Amica Mutual Ranks Highest for Second Consecutive Year

Long repair shop backlogs and lingering parts shortages have caused the average auto insurance repair cycle time to reach 23.1 days in 2023, up 6.2 days from 2022 and more than double the average repair time in 2021. According to the J.D. Power 2023 U.S. Auto Claims Satisfaction Study,SM released today, that long delay has not adversely affected customer satisfaction. Surprisingly, customer satisfaction with the auto insurance claims process improves this year, thanks to concerted efforts by insurers to carefully manage customer expectations.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231026687464/en/

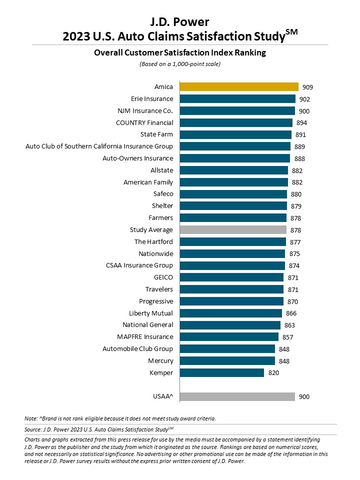

J.D. Power 2023 U.S. Auto Claims Satisfaction Study (Graphic: Business Wire)

“It’s really a testament to strong client management processes and improved digital communications,” said Mark Garrett, director of global insurance intelligence at J.D. Power. “Insurers have been able to earn significantly higher auto claim satisfaction scores at a time when costs and rates are rising—even though it’s never taken longer to get a vehicle repaired. Notable, too, is that insurers that have improved the most in overall satisfaction have done so in two key customer areas: showing concern for their situation at the beginning of the process and keeping them informed. Being empathetic toward the customer situation goes a long way in building trust with them.”

Following are key findings of the 2023 study:

- Overall satisfaction improves across most aspects of claims experience: Overall satisfaction with the auto insurance claims process this year rises 5 points (on a 1,000-point scale) to 878. This increase is driven by improvements in nearly every factor, including settlement; first notice of loss; claim servicing; estimation process; and repair process. The only factor to decline this year is rental experience, which falls 2 points.

- Repair cycle times now longer than ever: This year’s improvement in overall satisfaction comes despite it taking longer than ever for vehicles to be repaired. The average repair cycle time from first notice of loss (FNOL) to returning the vehicle to the claimant is now 23.1 days, an increase of 6.2 days from 2022 levels. The pre-pandemic average cycle time was 12 days.

- Slow repair cycles affect rental car satisfaction: An increasing percentage of customers say their rental period is not long enough or that they are incurring out-of-pocket expenses, which is having an adverse effect on rental car satisfaction. Overall rental satisfaction for repairable claims falls 32 points when the car is needed for 15 days or more.

- Aligning processes to customer preferences plays key role: Digital interactions are also driving an improvement in satisfaction, but primarily among those who prefer digital channels. Satisfaction declines among customers who prefer more personal interactions but are directed to digital processes. Aligning processes to preferences is key as customers increasingly want personal interactions—and doing so results in increased satisfaction.

- Digital FNOL usage increases, but challenges remain: Nearly one-fourth (24%) of auto claimants are using digital FNOL methods to report a claim, with 13% using an insurer’s mobile app and 10% using the insurer’s website.

Study Ranking

Amica Mutual ranks highest in overall customer satisfaction for a second consecutive year, with a score of 909. Erie Insurance (902) ranks second and NJM Insurance Co. (900) ranks third.

The 2023 U.S. Auto Claims Satisfaction Study is based on responses from 9,659 auto insurance customers who settled a claim within the past nine months prior to participating in the survey. The study excludes claimants whose vehicle incurred only glass/windshield damage or was stolen, or who only filed a roadside assistance claim. The study was fielded from September 2022 through August 2023.

For more information about the U.S. Auto Claims Satisfaction Study, visit https://www.jdpower.com/resource/jd-power-us-auto-claims-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2023145.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20231026687464/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com