With a market cap of $31.6 billion, Dover Corporation (DOV) is a diversified global manufacturer providing equipment, components, consumables, software, digital solutions, and support services across a wide range of industrial and commercial end markets. It operates through multiple segments serving industries such as vehicle aftermarket, clean energy and fueling, imaging and identification, pumps and process solutions, and climate and sustainability technologies.

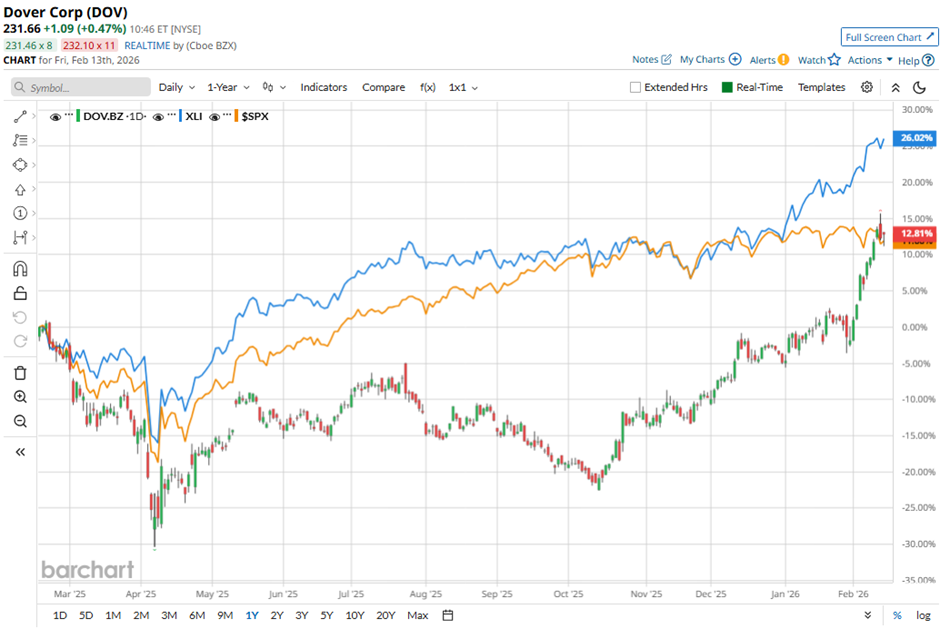

Shares of the Downers Grove, Illinois-based company have outpaced the broader market over the past 52 weeks. DOV stock has increased nearly 14% over this time frame, while the broader S&P 500 Index ($SPX) has returned 11.8%. Moreover, shares of the company are up 18.3% on a YTD basis, compared to SPX’s marginal decline.

Focusing more closely, the stock has lagged behind the State Street Industrial Select Sector SPDR ETF’s (XLI) 26.4% return over the past 52 weeks.

Dover Corporation reported strong Q4 2025 results on Jan. 29, including 5% organic revenue growth, bookings up 10% in the quarter, and adjusted EPS of $9.61, up 14% year over year and above prior guidance. Management also guided 2026 adjusted EPS to a robust $10.45 - $10.65, representing double-digit growth at the midpoint. However, the stock fell 1.7% on that day.

For the fiscal year ending in December 2026, analysts expect Dover’s EPS to grow 10.1% year-over-year to $10.58. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

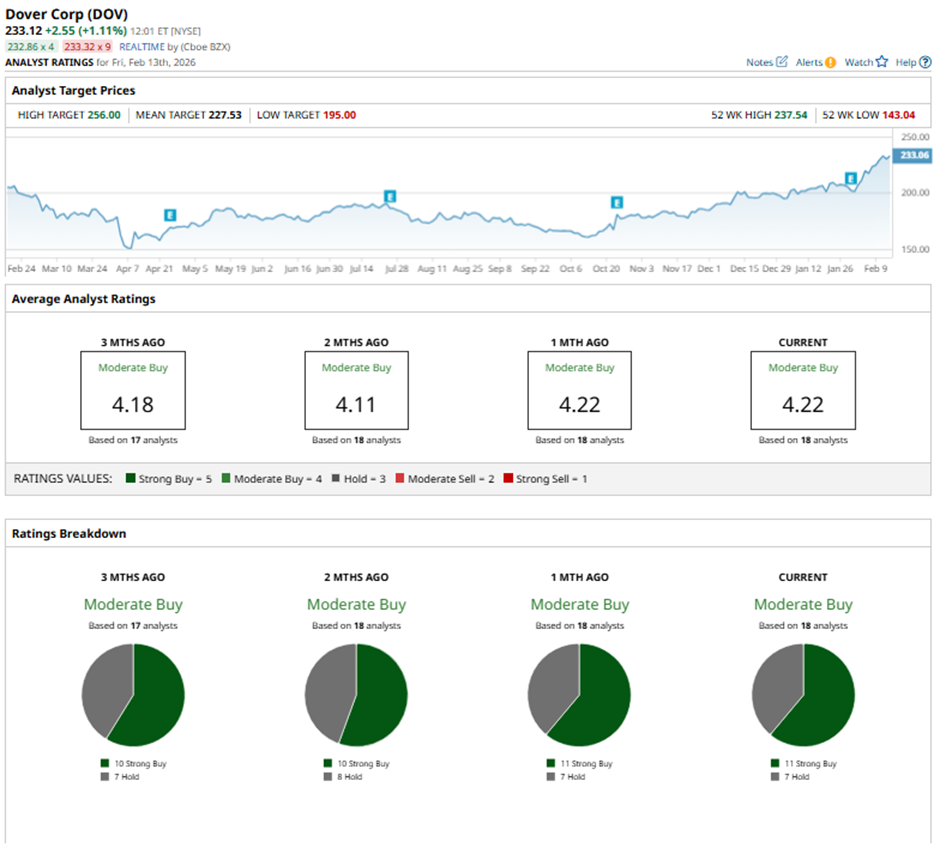

Among the 18 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings and seven “Holds.”

On Feb. 3, Seaport Research raised its price target on Dover Corporation to $245 and maintained a “Buy” rating.

As of writing, the stock is trading above the mean price target of $227.53. The Street-high price target of $256 implies a potential upside of 9.8% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart