The Company provides revenue estimates for growing pipeline of development projects

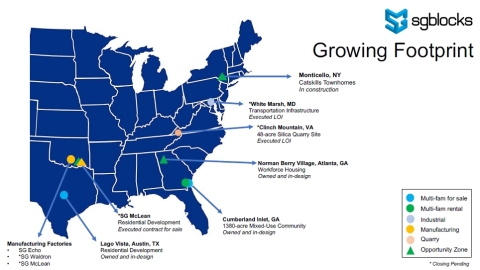

SG Blocks, Inc. (NASDAQ: SGBX) (“SG Blocks” or the “Company”), a leading designer, innovator and fabricator of modular structures, announced today that SGB Development Corp. (“SGB DevCorp”), a wholly-owned subsidiary of the Company, has released a map outlining the Company’s existing and currently planned development projects across the United States.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211208005104/en/

(Graphic: Business Wire)

“SGB DevCorp. is growing in size and scale in fairly short order. We remain focused on delivering existing projects and reviewing other opportunities for continued expansion,” Paul Galvin, Chairman & CEO stated. “Between housing shortages and the opportunities in the new infrastructure bill, we believe we are well positioned to rapidly grow our platform.”

These projects are intentionally diverse in geography and asset class to help reduce risk and to maximize returns. SGB DevCorp includes a pipeline of approximately 2,250 residential units for sale or rent and letter of intents have been executed for an industrial site and quarry. The potential gross revenue is represented below:

- Approximately $367 million dollars in gross potential manufacturing revenue over the next 4-5 years for SG Echo’s manufacturing factories due primarily from the Lago Vista, McLean, Cumberland and Norman Berry projects.

- Approximately $50-$70 million dollars in asset sales and earned development fees related to the current pipeline of SGB DevCorp projects.

- Approximately $40 million in gross potential revenue related to the quarry and industrial site projects currently under letters of intent estimated over the next 5-year period.

SGB DevCorp currently has projects located in Oklahoma, Texas, Georgia, Maryland, Virginia, and New York, with plans in place to scale and expand. Strategies range from factories to workforce housing, residential developments, mixed-use communities, and townhomes.

“We continue to believe in a strategy of filling factories with our own projects to create an integrated revenue stream,” Paul Galvin noted.

SG DevCorp’s current roster can be found in the imbedded graphic. The Company looks forward to sharing further updates on its pipeline of development projects.

About SG Blocks, Inc.

SG Blocks, Inc. is a premier innovator in advancing and promoting the use of code-engineered cargo shipping containers for safe and sustainable construction. The firm offers a product that exceeds many standard building code requirements, and also supports developers, architects, builders and owners in achieving greener construction, faster execution, and stronger buildings of higher value. Each project starts with GreenSteel™, the structural core and shell of an SG Blocks building, and then customized to client specifications. For more information, visit www.sgblocks.com.

Safe Harbor Statement

Certain statements in this press release constitute "forward-looking statements" within the meaning of the federal securities laws. Words such as "may," "might," "will," "should," "believe," "expect," "anticipate," "estimate," "continue," "predict," "forecast," "project," "plan," "intend" or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. These forward-looking statements are based upon current estimates and assumptions and include statements regarding being well positioned to rapidly grow SGB DevCorp’s platform, earning approximately $367 million dollars in gross potential manufacturing revenue over the next 4-5 years for SG Echo manufacturing factories due primarily from the Lago Vista, McLean, Cumberland and Norman Berry projects, earning approximately $50-$70 million dollars in asset sales and earned development fees related to the current pipeline of SGB DevCorp projects, earning approximately $40 million in gross potential revenue related to quarry and industrial site projects under letters of intent estimated over the next 5-year period, plans scale and expand SGB DevCorp.’s operations from factories to workforce housing, residential developments, mixed-use communities, and townhomes and sharing further updates on the pipeline of development projects. While SG Blocks believes these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based on information available to us on the date of this release. These forward-looking statements are subject to various risks and uncertainties, many of which are difficult to predict that could cause actual results to differ materially from current expectations and assumptions from those set forth or implied by any forward-looking statements. Important factors that could cause actual results to differ materially from current expectations include, among others, the Company’s ability to rapidly grow SGB DevCorp’s platform, the Company’s ability to complete the Lago Vista, McLean, Cumberland and Norman Berry projects as planned, the Company’s ability to complete the current pipeline of SGB DevCorp projects as planned, the Company’s ability to complete the quarry and industrial site projects under letters of intent as planned, the Company’s ability to scale and expand SGB DevCorp.’s operations from factories to workforce housing, residential developments, mixed-use communities, and townhomes and sharing further updates on the pipeline of development projects, the Company’s ability to provide further updates as planned, the Company’s ability to expand within various verticals as planned,, the Company’s ability to position itself for future profitability, the Company’s ability to maintain compliance with the NASDAQ listing requirements, and the other factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 and its subsequent filings with the SEC, including subsequent periodic reports on Forms 10-Q and 8-K. The information in this release is provided only as of the date of this release, and we undertake no obligation to update any forward-looking statements contained in this release on account of new information, future events, or otherwise, except as required by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211208005104/en/

Contacts

Investors:

Stephen Swett

(203) 682-8377

investors@sgblocks.com