The selloff in artificial intelligence (AI) plays has intensified, with hyperscalers particularly feeling the heat. Even Apple (AAPL), which had been looking steady amid the selloff, came under pressure and fell 5% on Feb. 12 on reports of Siri delays and the company facing Federal Trade Commission (FTC) scrutiny over alleged bias against conservative voices on Apple News.

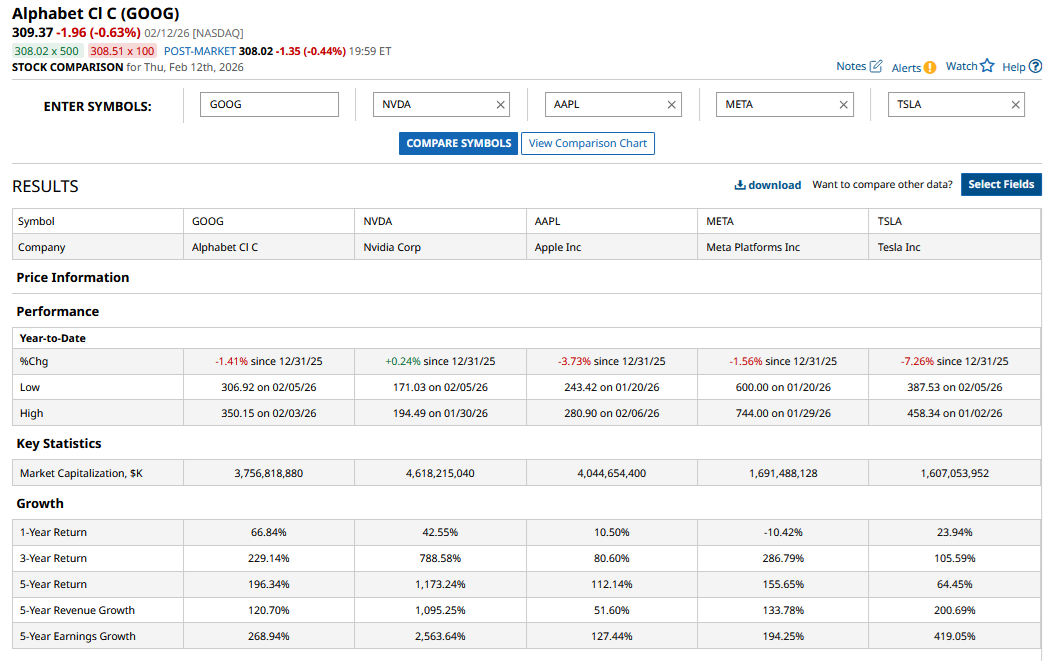

All “Magnificent Seven” stocks except Nvidia (NVDA) have turned red for the year, which is unsurprising. While growing AI capex is putting pressure on tech names, Nvidia stands to benefit from the spending spree, as much of it will end up in the company's coffers.

Alphabet (GOOGL), which was the best performing Magnificent Seven name last year, is the second-best performing constituent so far in 2026. Despite the post fourth-quarter earnings selloff, GOOGL stock is down just 2.3% for the year.

Previously, I had noted that Alphabet’s 2026 returns will be much milder than in 2025. With that in mind, let's analyze whether GOOGL stock is now in the “buy” zone, beginning with a snapshot of its recent financial performance.

Alphabet Reported a Strong Set of Numbers for Q4 2025

It was overall a strong fourth-quarter 2025 earnings report from Alphabet, with revenue rising nearly 18% and net profits up 30% year-over-year (YOY). The company's topline growth was the second-highest among the Magnificent Seven, and only Meta Platforms (META) fared better. However, Nvidia — which is yet to report its quarterly earnings — is expected to post much higher growth thanks to the AI capex spree.

Beyond the headline numbers, Alphabet’s earnings had a lot of positives. For instance, cloud revenue grew 48% with backlog growing 55% sequentially to $240 billion. While Microsoft (MSFT) has a much bigger backlog, much of it is tied to OpenAI, raising concerns over its durability.

YouTube — which I have long maintained is an underappreciated asset in Alphabet’s portfolio — is now running at an annualized revenue run rate of $60 billion. The company had 325 million paid subscribers at the end of 2025, led by YouTube Premium and Google One.

While Alphabet’s earnings were as flawless as we can have in the real world, GOOGL stock still fell following the confessional after the company raised its 2026 capex budget to between $175 billion and $185 billion. That is roughly twice what it spent last year.

Alphabet Is an AI Success Story

Alphabet has stepped up its game in AI after having lost the first round to OpenAI. Gemini 3 has been a particularly successful story, and the Gemini app now has over 750 million monthly active users. The company has been looking at ways to monetize the AI mode in search, which includes adding ads below the responses and sponsored offers for shopping in the AI mode.

During the Q4 earnings call, CEO Sundar Pichai said, “We're seeing our AI investments and infrastructure drive revenue and growth across the board.” Those are the kind of golden words I like to hear unambiguously in any tech company's earnings call.

However, the incremental revenue gains are coming at a massive cost, and tech companies may no longer be able to pay the bills with their organic cash flows and need to turn to external financing. Alphabet, for instance, recently raised over $30 billion through bond sales, receiving outsized attention for the 100-year bond that it issued as part of the offering.

This news drew yet another comparison to the dot-com euphoria, as the last time a tech company — Motorola, to be precise — issued a bond of that duration was in 1997. The company has since changed hands twice — Google sold Motorola to Lenovo (LNVGY) in 2014 after acquiring the company two years earlier.

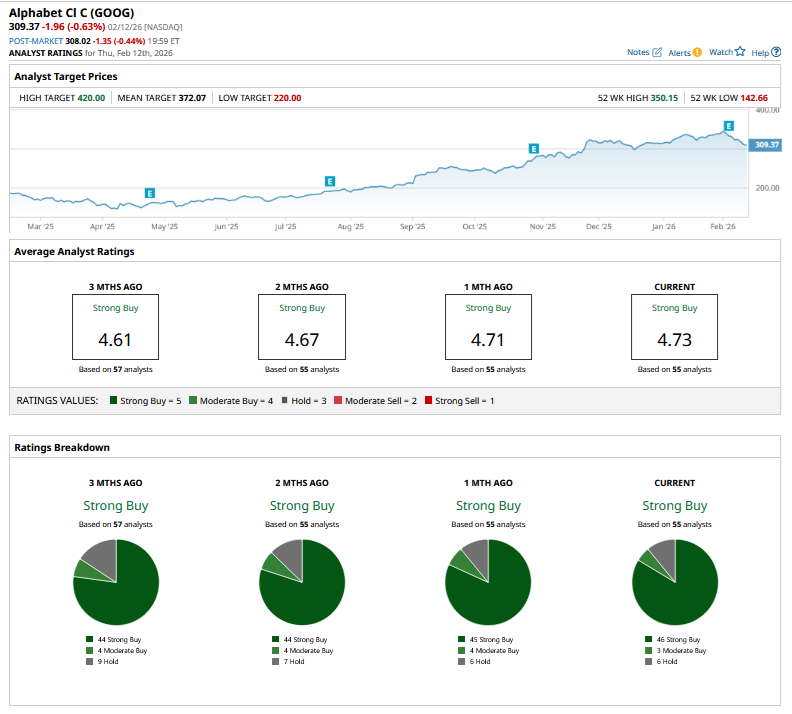

With that little digression behind, though, Alphabet stock’s forecast offers some promise. Sell-side analysts went on an overdrive, raising their GOOGL stock target prices following Q4 earnings. Pivotal Research raisied its price target to a Street-high of $420, implying about 37% potential upside from current price levels. The mean target price sits at $373.58, marking potential upside of about 12% from here.

Is GOOG Stock a Buy?

Alphabet now trades at a forward price-to-earnings (P/E) multiple of 26.7 times, which is higher than its historical averages both on an absolute basis and in comparison with its Magnificent Seven peers. I would argue that the company has earned the right to command premium valuations by showing its mettle in protecting its turf from AI upstarts. However, while I continue to remain invested in the stock, I don’t find the valuations compelling enough to trigger a fresh purchase and would wait for a better entry point.

On the date of publication, Mohit Oberoi had a position in: GOOGL , AAPL , NVDA , META , MSFT . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart