In an exclusive interview with Finance Today, Daniel John Impens, Strategic Partner at OT MANAGEMENT, LLC, outlined how the firm’s Collective Capital Alliance (CCA) initiative has pushed institutional growth and profitability to new highs. By relying on systematic intraday trading, disciplined collective execution, and a large-scale trader development pipeline, OT MANAGEMENT has surpassed traditional asset managers in efficiency, resilience, and capital turnover.

United States, 6th Dec 2025 – As market conditions shift and investment firms reassess structural models, OT MANAGEMENT, LLC, a registered investment advisory firm in the United States, continues refining its approach to intraday discipline, risk-managed execution and participant development. In a recent interview, Strategic Partner Daniel John Impens described how the Collective Capital Alliance (CCA) initiative has become a key part of the firm’s long-term institutional framework.

Impens explained that the initiative focuses on creating a systematic environment that minimizes overnight exposure and reduces sensitivity to macro volatility. “We emphasize shorter, measurable time windows that allow uncertainty to be managed more effectively,” he said. According to him, this discipline-oriented design aims to strengthen operational consistency across different market phases. Impens explained that the early development of CCA stemmed from a structural requirement to align analytical tools, market-monitoring processes and participant behavior under a unified operational model. This alignment, he said, was essential to reducing fragmentation and improving institutional consistency.

Impens added that the CCA framework incorporates layered discipline mechanisms. The first centers on structural confirmation, helping avoid premature decisions when key validation indicators are incomplete. The second involves methodical oversight processes designed to limit impulsive or emotionally driven behavior. “The intention is to build consistent analytical habits,” he said. “Technical alignment ensures that decisions follow a shared framework rather than fragmented interpretation.”

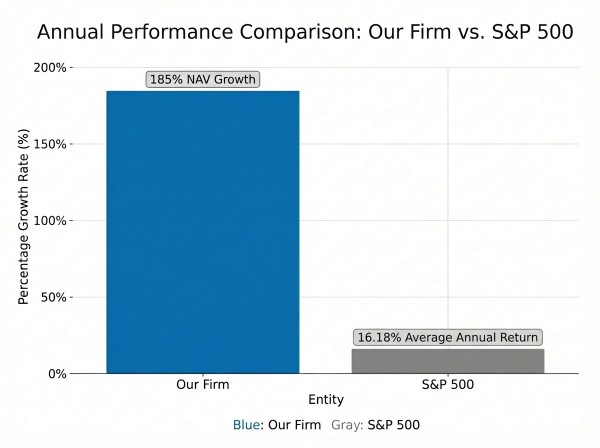

As part of the interview, Impens referenced an internal historical illustration (below) used in the firm’s educational materials—a comparison chart showing the firm’s past NAV movement alongside the long-term average return of the S&P 500 to support discussions on research methodology. The graphic, included as an analytical reference, The graphic, included as an analytical reference, depicts a period in which internal NAV rose at a significantly faster rate than the S&P 500’s historical average of approximately 16%. Impens stressed that the chart is for descriptive discussion only and not intended as a performance forecast or investment indication.

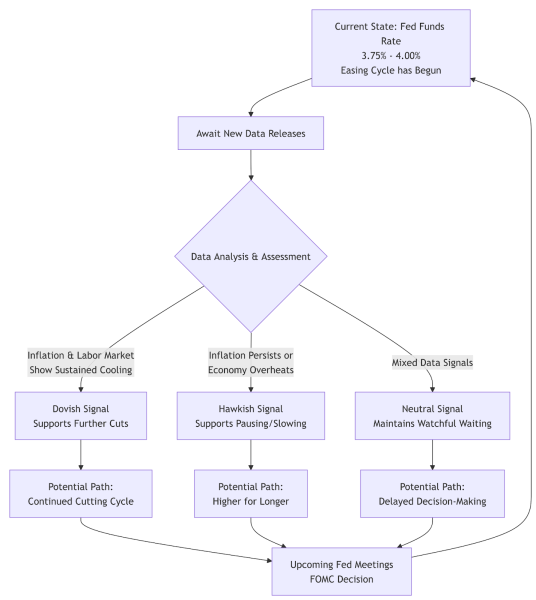

The conversation also highlighted a second visual used in OT MANAGEMENT’s internal research: a Federal Reserve policy flowchart—a conceptual framework used to help participants understand how various economic indicators (e.g. inflation trends, job-market data, and mixed economic signals) relate to FOMC’s rate-cut or wait-and-see decisions.

Impens noted that such frameworks help participants understand macro conditions without relying on speculative interpretation. “We encourage structured thinking—tools that help users interpret data in a consistent, disciplined way.” He also explained that CCA’s developmental ecosystem—combining structured training, psychological reinforcement and tool-based education—helps maintain alignment across a growing participant network.

Impens emphasized that CCA extends beyond strategy. It incorporates training, psychological reinforcement, and methodical pre-trade assessment. “Consistency at scale requires alignment,” he said. “Our role is to build a system that supports that alignment through education and structured processes.”

He added that synchronization is becoming increasingly important as markets evolve. “Traditional asset management often operates in separated channels,” Impens said. “What we are building is a coordinated approach that allows risk management, analysis, and execution to function more cohesively.”

Regarding the macro backdrop, Impens commented that firms capable of adapting to shifts in rate cycles and liquidity may be better positioned for structural opportunities. “Preparedness is more important than prediction,” he said. “CCA is about creating that readiness.”

He concluded by noting that the initiative is an ongoing developmental platform rather than a short-term directional project. “Institutional progression takes time. Our focus is sustainable structure, disciplined methodology, and coordinated engagement.”

About OT MANAGEMENT

OT MANAGEMENT, LLC is a U.S.-registered investment advisory firm focusing on systematic intraday methodologies, coordinated decision frameworks, and participant development. Its Collective Capital Alliance initiative integrates analytical tools, structured training, and risk-managed execution processes to enhance operational consistency for traders and institutional partners. The firm emphasizes transparency, disciplined practice, and long-term structural growth.

Media Contact

Organization: OT MANAGEMENT

Contact Person: Daniel John Impens

Website: https://otmmmx.com/

Email: Send Email

Country:United States

Release id:38514

View source version on King Newswire:

Wall Street Focus: How the Collective Capital Alliance Accelerates OT MANAGEMENT’s Institutional Expansion