recently climbed to a new 52-week high and are up 41% over the past year. That performance stands out in the streaming space, particularly when compared with industry heavyweight Netflix (NFLX). Shares of NFLX stock have risen by 3% over the same 12-month period.

At the core, Roku’s business comprises two main segments: platform and devices. The platform segment is the company’s primary growth engine, generating revenue from digital advertising and the distribution of streaming services. As more users spend time watching content on Roku’s operating system, advertisers gain access to a large, increasingly engaged audience, which supports higher ad demand and improved monetization.

Meanwhile, the devices segment includes sales of streaming players, Roku-branded televisions, audio equipment, smart home products and services, and related accessories. While hardware margins tend to be thinner, these products play a strategic role by expanding Roku’s user base and supporting long-term platform growth.

A key driver behind Roku’s recent momentum has been rising user engagement. Viewers are spending more time on the platform, increasing advertising inventory and making Roku more attractive to content partners and marketers. At the same time, the company continues to deepen integrations with third-party platforms, strengthening its ecosystem and opening additional avenues for revenue generation. These developments enhance Roku’s ability to monetize its audience more effectively over time.

Looking ahead, broader trends in digital advertising and streaming consumption appear favorable. As advertisers continue to shift budgets toward digital channels, Roku is well-positioned to benefit from increased spending. This environment provides a solid foundation for growth, particularly as the company enters 2026 with a larger user base, higher engagement levels, and improved monetization capabilities.

2026 Could Be a Year of Solid Growth for Roku

Roku’s recent financial performance strengthens the bullish narrative around ROKU stock. The company delivered strong third-quarter results, achieving positive operating income ahead of expectations. Its platform revenue grew 17% year-over-year (YOY), supported by strength in streaming services distribution and video advertising. Roku also expanded integrations with third-party platforms, increased Roku-billed subscriptions, and enhanced both its Home Screen and the overall Roku Experience.

User engagement continued to climb. Streaming hours reached 36.5 billion during the three months ended Sept. 30, 2025, up from 32 billion a year earlier, representing a 14% increase. This sustained growth in viewing strengthens Roku’s advertising momentum and supports improving operating leverage.

Looking ahead, the company appears well-positioned to deliver double-digit platform revenue growth while expanding operating margins in 2026. Video advertising on the platform is growing rapidly, and Roku’s expanding integrations with demand-side platforms will support its growth.

Roku is also gaining traction with Roku Ads Manager, its self-serve advertising platform aimed at small- and medium-sized businesses and performance marketers. This offering is helping diversify advertising demand beyond large brand advertisers, making Roku’s revenue base more resilient across economic cycles.

Roku is expanding its partner ecosystem. A recent integration with measurement platform AppsFlyer now spans the entire Roku platform. These types of integrations increase Roku’s appeal to enterprise advertisers and performance-focused marketers who require robust measurement capabilities.

Roku’s streaming services business also stands to benefit from premium subscriptions and its recent acquisition of Frndly TV. Improvements in content discovery are helping viewers find compelling entertainment more easily which, in turn, is driving growth in Roku-billed subscriptions, particularly in premium offerings. The company’s sports experience, which aggregates sports programming across the platform, continues to improve user engagement by helping fans quickly find when and where their favorite teams are playing.

Roku has also begun to leverage its platform to launch owned-and-operated services. The recent introduction of Howdy, a new subscription video-on-demand service priced at $2.99 per month and offered entirely ad-free, highlights this strategy. By targeting a low-cost, high-quality niche, Roku is tapping into a significant untapped opportunity and using its platform scale to drive cost-efficient sign-ups and engagement.

The Bottom Line

Roku’s improving financial performance, growing user engagement, expanding advertising tools, and broader content strategy suggest that 2026 could mark another year of solid growth for the company. With positive operating income restored, strong platform growth, and favorable industry trends, Roku could deliver solid revenue and improved margins in 2026, acting as a meaningful catalyst for the stock.

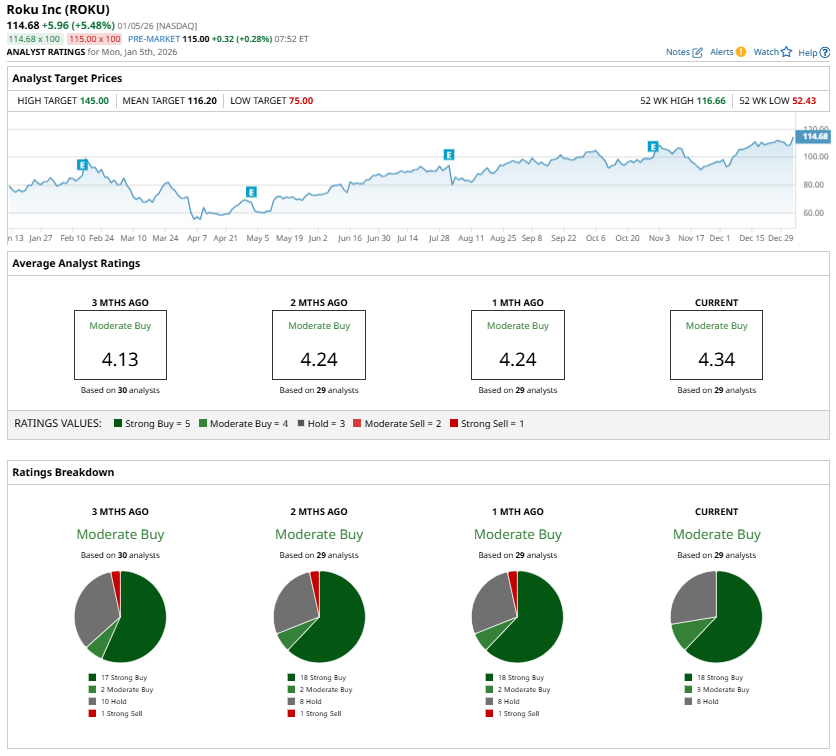

Wall Street analysts currently maintain a “Moderate Buy” consensus rating on ROKU stock, indicating cautious optimism about its growth trajectory.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Precious Metals Remain Strong: Why That’s a Red Flag for Stocks Amid Venezuela Tumult

- Will Roku Dominate Streaming Stocks in 2026?

- What's Driving the Parabolic Rise in Silver Futures, and How Long Can the Rally Last?

- Michael Burry Says He Isn’t Shorting Tesla Stock. What Does That Mean for You in 2026?