With a market cap of $82.1 billion, The Williams Companies, Inc. (WMB) owns and operates about 33,000 miles of natural gas pipelines and related assets. It provides natural gas transmission, gathering, processing, and marketing services across major energy-producing regions of the United States.

Shares of the Tulsa, Oklahoma-based company have outperformed the broader market over the past 52 weeks. WMB stock has increased 19.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.5%. Moreover, shares of Williams are up 10.4% on a YTD basis, compared to SPX's 1.9% gain.

Looking closer, shares of the pipeline operator have also outpaced the State Street Energy Select Sector SPDR ETF's (XLE) 13.8% return over the past 52 weeks.

Shares of WMB fell 4.3% following its Q3 2025 results on Nov. 3, 2025, as adjusted EPS came in at $0.49, missing analyst expectations. The miss was driven by higher interest costs, which rose to $372 million from $338 million, and operating and maintenance expenses increased to $583 million, offsetting gains from higher service revenues. Additionally, revenue of $2.92 billion fell short of forecasts.

For the fiscal year that ended in December 2025, analysts expect Williams' adjusted EPS to grow 10.4% year-over-year to $2.12. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

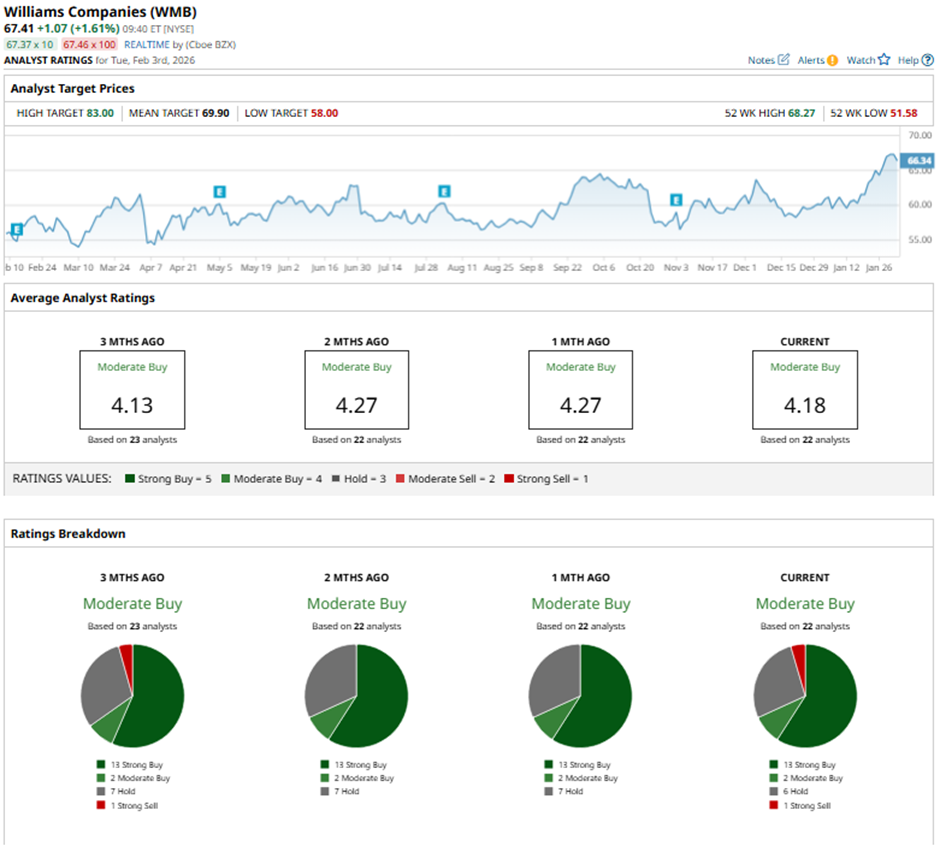

Among the 22 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, two “Moderate Buys,” six “Holds,” and one “Strong Sell.”

On Feb. 3, Jefferies raised its price target on Williams to $76 and maintained a “Buy” rating.

The mean price target of $69.90 represents a 3.7% premium to WMB’s current price levels. The Street-high price target of $83 suggests a 23.1% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart