Multi-client warehousing capability provides new avenue for growth; expands presence in key supply chain geography

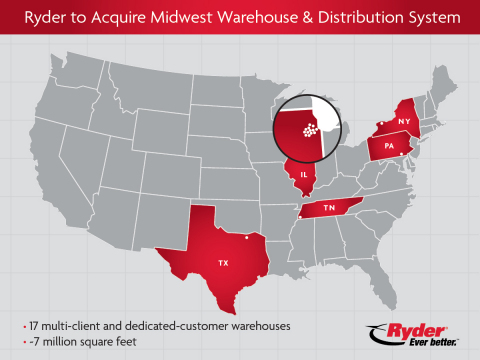

Ryder System, Inc. (NYSE: R), a leader in supply chain, dedicated transportation, and fleet management solutions, announces it has entered into a definitive agreement to acquire all of the outstanding equity of Midwest Warehouse & Distribution System (Midwest). Midwest, based in Woodridge, Ill., provides warehousing, distribution, and transportation solutions primarily for food, beverage, and consumer packaged goods (CPG) companies. Midwest operates nine multi-client and eight dedicated-customer warehouses in five regions, primarily in the greater Chicago area—a key distribution hub—and to a lesser extent in New York, Pennsylvania, Tennessee, and Texas. Midwest’s warehouse space totals approximately seven million square feet and is supported by a company-owned fleet of trucks to service customers.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211027005502/en/

Ryder to acquire Midwest Warehouse & Distribution System which operates 17 multi-client and dedicated-customer warehouses, primarily in the greater Chicago area. The multi-client warehousing capability will provide a new avenue for growth for Ryder and expands the 3PL's presence in a key supply chain geography. (Graphic: Business Wire)

The transaction, which the parties expect to complete in early November 2021, is expected to add approximately $135 million in annual revenue to Ryder’s supply chain solutions business segment in 2022 and provide incremental growth to Ryder’s earnings in 2022.

“In addition to having a significant presence in a key geography, Midwest has built a proven model for multi-client warehousing and distribution—a capability that we’ve been targeting for some time,” says Steve Sensing, president of global supply chain solutions for Ryder. “We currently serve nine out of the top 10 U.S. food and beverage companies, and this acquisition enables us to offer those customers—as well as additional blue-chip customers in Midwest’s portfolio—even more capacity and greater flexibility.”

Ryder will integrate Midwest’s facilities and operations into its CPG business, retain Midwest’s executive team, and continue operations with the company’s workforce.

“Multi-client warehouse environments are a great entry point for new customers looking for a 3PL that can meet their needs now and in the future,” says Darin Cooprider, senior vice president of CPG for Ryder. “As our customers’ businesses grow and evolve, we can seamlessly transition them from multi-client warehouses to dedicated facilities. We offer dedicated transportation solutions for guaranteed capacity and a robust transportation management offering which can help mitigate market fluctuations. And, we offer proprietary technologies that set the standard for real-time visibility and collaboration across the end-to-end supply chain, so we can help our customers avoid costly delays and continually find efficiency gains. We do what we do best, so our customers can focus on what they do best.”

“Ryder stood out to us because our companies share the same culture focused on trust, safety, taking care of employees, and putting customers first,” says Ed Borkowski, president of Midwest Warehouse & Distribution System. “By combining our people, experience, and expertise, we are positioning our valued employees and customers for continued success within the rapidly evolving supply chain & logistics industry.”

Wofford Advisors LLC served as Ryder’s strategic advisor for the transaction and Blank Rome LLP acted as legal counsel. Republic Partners LLC and Freeborn & Peters LLP represented Midwest.

About Ryder System, Inc.

Ryder System, Inc. (NYSE: R) is a leading logistics and transportation company. It provides supply chain, dedicated transportation, and fleet management solutions, including full service leasing, rental, and maintenance, used vehicle sales, professional drivers, transportation services, freight brokerage, warehousing and distribution, e-commerce fulfillment, and last mile delivery services, to some world’s most-recognized brands. Ryder provides services throughout the United States, Mexico, Canada, and the United Kingdom. In addition, Ryder manages nearly 235,000 commercial vehicles and operates more than 300 warehouses encompassing approximately 64 million square feet. Ryder is regularly recognized for its industry-leading practices in third-party logistics, technology-driven innovations, commercial vehicle maintenance, environmentally friendly solutions, corporate social responsibility, world-class safety and security programs, military veteran recruitment initiatives, and the hiring of a diverse workforce. www.ryder.com

Note Regarding Forward-Looking Statements: Certain statements and information included in this news release are "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. These forward-looking statements, including our expectations regarding the benefits and timing of the transaction, are based on our current plans and expectations and are subject to risks, uncertainties and assumptions. Accordingly, these forward-looking statements should be evaluated with consideration given to the many risks and uncertainties that could cause actual results and events to differ materially from those in the forward-looking statements including those risks set forth in our periodic filings with the Securities and Exchange Commission. New risks emerge from time to time. It is not possible for management to predict all such risk factors or to assess the impact of such risks on our business. Accordingly, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

ryder-scs

ryder-usa

View source version on businesswire.com: https://www.businesswire.com/news/home/20211027005502/en/

Contacts

Media Contacts

Anne Hendricks, Ryder

amhendricks@ryder.com

Amy Federman

afederman@ryder.com