Honda (Mass Market) and Lexus (Premium) Win Brand Awards

ALG, the division of J.D. Power known as the industry benchmark of automotive residual value projections, today announced recipients of the J.D. Power 2022 U.S. ALG Residual Value Awards, highlighted by Honda and Lexus being named brand award winners in the mass market and premium segments, respectively.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211118005622/en/

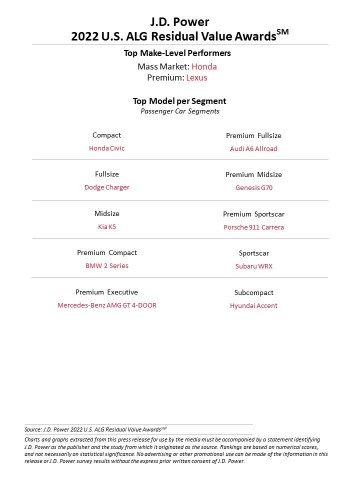

J.D. Power 2022 U.S. ALG Residual Value Awards (Graphic: Business Wire)

“Accurately forecasting residual values in the auto industry is a key factor in assessing an estimated $225 billion lease portfolio of vehicles in the United States,” said Eric Lyman, vice president of ALG. “The brands and vehicle models that rise to the top demonstrate that they score well across the award program’s criteria, including manufacturers’ superior design and quality.”

The J.D. Power U.S. ALG Residual Value Awards are the automotive industry standard in recognizing vehicle models projected to hold the highest percentage of their manufacturer’s suggested retail price following a three-year period of ownership. This value retention is a key variable in the lease cost of a vehicle, underscoring an automaker’s success in the areas of long-term quality and design, as well as the overall desirability of automotive brands and their models. It is also a vital component to vehicle shoppers as it helps forecast a vehicle’s resale value once they sell or trade-in the vehicle for a new one, consistently cited as an important purchase consideration by shoppers.1

For model-year 2022, 16 different brands have won awards in 29 segments. The award process consists of evaluating 284 models through analysis of used-vehicle performance, brand outlook and product competitiveness. Eligibility for a brand award requires a manufacturer to have model entries in at least four different segments. To account for differences across trim levels, model averages are weighted based on percentage share relative to the entire model line.

In addition to the mass market brand level award, Honda also takes home three model-level awards. Lexus ranks highest among premium brands despite not having a segment-winning model. “The achievement of Lexus speaks to an impressive, industry-leading continuity of residual value across its entire lineup,” Lyman said. “It’s like a decathlete who doesn’t have to win any of the individual 10 events but scores enough points in each of them to stand atop the podium.”

Model-Level Residual Value Awards

Honda and Hyundai share the most model-level awards, with three each. They are followed by a diverse list of manufacturers winning in two categories: Audi, Kia, Land Rover, Mercedes-Benz, Subaru and Toyota.

- Honda: Civic, Passport and Odyssey

- Hyundai: Accent, Kona and Kona EV

- Audi: A6 Allroad and Q3

- Kia: K5 and Telluride

- Land Rover: Range Rover Velar and Discovery

- Mercedes-Benz: AMG GT 4-Door and Metris

- Subaru: WRX and Forrester

- Toyota: Tacoma and Tundra

Noteworthy for 2022, the Mercedes-Benz AMG GT 4-Door tops long-time segment leader Lexus LS in the Premium Executive segment, while the new Ford Bronco beats out perennial winners Jeep Wrangler and Toyota 4Runner for top honors in the Off-Road Utility segment. Also of note are the increasingly popular electric vehicle winners, which are highlighted by the Kona EV in the Mass Market Electric segment and the Tesla Model Y in the Premium Electric segment.

Numerous variables affect the actual residual value of a vehicle over a multi-year lease term. Examples include mileage, quality/reliability, options and feature sets, weather and macroeconomic environment. Since these factors need to be taken into account in order to accurately forecast residual values, the more granularity and greater the understanding of the effect of each variable, the better equipped manufacturers and lenders are able to maximize profitability. The combination of J.D. Power insights and data with the deep experience of ALG in residual values allows for even more accurate end-of-lease forecasting capabilities.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021159.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power U.S. Sales Satisfaction Index (SSI) Study

View source version on businesswire.com: https://www.businesswire.com/news/home/20211118005622/en/

Contacts

Media Relations Contacts

Shane Smith; East Coast; 424-903-3665; ssmith@pacificcommunicationsgroup.com

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com