Masco Corporation (MAS) is a Michigan-based global manufacturer and distributor of branded home improvement and building products serving residential repair/remodel and new construction markets. Valued at $15.9 billion by market cap, Masco operates a portfolio of industry-leading brands across plumbing fixtures, paints/coatings, and decorative architectural hardware, selling through home centers, wholesalers, contractors, and e-commerce channels worldwide.

Shares of this branded home improvement and building products leader have underperformed the broader market over the past year. MAS has surged 1.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 12.9%. However, in 2026, MAS stock is up 22.2%, compared to the SPX’s marginal fall on a YTD basis.

Narrowing the focus, MAS’ underperformance is also apparent compared to the State Street SPDR S&P Homebuilders ETF (XHB). The exchange-traded fund has soared 13.6% over the past year.

On Feb. 10, Masco released its fiscal 2025 Q4 earnings, and its shares rose 8.7%. It reported net sales of $1.79 billion, down 2% year over year with adjusted EPS dropping 8% from the year-ago quarter to $0.82. Profitability declined as adjusted operating profit fell to $259 million and adjusted operating margin to 14.4%. Looking ahead, the company expects its adjusted EPS to be in the range of $4.10 to $4.30.

For the current fiscal year, ending in December, analysts expect MAS’ EPS to rise 6.1% to $4.20 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

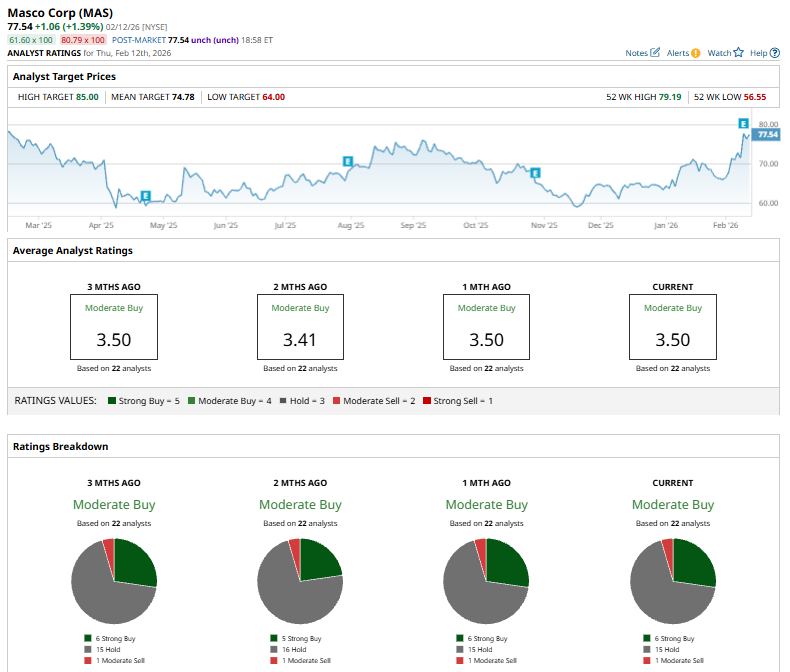

Among the 22 analysts covering MAS stock, the consensus is a “Moderate Buy.” That’s based on six “Strong Buy” ratings, 15 “Holds,” and one “Moderate Sell.”

This configuration is bullish than two months ago, with five analysts suggesting a “Strong Buy.”

On Feb. 13, Citigroup analyst Anthony Pettinari maintained a “Neutral” rating on Masco but raised the price target to $84 from $71, signaling a more constructive outlook on the stock’s valuation and earnings trajectory.

Masco currently trades above its mean price target of $74.78, and its Street-high price target of $85 suggests an ambitious upside potential of 9.6%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart