- San Francisco ranks second as it rebounds from COVID-19 and continues the shift to sustainable mobility options

- Helsinki, Amsterdam, Berlin, and Zurich climb up the ranking to the top 10, while Singapore, London, New York, and Hong Kong lose ground

- New sustainable mobility sub-index showcases how cities are investing and organising to ensure their urban mobility is sustainable, with Scandinavian cities leading the charge

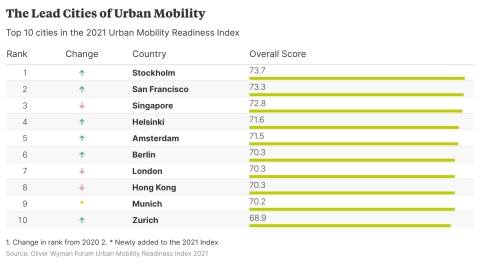

Stockholm, San Francisco, and Singapore top the 2021 Urban Mobility Readiness Index launched today by the Oliver Wyman Forum and the UC Berkeley Institute of Transportation Studies (ITS). These cities are leading with measures such as investment in new technologies, including electric vehicles, and others benefitting from rebounding local industry and the transition to remote work following the pandemic, which has reduced congestion and encouraged residents to adopt more physically active mobility options.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211102006065/en/

The Top 10 cities in Oliver Wyman's 2021 Urban Mobility Readiness Index (Graphic: Business Wire)

The impact of COVID-19

Launching at the Global Mobility Executive Forum taking place at Expo 2020 in Dubai, the 2021 Index highlights that COVID-19 continues to have a major impact on urban mobility. For some, the year has been surprisingly positive, seeing an uplift in sustainable mobility.

Stockholm (1st) is now ranked number one thanks to continued investment in electrification and micromobility infrastructure, as well as corresponding increases in walking and cycling, accelerating the city’s trend toward sustainable mobility. San Francisco (2nd) rose nine places to rank second overall due in part to a boom in remote working, which greatly reduced congestion and drove residents toward more active mobility. Meanwhile, Helsinki (4th) made strides in sustainable mobility, including significant car-free zones and low levels of air pollution, Amsterdam (5th), world-renowned for its cycling culture and infrastructure, pushed forward with its large-scale, smart city initiative encouraging the development and adoption of electric vehicles, and Berlin (6th) further embraced multimodality, with diverse, connected modes of public transit.

For a larger number however, it has been quite the opposite, with falling investment and a shift to greater private car use. Singapore (3rd), which topped the list for the last two years, is now third as the strict regulatory environment has curbed the level of micromobility growth observed in other regions. London (7th) is suffering from a decline in the innovation ecosystem under COVID-19 and Brexit, while Hong Kong’s (8th) social unrest has meant fewer investments in its mobility sector. Lastly, New York (11th) suffered during the pandemic due to many leaving the City and the high adoption of private vehicles in place of public transit.

John Romeo, Managing Partner, Oliver Wyman Forum, says: “The cities coming out on top of the 2021 Urban Mobility Readiness Index have made significant investments in new, sustainable infrastructure and technologies that will only become more important in the future as we grapple with evolving challenges of the pandemic and climate change. Stockholm is a bright example of what can be achieved, and we should also recognize the efforts made across the globe to make our cities more resilient.”

Alexandre Bayen, Director, Berkeley ITS, adds: "The rise of San Francisco in the rankings from 11th in 2020 to 2nd in 2021 shows the index’s ability to capture multiple factors, including the remarkable capacity of the Bay Area to adapt its mobility ecosystem to the pandemics. While tech continued to boom, a large part of the population was already prepared for remote work and learning, traffic congestion improved, and many embraced walking and more active mobility.”

A focus on sustainability

This year, the Oliver Wyman Forum added the sustainable mobility sub-index, a distinct set of metrics focusing on how cities are investing and organizing to ensure their urban mobility is sustainable.

The Scandinavian cities all score well, with Oslo, (1st) commonly known as the electric vehicle capital of the world, coming out on top, closely followed by Helsinki (3rd) and Stockholm (5th). At 15% above the average, European cities do particularly well in sustainable mobility thanks to a comprehensive package of electrification, active mobility, and a lower shift to private vehicles, complemented by more robust public transit. The all-Scandinavian grouping is broken up by Amsterdam (2nd) in second place, Hong Kong (4th) in fourth and Singapore (6th) in sixth.

Guillaume Thibault, Partner, Oliver Wyman Forum, says: “With COP26 in full swing, the Oliver Wyman Forum’s sustainable mobility sub-index is a crucial addition to track the resilience and investment of 60 of the world’s most important cities. The challenges of COVID-19 encouraged a number of cities to innovate in more sustainable and active forms of mobility, most notably by improving their cycling infrastructure.”

About the analysis

The Oliver Wyman Forum, in partnership with the University of California, Berkeley, has developed an annual forward-leaning ranking of how well-positioned global cities are to lead mobility’s next chapter. The 2021 Urban Mobility Readiness Index measures 60 cities across 57 KPIs. The Sustainability sub-index is a distinct analysis of a sub-set of 16 KPIs, focusing on how cities are investing and organising to ensure their urban mobility is sustainable.

About the Oliver Wyman Forum

The Oliver Wyman Forum is committed to bringing together leaders in business, public policy, social enterprises, and academia to act on shared global challenges. The Oliver Wyman Forum strives to discover and develop innovative solutions by conducting research, convening leading thinkers, analyzing options, and inspiring action. Together with our growing and diverse community, we think we can make a difference. For more information, visit www.oliverwymanforum.com.

About Oliver Wyman

Oliver Wyman is a global leader in management consulting. With offices in 60 cities across 29 countries, Oliver Wyman combines deep industry knowledge with specialized expertise in strategy, operations, risk management, and organization transformation. The firm has more than 5,000 professionals around the world who work with clients to optimize their business, improve their operations and risk profile, and accelerate their organizational performance to seize the most attractive opportunities. Oliver Wyman is a business of Marsh McLennan [NYSE: MMC]. For more information, visit www.oliverwyman.com. Follow Oliver Wyman on Twitter @OliverWyman.

About Berkeley ITS

The Institute of Transportation Studies at the University of California Berkeley was created in 1947 by the State of California to support research efforts related to future mobility. It is an organized research unit on campus, comprising seven research centers, a start-up accelerator program, a transportation training program, a library and testing facilities for automated vehicles. It employs over 200 faculty, researchers and technical staff, focused around verticals of mobility, which include digitalization, automation, electrification, the shared economy, policy, planning and finance. its.berkeley.edu/

View source version on businesswire.com: https://www.businesswire.com/news/home/20211102006065/en/

Contacts

Francine Minadeo

Mobile: 917-573-8826

Francine.Minadeo@oliverwyman.com