My January 20, 2026, Barchart quarterly report on the base metals sector highlighted LME copper forwards and COMEX copper futures, which posted gains of over 41% in 2026. I concluded the report with the following:

I remain bullish on base metals, but would only enter or add to long risk positions on price corrections. Expect price volatility, and you will not be disappointed.

LME copper forwards and COMEX copper futures closed 2025 at $12,423 per ton and $5.6820 per pound, respectively. At over $12,900 per ton and above $5.80 per pound in early February 2026, copper futures and forwards have moved higher despite recent price volatility.

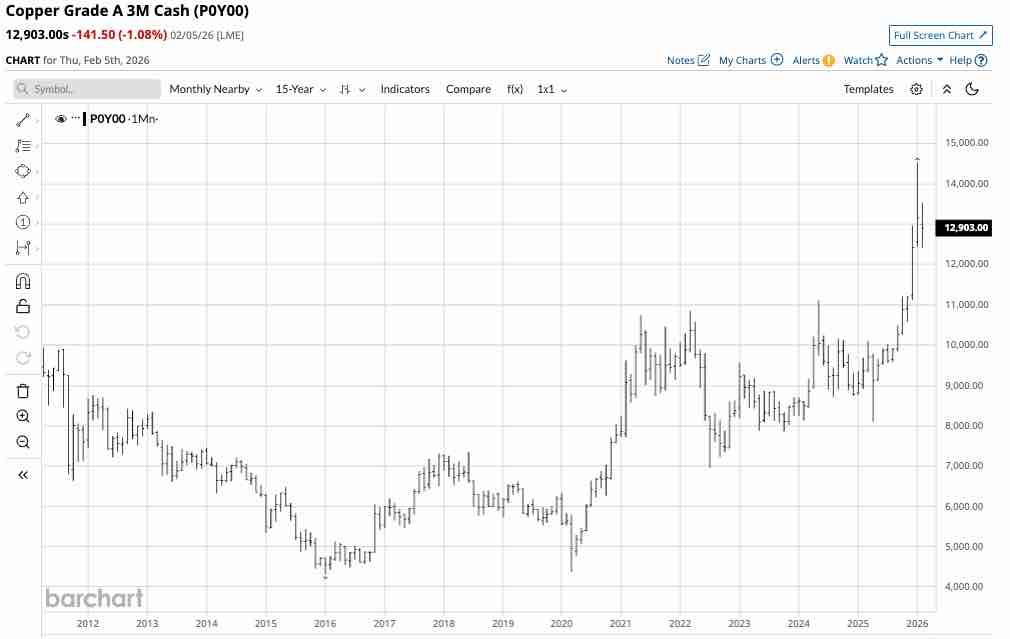

LME forwards are higher despite volatility

LME copper three-month forwards reached a record high of $14,527.50 per metric ton in January 2026, 16.9% higher than the 2025 closing price.

The monthly chart highlights LME copper’s continued price strength. While the price declined from the January high, it remains just above $12,900 per ton in early February 2026.

