U.S. Treasury bonds are getting exciting. No, really they are. Let me explain.

One of the things I enjoy most about being part of the Barchart team is that it expands my reach as an investor. Barchart created a leadership reputation for commodities data, and expanded from there. And if there’s anything I hope investors will take away from my advice these days, it is to widen the angle of what they consider investing. And for me, bonds are at the top of the list. Here’s why.

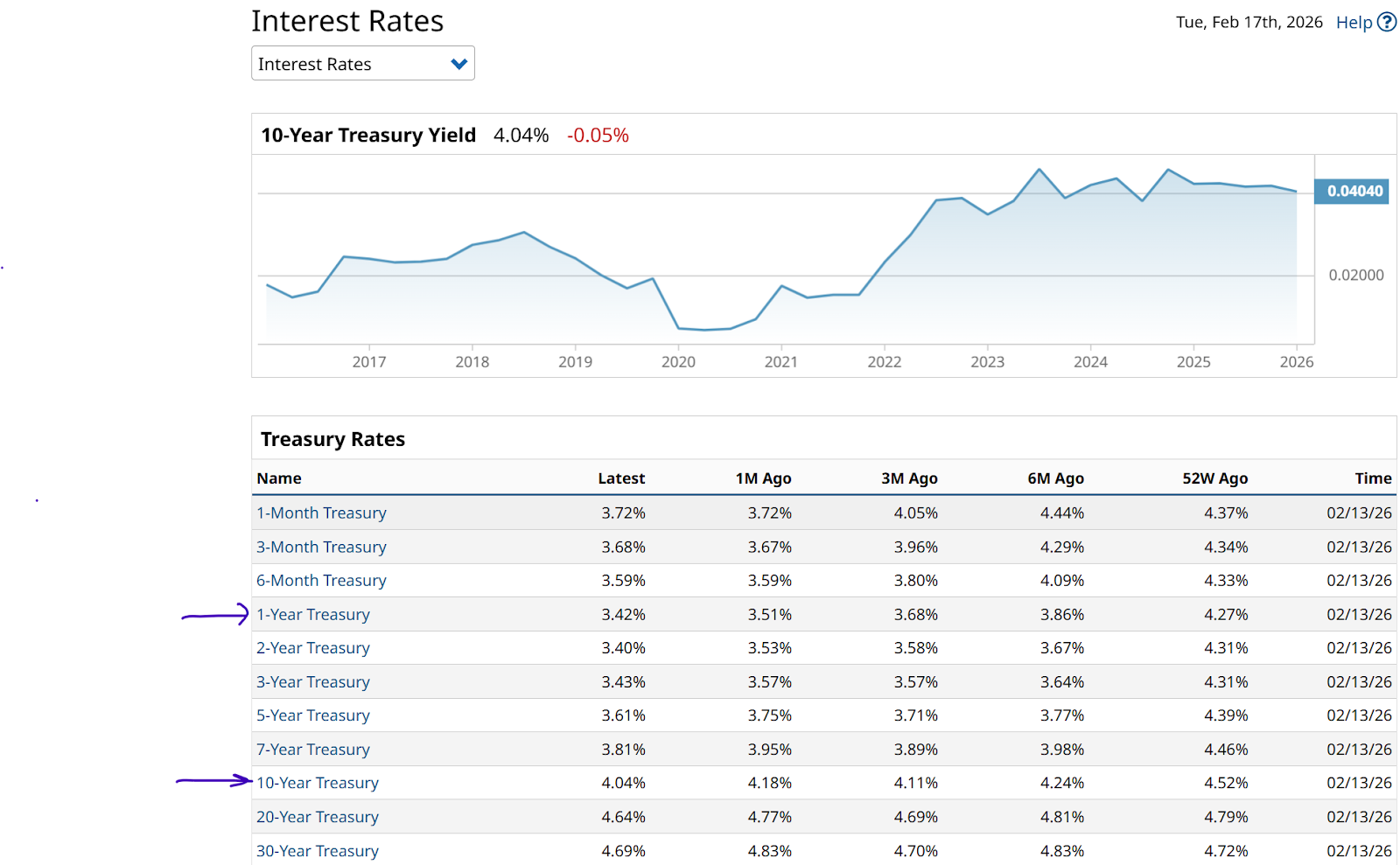

Below is the current yield curve, and some history. It shows us that 10-year U.S. Treasury bond (ZNH26) yields are about as high as they’ve been during the past decade. It also shows (where I placed arrows) that yields are coming down across the curve.

For how long, we don’t know. But I’m focused on where we are within the past couple of decades, more so than right now. And I see opportunity. But I don’t think it will last forever.

Stocks as the Core? Not for This Stock Investor. It's My Bond Ladder.

Successful long-term management starts with a solid anchor, and for me, that is not an equity portfolio. While high returns on stocks are exciting, they can add stress if they are part of a volatile cycle. I am a very conservative type, and so my big equity exposure is hedged anyway. That provides some cushion to the downside. But bonds are different.

A bond ladder — specifically using zero coupon U.S. Treasurys — provides a predictable amount of money that matures on a set schedule, creating a dedicated future cash flow.

- Predictable cash flow: Each rung of the ladder represents a bond maturing in a different year, ensuring you know exactly when you will receive your principal back.

- No reinvestment risk: Because zero coupon bonds do not pay periodic interest, you avoid the risk of having to reinvest small payments at lower rates.

- Risk-tolerance booster: Knowing that a large portion of your money is set to return a rate of 4.5% percent or higher allows you to take bigger chances with your equity and trading portfolios. And that is the main point here.

- Compound growth: Holding these in a tax-deferred account like an IRA allows the discounted purchase price to grow toward its full face value without annual tax on the imputed interest.

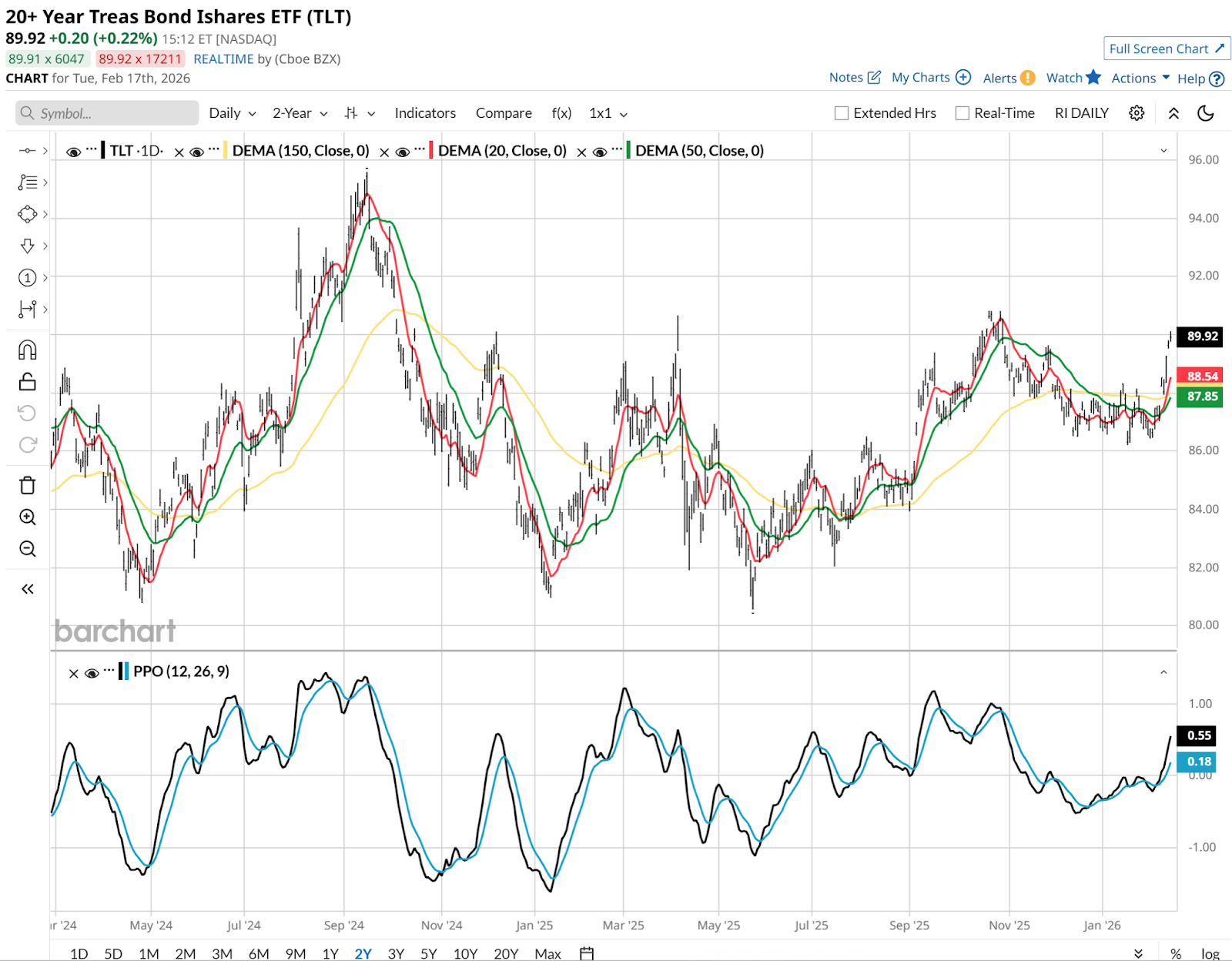

It is encouraging that the 20+ Year Treas Bond Ishares ETF (TLT) is starting to hint at higher price and lower yield. That can add return to the yield, whether you own bonds paying interest or zeroes like I do. But don’t be lulled into complacency. TLT and bonds across most of the curve other than very short-term maturities can be volatile.

If rates go down, bond prices go up, so that’s the easy part. But higher rates and lower bond prices can be unsettling. That’s why I’m always prepared to hedge.

Hedging the Enemy: Managing Inflation and Rate Risk

