State Farm Ranks Highest among Small Commercial Insurers

A toxic combination of business disruption and economic uncertainty strained the relationship between small businesses and their commercial line insurers during the pandemic, causing customer satisfaction to decline beginning in 2020 for the first time in seven years. According to the J.D. Power 2022 U.S. Small Commercial Insurance Study,℠ released today, that trend has reversed, with overall small business customer satisfaction climbing 13 points (on a 1,000-point scale) to just 2 points lower than its pre-pandemic high.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220823005377/en/

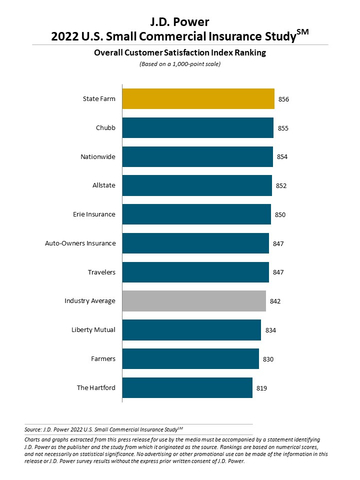

J.D. Power 2022 U.S. Small Commercial Insurance Study (Graphic: Business Wire)

“It’s noteworthy that we’re seeing increases in satisfaction across all factors—including price—at a time when 30% of small business customers have experienced an insurance premium increase,” said Stephen Crewdson, senior director of global insurance intelligence at J.D. Power. “That’s the highest proportion of customers experiencing price increases that we’ve seen in the past eight years. Insurers that notify their small business customers in advance of a price increase and proactively work with them to mitigate the financial effects of those premium increases are finding that it is possible to drive strong customer engagement and high levels of customer satisfaction even in a difficult economic environment.”

Following are some key findings of the 2022 study:

- Customer satisfaction improves following pandemic-era dip: Overall small business customer satisfaction with commercial insurers is 842, up 13 points from 2021. Customer satisfaction improves across all factors in the study and is led by interaction; billing and payment; and policy offerings. Customer satisfaction with commercial insurance climbed steadily from 2013 until the pandemic, reaching an all-time high of 844 in 2019.

- Smallest small businesses feel less satisfied: Although overall customer satisfaction improves across all categories of businesses evaluated in the study, the micro category—which consists of businesses with fewer than five employees—has a lower overall satisfaction score (826) than do medium-size (841) and larger (852) small businesses.

- Proactive communication about premium increases influences satisfaction: Customer satisfaction with the price of their small business insurance policies rises 3 points this year, despite 30% of small businesses experiencing a premium increase. The study finds that proactive communication plays a big role in that trend. When customers experience an increase—but are notified in advance, discuss ways to mitigate the effect of the increase and completely understand why their premiums increased—they are nearly as satisfied with price as customers who did not have an increase at all.

Study Ranking

State Farm ranks highest in overall customer satisfaction with a score of 856. Chubb (855) ranks second and Nationwide (854) ranks third.

The 2022 U.S. Small Commercial Insurance Study is based on responses from 2,254 small commercial insurance customers. The study, now in its 10th year, examines overall customer satisfaction among small commercial insurance customers with 50 or fewer employees. Overall satisfaction is comprised of five factors (in alphabetical order): billing and payment; claims; interaction; policy offerings; and price. The study was fielded from March through June 2022.

For more information about the J.D. Power U.S. Small Commercial Insurance Study, visit https://www.jdpower.com/business/insurance/us-small-commercial-insurance-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2022105.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20220823005377/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com