Valued at a market cap of $88.2 billion, DoorDash, Inc. (DASH) is a commerce platform that connects merchants, consumers, and independent contractors. The San Francisco, California-based company provides various services, such as customer acquisition, demand generation, order fulfillment, merchandising, payment processing, and customer support.

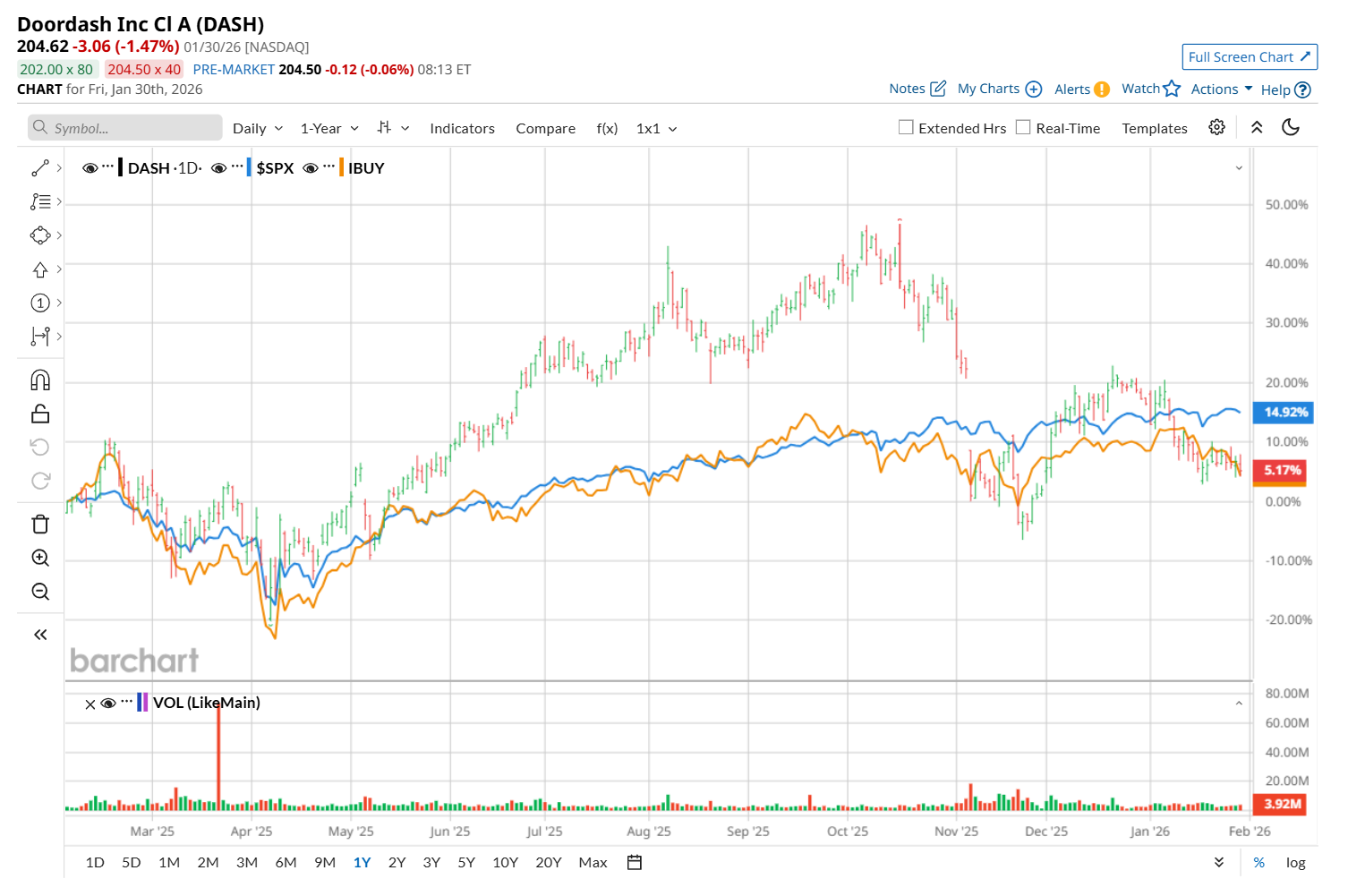

This commerce platform has lagged behind the broader market over the past 52 weeks. Shares of DASH have gained 8.5% over this time frame, while the broader S&P 500 Index ($SPX) has surged 14.3%. Moreover, on a YTD basis, the stock is down 9.7, compared to SPX’s 1.4% return.

Narrowing the focus, DASH has also underperformed the Amplify Online Retail ETF (IBUY), which gained 3.7% over the past 52 weeks and declined 3.9% on a YTD basis.

On Nov. 5, DASH reported mixed Q3 results, and its shares crashed 17.5% in the following trading session. Due to strong growth in total orders, the company’s overall revenue increased 27.3% year-over-year to $3.4 billion, surpassing analyst estimates by 2.7%. However, while its EPS of $0.55 also grew 44.7% from the same period last year, it missed analyst expectations by a notable margin, making investors jittery.

For the current fiscal year, ending in December, analysts expect DASH’s EPS to grow 662.1% year over year to $2.21. The company’s earnings surprise history is mixed. It topped the consensus estimates in two of the last four quarters, while missing on two other occasions.

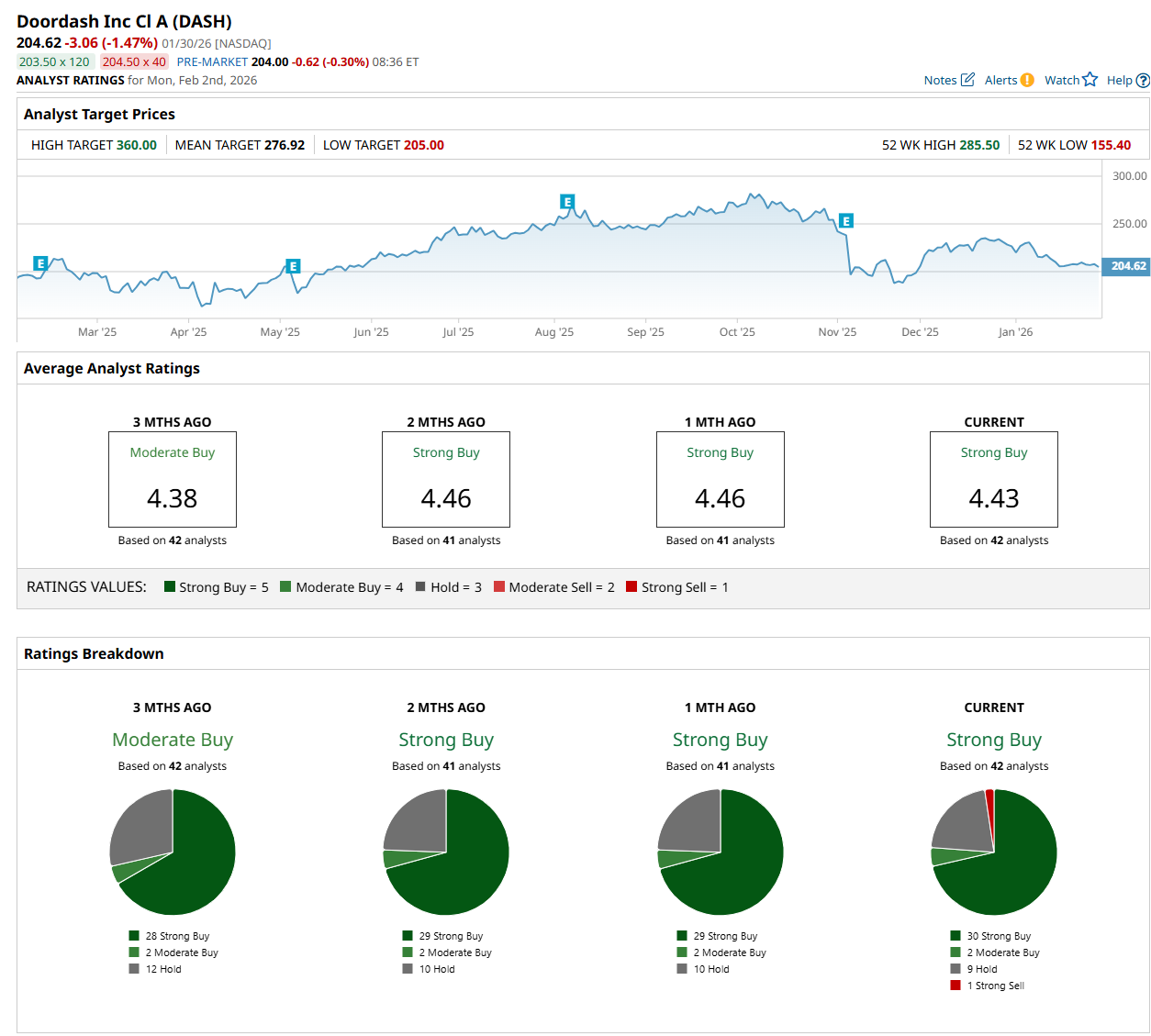

Among the 42 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 30 “Strong Buy,” two "Moderate Buy,” nine “Hold,” and one “Strong Sell” rating.

The configuration is more bullish than a month ago, with 29 analysts suggesting a "Strong Buy” rating.

On Jan. 30, Nikhil Devnani from AllianceBernstein Holding L.P. (AB) maintained a "Buy" rating on DASH, with a price target of $285, indicating a 39.3% potential upside from the current price levels.

The mean price target of $276.92 represents a 35.3% premium from DASH’s current price levels, while the Street-high price target of $360 suggests a 75.9% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- AMD’s Q4 Earnings Are Set To Impress: Should You Buy, Sell, Or Hold?

- ‘Solar Is Everything’: Tesla’s Elon Musk Says Other Energy Sources Are a Waste of Time, Like ‘a Caveman Throwing Some Twigs Into the Fire’

- Could Meta Platforms Stock Hit $1,000 in 2026?

- Groundhog Day Gloom? Why the Nasdaq Is Shaking Off Phil's Shadow and Facing Reality