With a market cap of $19.6 billion, C.H. Robinson Worldwide, Inc. (CHRW) is a global logistics company providing freight transportation, supply chain, and related services across the United States and internationally through its North American Surface Transportation and Global Forwarding segments. The company also markets fresh fruits and vegetables under the Robinson Fresh brand.

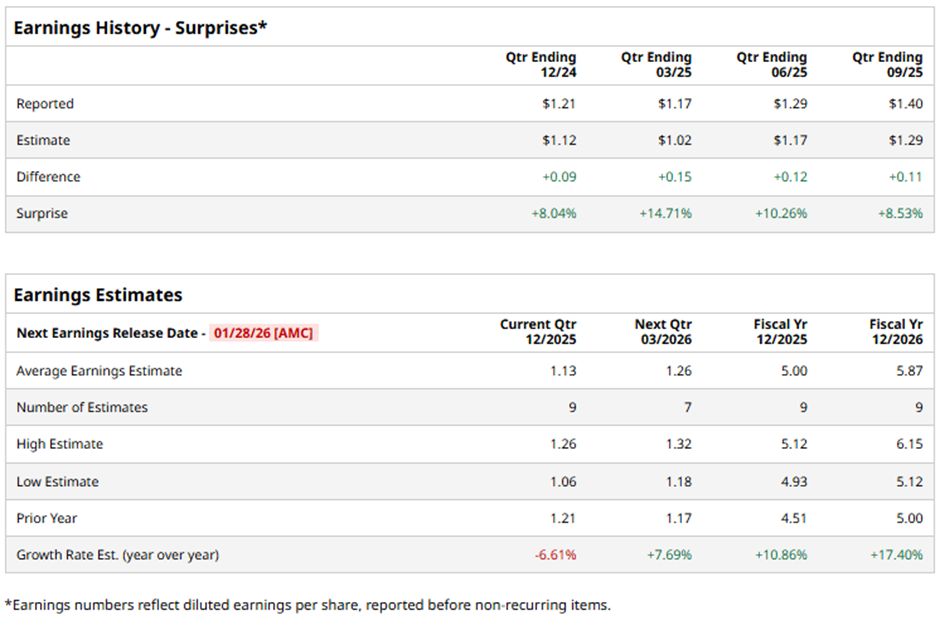

The Eden Prairie, Minnesota-based company is expected to announce its fiscal Q4 2025 results after the market closes on Wednesday, Jan. 28. Ahead of its upcoming earnings report, analysts project CHRW to report an adjusted EPS of $1.13, down 6.6% from $1.21 in the year-ago quarter. However, it has surpassed Wall Street's bottom-line estimates in the past four quarters.

For fiscal 2025, analysts expect the transportation logistics company to post adjusted EPS of $5, a rise of 10.9% from $4.51 in fiscal 2024. Moreover, adjusted EPS is anticipated to increase 17.4% year-over-year to $5.87 in fiscal 2026.

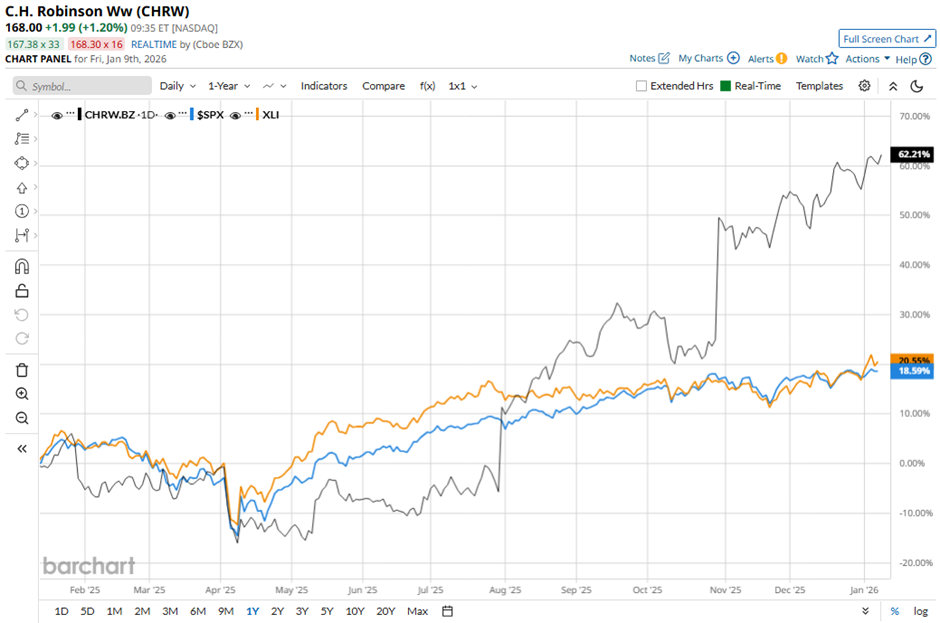

CHRW stock has climbed 60.2% over the past 52 weeks, outpacing the S&P 500 Index's ($SPX) nearly 17% gain and the State Street Industrial Select Sector SPDR ETF's (XLI) 21.1% increase over the same period.

Despite reporting weaker-than-expected Q3 2025 revenue of $4.14 billion on Oct. 29, C.H. Robinson’s shares surged 19.7% the next day because its adjusted EPS of $1.40 beat analyst expectations, reflecting strong cost control. Operating expenses dropped 12.6%, and headcount declined 10.8%, boosting margins despite soft freight demand. Investors reacted positively to these efficiency gains and management’s progress in streamlining operations, including exiting its European Surface Transportation business.

Analysts' consensus rating on CHRW stock is cautiously optimistic, with a "Moderate Buy'' rating overall. Out of 26 analysts covering the stock, opinions include 15 "Strong Buys," one "Moderate Buy,'' nine "Holds," and one "Moderate Sell." This consensus is more bullish than three months ago, with 13 “Strong Buy” ratings on the stock.

As of writing, the stock is trading above the average analyst price target of $156.48.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart