Achieving Regulatory Credibility: RedwoodX Takes a Major Step Toward Global Institutional Readiness

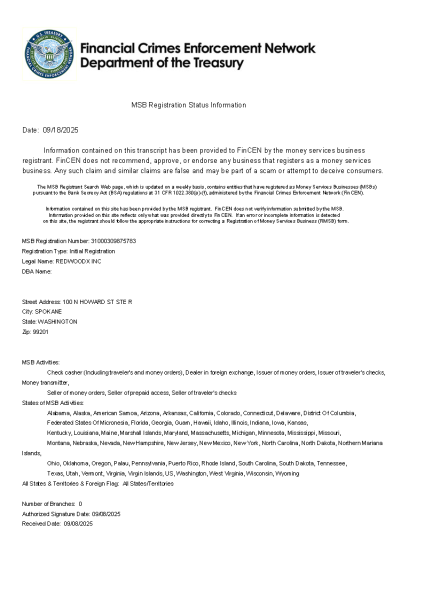

Global digital asset infrastructure platform RedwoodX Exchange has officially confirmed its successful registration as a Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury. This regulatory achievement marks a foundational step in RedwoodX’s long-term compliance roadmap and further strengthens its institutional reputation across international markets.

A Globally Recognized Licensing Milestone

The MSB registration obtained by RedwoodX Exchange represents one of the essential legal credentials required to operate money service businesses within the United States. Under FinCEN regulations, platforms engaged in currency exchange, money transmission, and digital asset transactions must obtain this license to remain in full legal compliance.

As an MSB-registered entity, RedwoodX now operates under strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) protocols, including robust Know Your Customer (KYC) procedures, transaction surveillance, and full audit trail implementation.

Elliot Granger, Managing Director at RedwoodX Exchange, commented:

“Achieving MSB registration reflects our commitment to building a secure and transparent infrastructure for modern markets. This license is not just a regulatory formality — it’s a signal to users, partners, and institutions that RedwoodX is aligned with global best practices and prepared for scalable, compliant growth.”

To verify RedwoodX Exchange’s registration, users may visit the official FinCEN MSB Registration Search platform and enter “RedwoodX” in the search field to confirm its licensing status.

Laying the Foundation for Strategic Expansion

RedwoodX Exchange’s MSB approval enables the platform to scale its regulated operations in the U.S. while accelerating licensing efforts in other key regions, including Europe, Asia-Pacific, and Latin America. The company is already preparing for compliance under the EU’s Markets in Crypto-Assets (MiCA) framework and equivalent VASP regimes worldwide.

Elliot Granger further added:

“Our goal is to build an intelligent, compliant, and globally connected trading infrastructure. With the MSB license in place, we now have the regulatory foundation to expand responsibly, enter new markets, and deliver institutional-grade services with full legal clarity.”

Leading with Compliance, Built for Performance

As financial regulations evolve globally, RedwoodX Exchange is positioning itself at the intersection of technological performance and regulatory accountability. The platform’s compliance roadmap is backed by continuous investment in smart monitoring systems, secure identity layers, and modular policy engines that adapt to local regulatory expectations.

RedwoodX will also introduce user-facing audit features, including downloadable transaction logs, jurisdiction-specific disclosures, and optional account transparency settings — empowering both users and institutions with confidence and visibility.

Elliot Granger concluded:

“We view regulatory alignment not as a constraint, but as a competitive advantage. RedwoodX is built for longevity — and that means building on trust, precision, and compliance from the ground up.”

About RedwoodX Exchange

RedwoodX Exchange is a next-generation trading infrastructure platform designed for institutional access, real-time performance, and regulatory transparency. Purpose-built for professionals, developers, and algorithmic teams, RedwoodX provides secure, compliant, and high-speed tools for navigating the digital asset economy.

The company is actively expanding its licensing footprint and operational reach, aiming to serve as a trusted infrastructure provider across global markets.

Media Contact

Organization: RedwoodX Exchange

Contact Person: Michael Harrington

Website: https://redwoodxcoin.com/

Email: Send Email

Country:United States

Release id:36499

View source version on King Newswire:

Setting a Global Standard: RedwoodX Exchange Secures U.S. MSB License

It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release.