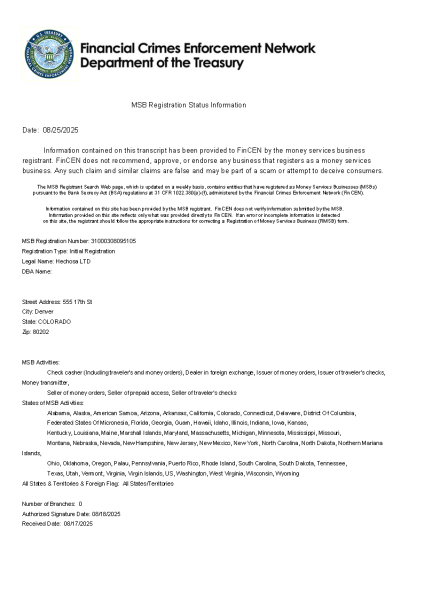

Hechosa Exchange announced that it has officially obtained a Money Services Business (MSB) license from the U.S. Financial Crimes Enforcement Network (FinCEN). This achievement marks a major milestone in the company’s global compliance strategy and paves the way for expansion across North America.

United States, 12th Nov 2025 – Hechosa Exchange, an innovative digital asset trading platform, today confirmed its successful registration as a Money Services Business (MSB) under the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN). This accomplishment represents a critical step in the company’s long-term compliance roadmap and reinforces its commitment to transparent, responsible, and globally aligned financial operations.

A Key Milestone in Regulatory Advancement

The MSB license is one of the core regulatory requirements for operating cryptocurrency and digital asset services in the United States. Hechosa Exchange’s approval signifies that its architecture, risk control systems, and data governance standards meet the stringent requirements set forth by FinCEN. The license enables the platform to provide secure money transmission and exchange services while maintaining full alignment with anti-money laundering (AML) and counter-terrorist financing (CFT) obligations.

Strengthening Infrastructure for Compliance and Security

In preparation for regulatory approval, Hechosa Exchange implemented a comprehensive series of system upgrades, including an on-chain identity verification module (ZK-KYC), cross-chain data isolation framework, and multi-dimensional auditing interface. These technical innovations form the foundation of its next-generation compliance infrastructure, ensuring both operational transparency and user privacy protection.

Compliance as a Service (CaaS) Model

Hechosa Exchange has adopted a “Compliance-as-a-Service” (CaaS) model to enhance regulatory adaptability for both its own platform and ecosystem partners. The framework operates on a three-layer structure—identity, transaction, and data—allowing dynamic configuration of user permissions, transaction limits, and data storage based on jurisdictional requirements. This architecture ensures that compliance obligations are met efficiently without compromising platform scalability or user experience.

A Strategic Step Toward Institutional Integration

The successful acquisition of the FinCEN MSB license positions Hechosa Exchange as a fully compliant operator within the U.S. digital asset ecosystem. The move enhances its credibility with institutional investors and traditional financial partners seeking regulated, secure, and transparent platforms. It also underscores the company’s dedication to advancing responsible innovation and strengthening trust between digital and conventional finance.

Executive Commentary

“Obtaining the MSB license demonstrates Hechosa Exchange’s unwavering commitment to regulatory integrity,” said Andrew Harlan, Head of Strategic Innovation at Hechosa Exchange. “This achievement allows us to expand with confidence, foster stronger relationships with global regulators, and continue building infrastructure that defines the future of compliant digital finance.”

Advancing the Vision of Trust and Transparency

As the digital finance industry evolves toward institutional maturity, compliance capability has become a defining measure of long-term sustainability. With this milestone, Hechosa Exchange reinforces its vision of “Trusted Liquidity,” contributing to the global development of transparent and secure digital asset market infrastructure.

About Hechosa Exchange

Hechosa Exchange is a global financial technology company providing secure, transparent, and innovative solutions for digital asset trading. Through advanced technology, AI-driven systems, and a compliance-first framework, the company empowers participants to engage confidently in a regulated and responsible digital economy.

Media Contact

Organization: Hechosa Exchange

Contact Person: Tyler Grant

Website: https://hechosa.com/

Email: Send Email

Country:United States

Release id:36905

Disclaimer: This announcement is for informational purposes only and does not constitute financial or investment advice.

View source version on King Newswire:

Hechosa Exchange Secures U.S. FinCEN MSB License, Strengthening Global Compliance Framework