U.S. Bancorp Investments Ranks Highest in Wealth Management Mobile App Satisfaction

Wealth management firms have invested heavily in upgrading their apps, with 75% making feature enhancements in the past year, up from 44% a year ago. However, according to the J.D. Power 2021 U.S. Wealth Management Mobile App Satisfaction Study,℠ released today, while these efforts are paying off in terms of greater utilization, improved engagement and higher overall customer satisfaction scores, wealth management still lags other industries when it comes to the overall app user experience.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211123005385/en/

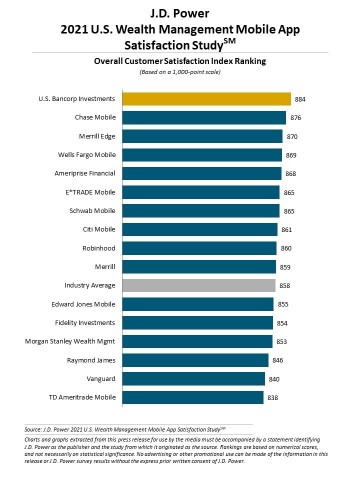

J.D. Power 2021 U.S. Wealth Management Mobile App Satisfaction Study (Graphic: Business Wire)

“The pace of customer adoption of mobile has accelerated dramatically across virtually every industry, and that’s both an opportunity and a challenge for wealth management firms,” said Michael Foy, senior director of wealth intelligence at J.D. Power. “Clearly, the investment that firms have put behind their digital strategies is having a positive effect on app user experience and overall utilization rates, but that same thing is happening everywhere, and some industries are just moving faster. Wealth management firms have some unique challenges because of legacy back-end technology and the sheer complexity and range of services they need to provide. But there are unique opportunities to leverage an app to deliver relevant educational content and facilitate communication with advisors.”

Following are key findings of the 2021 study:

- Customer satisfaction and usage surges: Overall customer satisfaction with wealth management mobile apps this year is 858 (on a 1,000-point scale), up nine points from a year ago. Major drivers of this increase are speed, range of services offered and overall appearance. The number of customers using their wealth apps daily has increased four percentage points year over year and the number using them multiple times per day has increased three percentage points.

- Wealth app customer satisfaction lags other financial apps: Despite increased customer satisfaction, overall customer satisfaction with wealth apps trails average app satisfaction scores in J.D. Power studies in the banking (860), credit card (867) and insurance (877) industries. While wealth management firms are spending big on updates, with 31% introducing major feature updates this year, that number jumps to 33% for credit card apps and 50% for banking apps.

- Seamless advisor interaction via app creates opportunity: A key differentiator for wealth management apps vs. those of other industries is direct line connectivity to human advisors. Still, just 44% of wealth app users who work with an advisor say they communicate with them via the app, which is unchanged from 2020.

- App-based investor education can improve: While firms are very proficient at providing apps with market-related news and information, many fall short on delivering personalized content and guidance. Just more than half (51%) of customers strongly agree that their wealth app provides tailored insights and content and just 47% say it is very easy to research investment options on their wealth app.

“Customer expectations for a seamless multi-channel experience are rising rapidly in line with significant investment and innovation for nearly every customer touch point across every industry,” said Amit Aggarwal, senior director of digital solutions at J.D. Power. “The key for wealth management firms to level up in this competitive environment is to heavily lean into their unique value propositions, making it easy and intuitive for investors to move seamlessly between the app and other digital or human channels, while delivering personalized guidance and important information along the way.”

The 2021 U.S. Wealth Management Mobile App Satisfaction Study evaluates customer satisfaction with wealth management mobile apps based on five factors (in order of importance): range of services; clarity of information; ease of navigating; appearance; and speed of screens loading. The study is based on responses from 3,025 full-service and self-directed investors and was fielded in July-August 2021.

Study Ranking

U.S. Bancorp Investments ranks highest in overall customer satisfaction with wealth management apps, with a score of 884. Chase Mobile (876) ranks second and Merrill Edge (870) ranks third.

For more information about the U.S. Wealth Management Mobile App Satisfaction Study, visit

https://www.jdpower.com/business/financial-services/us-wealth-management-mobile-app-satisfaction-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021161.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20211123005385/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com