San Jose, California-based Super Micro Computer, Inc. (SMCI) develops and manufactures advanced server and storage solutions built on a modular and open architecture. Valued at $17.4 billion by market cap, the company offers servers, storage systems, motherboards, full racks, chassis, and accessories worldwide.

Shares of this AI server giant have underperformed the broader market over the past year. SMCI has gained 1.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.3%. In 2026, SMCI stock is down marginally, compared to the SPX’s 1.4% rise on a YTD basis.

Narrowing the focus, SMCI’s underperformance is also apparent compared to the Technology Select Sector SPDR Fund (XLK). The exchange-traded fund has gained about 23.9% over the past year. Meanwhile, SMCI’s dip on a YTD basis mirrors the ETF’s marginal losses over the same time frame.

SMCI's underperformance is driven by ongoing profit margin pressure and limited clarity on future profitability, particularly in Tier 2 cloud markets. Timing issues with large customer orders and competitive dynamics pushing down average selling prices are also weighing on the stock. These factors led to a downgrade in price target and eroded investor confidence.

For the current fiscal year, ending in June, analysts expect SMCI’s EPS to grow marginally to $1.73 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing the forecast on two other occasions.

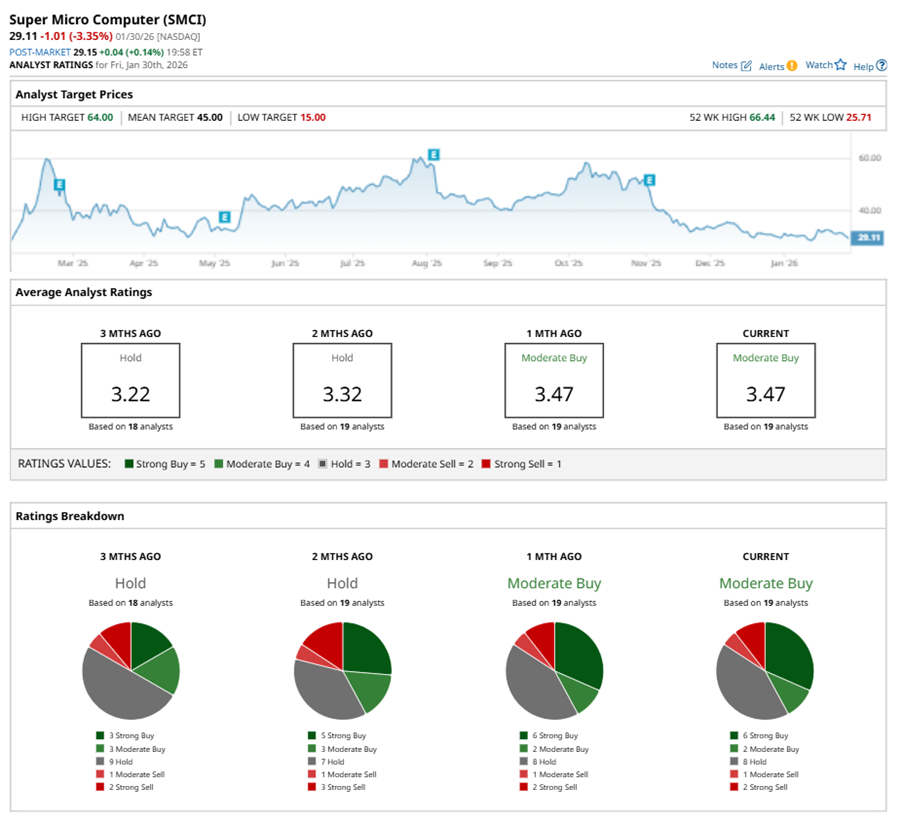

Among the 19 analysts covering SMCI stock, the consensus is a “Moderate Buy.” That’s based on six “Strong Buy” ratings, two “Moderate Buys,” eight “Holds,” one “Moderate Sell,” and two “Strong Sells.”

This configuration is more bullish than two months ago, with an overall “Hold” rating, consisting five analysts suggesting a “Strong Buy,” three advising a “Moderate Buy,” and three giving a “Strong Sell.”

On Jan. 30, Nehal Chokshi from Northland Securities reiterated a “Buy” rating on SMCI with a price target of $63, implying a potential upside of 116.4% from current levels.

The mean price target of $45 represents a 54.6% premium to SMCI’s current price levels. The Street-high price target of $64 suggests an ambitious upside potential of 119.9%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Groundhog Day Gloom? Why the Nasdaq Is Shaking Off Phil's Shadow and Facing Reality

- SoFi’s Earnings Growth Looks Strong. Is This Dip a Buying Opportunity?

- This Is the Most Oversold Dividend Aristocrat Worth Buying

- MicroStrategy Is Trading Below NAV Again. Should You Buy MSTR Stock Here or Stay Far, Far Away?