Inflation is the primary enemy of a long-term bond ladder. To address this, active management is necessary to neutralize sudden upward shifts in rates.

- Shorting bonds: I use the ProShares Short 20+ Year Treasury ETF (TBF) to profit when long-term bond prices decline.

- Active supplements: While TLT has caused heartache for many who bought the dip too early, it remains a liquid tool for active management.

- Options strategies: Buying puts and calls on TLT helps protect the core ladder from market panic or unexpected spikes in yields.

- Yield protection: If rates spike, a small position in TBF or TLT puts can help neutralize the impact on the overall portfolio value.

The Generational Opportunity

I believe time is getting shorter to lock in these historically high yields. If market yields drop, the prices of these zero coupon bonds appreciate significantly. For every 1% drop in the yield on a 20-year bond, the profit on the bond portfolio can be substantial.

This allows for a tactical choice. Either wait for the bonds to mature for the guaranteed cash flow, or cash them in early to pull forward years of future returns. The bottom line for me: I set up my bond ladder first, as soon as I semi-retired. Then, I built out my equity, exchange-traded fund (ETF), and other growth and tactical strategies.

I no longer am in the business of telling others how to invest their hard-earned capital. But I do suggest that bond laddering might just be applicable to many more people, across multiple generations, than people realize.

Rob Isbitts created the ROAR Score, based on his 40+ years of technical analysis experience. ROAR helps DIY investors manage risk and create their own portfolios. For Rob's written research, check out ETFYourself.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- My Bond Ladder Is Like a Second Social Security Payment. How I Set It Up.

- Stock Index Futures Climb as AI Jitters Ease, FOMC Minutes and U.S. Economic Data in Focus

- Make This Trade Now Before Kevin Warsh Takes Over at the Fed

- Stocks Set to Open Lower as AI Jitters Linger, Fed Minutes and U.S. Economic Data Awaited