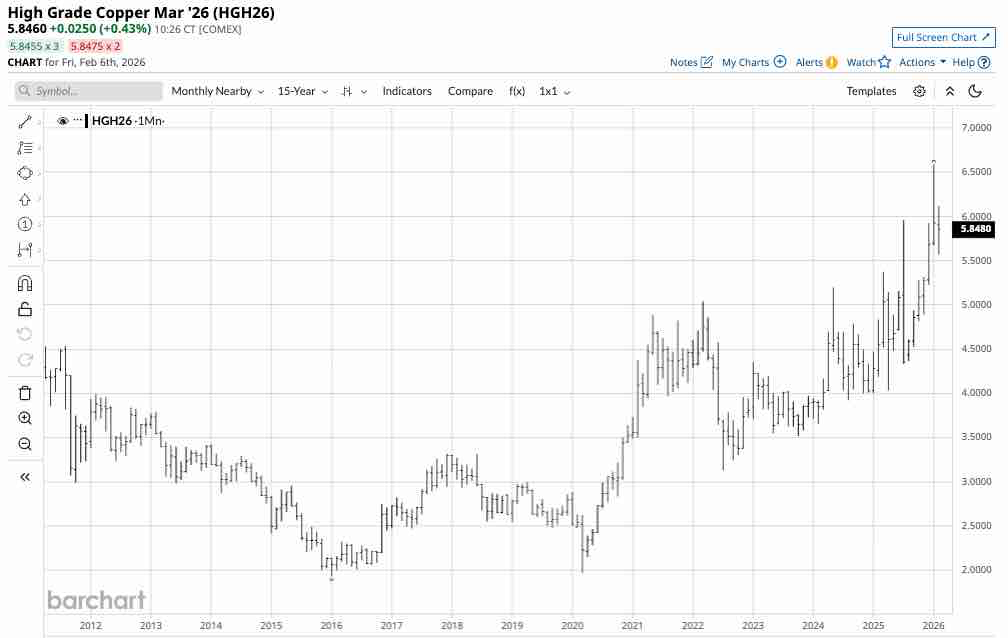

COMEX copper futures rally and trade in a wide range

COMEX copper futures reached a record high of $6.5830 per pound in late January 2026, 15.9% higher than the 2025 closing price.

The monthly chart highlights COMEX copper’s continued price strength. While the price declined from the January high, it remains above $5.80 per pound in early February 2026.

LME and COMEX copper have traded in wide price ranges over the past months. However, price corrections in both the forwards and futures have not violated critical technical support levels, leaving the bullish trends firmly intact.

Copper’s fundamental story remains intact

Copper is traditionally the leading base metal, a critical component in infrastructure construction. However, technological advances in green energy and AI infrastructure have increased the demand side of copper’s fundamental equation. In May 2022, Goldman Sachs analysts called copper “the new oil,” due to rising green energy demand. Meanwhile, AI infrastructure development over the coming years will only increase copper demand due to the rising electrification requirements.

In late 2025, JPMorgan analysts highlighted copper’s “essentially flat mine supply growth” and its fundamental tightness. Copper prices have already risen above JP Morgan’s 2026 forecast levels.

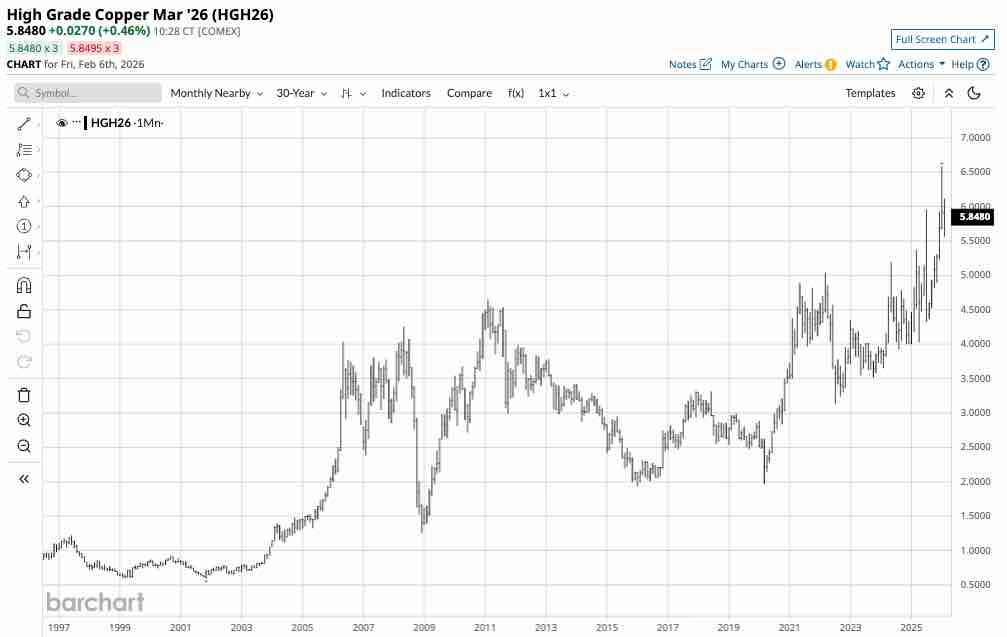

Buying dips has been optimal for years

Copper’s bullish trend began around the turn of this century, and the price has made higher lows and higher highs, never violating any critical technical support levels.

The monthly 30-year chart shows copper’s bullish trend, which began in 2001 at 60.40 cents per pound. At the peak, copper prices were over 10 times higher than the 2001 low. While the copper futures and forwards markets have experienced elevated price volatility, lows in 2001, 2008, 2016, 2020, 2022, 2023, and 2024 have not violated previous lows and have led to higher record highs.

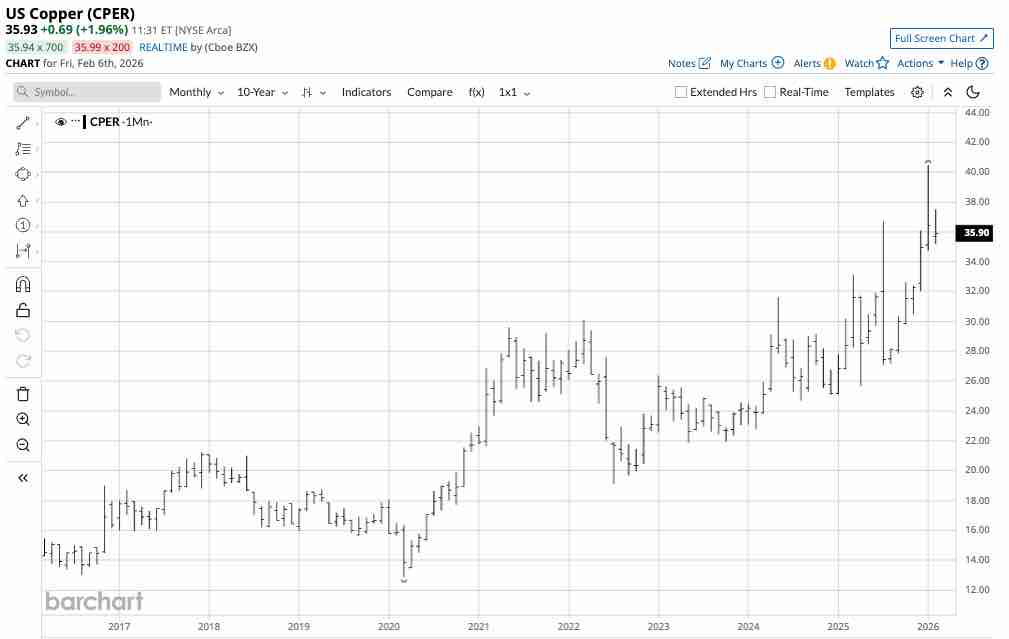

CPER is a copper ETF product

As technical and fundamental factors have aligned over the past years and continue in 2026, the odds favor higher highs for the red base metal.

The most direct route to copper exposure is through LME forwards or CME’s COMEX division futures contracts. The U.S. Copper ETF (CPER) is a liquid alternative for market participants seeking copper exposure through standard equity accounts. At $35.93 per share, CPER had over $766.4 million in assets under management. CPER trades an average of over 2.321 million shares daily and charges a 0.88% management fee.

The monthly chart highlights copper’s ascent. In 2025, LME and COMEX copper rose by over 41%. The CPER ETF moved 39% from $25.16 at the end of 2024 to $34.96 per share on December 31, 2025. The difference between the ETF and the futures and forwards was timing and the ETF’s management fee. One drawback of CPER is that while copper forwards and futures trade around the clock, CPER is only available during U.S. stock market hours. The ETF may miss highs or lows that occur when the stock market is closed.

Technical and fundamental factors support the continuation of the copper bull in February 2026. Given the red metal’s high volatility, buying on dips has been optimal since 2001, and I expect that trend to continue.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart