Businesses can offer a trusted, bank-backed consumer financing option that helps make purchases affordable

U.S. Bank, an industry leader in payment services, announces today the launch of Avvance, an embedded, multi-channel point of sale lending solution. Avvance empowers businesses with the ability to offer consumer financing during checkout with a quick application and instant decisioning.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231024792881/en/

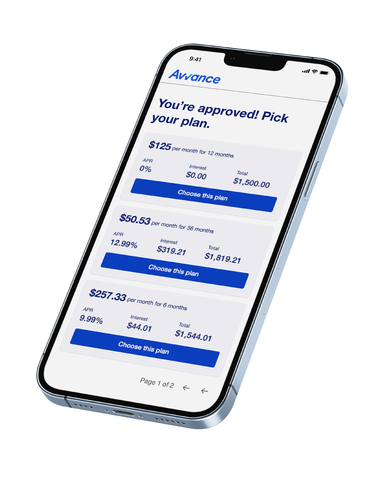

(Photo: Business Wire)

Payment methods are constantly evolving and so are consumer expectations. Avvance offers a transparent, convenient way to pay over time with loan options available during the checkout experience. Backed by U.S. Bank, offers are personalized providing flexibility while maintaining healthy spending habits. For business owners, Avvance is embedded in the checkout process, enabling them to offer convenience for their customers from a trusted provider without the hassle of managing payments after the sale.

“Consumers like the certainty of knowing their payment amount and terms at the time of sale, with easy and instant access to credit. With Avvance, business owners have the ability to attract new customers while increasing their buying power, resulting in increased sales,” said Mia Huntington, executive vice president of Buy Now, Pay Later and Point-of-Sale Lending at U.S. Bank and Elavon. “Our point-of-sale lending product allows business owners the ability to offer affordable financing while they receive full payment at the time of sale. U.S. Bank, the primary source of the consumer loans, manages all aspects from application to servicing, so business owners can focus on what they do best — running their business.”

U.S. Bank Avvance™ offers flexible alternatives to pay so customers can own the purchase and the process, and business owners attract more sales, more often, streamlining the payment experience.

To learn more about Avvance, visit www.avvance.com.

About U.S. Bank

U.S. Bancorp, with approximately 75,000 employees and $668 billion in assets as of September 30, 2023, is the parent company of U.S. Bank National Association. Headquartered in Minneapolis, the company serves millions of customers locally, nationally and globally through a diversified mix of businesses including consumer banking, business banking, commercial banking, institutional banking, payments and wealth management. U.S. Bancorp has been recognized for its approach to digital innovation, community partnerships and customer service, including being named one of the 2023 World’s Most Ethical Companies and Fortune’s most admired superregional bank. To learn more, please visit the U.S. Bancorp website at usbank.com and click on “About Us.”

About Elavon

Elavon is owned by U.S. Bank (NYSE: USB), the fifth-largest bank in the United States, and provides end-to-end payment processing solutions and services to more than 1.3 million customers in the United States, Europe, and Canada. As the leading provider for airlines and a top five provider in hospitality, healthcare, retail, and public sector/education, Elavon’s innovative payment solutions are designed to solve pain points for businesses from small to the largest global enterprises.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231024792881/en/

Contacts

Joseph Rauch

Joseph.Rauch@usbank.com

919.260.2994