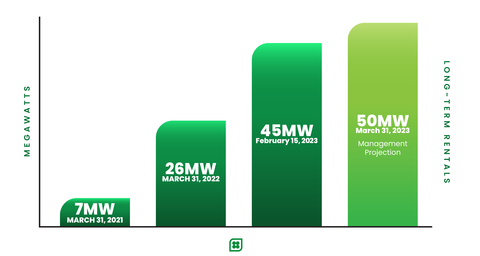

EaaS Rental Units under Contract Hits 45 MW with a Plan to Reach 50 MW by March 31

Capstone Is Focused On Growing the EaaS Business Model as Quickly as Possible Because It Provides Higher Margins, More Constant and Predictable Revenue Streams

Capstone Green Energy Corporation (NASDAQ: CGRN) a global leader in carbon reduction and on-site resilient green Energy-as-a-Service (EaaS) solutions, announced that its southern U.S. distributor, Lone Star Power Solutions, has contracted with a large West Texas energy company to provide a new 3.6 MW EaaS rental contract pushing its total EaaS contracts to 45 MW.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230215005357/en/

Capstone Green Energy EaaS Contract Growth Chart (Graphic: Business Wire)

The Company is confident in its ability to achieve sustained positive adjusted EBITDA results when it reaches its target of 50 MW - of deployed rental units, combined with its recent across-the-board price increase that went into effect on January 30, 2022. This new contract represents the continued expansion of the EaaS strategy and is indicative of ongoing customer demand. The large West Texas energy producer will use the microturbine energy systems to power production loads using the on-site gas produced from its day-to-day operations.

The 3.6 MW of Capstone systems will replace traditional reciprocating engine generator rental units. Capstone Green Energy’s EaaS solution was selected due to its proven track record of reliability in the oil and gas fields across the world and its extremely low emissions profile as the energy company looks to decarbonize its operations. Additionally, the customer will benefit from fixed operating costs for the duration of the rental since all maintenance is included in the contract, providing cost savings and added convenience.

“Our focus remains our EaaS rental business and the benefits it brings us, including higher margin rates and predictable revenues and cash flow while transitioning us away from being only a manufacturing company. The growth shows our customers both need and want this solution and that we can provide it, solving both our customer’s needs and driving returns for our shareholders,” stated Capstone Green Energy President and Chief Executive Officer Darren Jamison.

“Our overall financial goals are unchanged: we are focused on growing revenue and reaching positive Adjusted EBITDA on a sustainable basis. EaaS is a pivotal factor in achieving this goal in conjunction with our recent price increase and cost control initiatives. I am confident we will meet our strategic goal of 50 MW by March 31, 2023, as we continue to manage customer delivery dates and navigate the global supply chain challenges,” added Mr. Jamison.

About Capstone Green Energy

Capstone Green Energy (NASDAQ: CGRN) is a leading provider of customized microgrid solutions and on-site energy technology systems focused on helping customers around the globe meet their environmental, energy savings, and resiliency goals. Capstone Green Energy focuses on four key business lines. Through its Energy as a Service (EaaS) business, it offers rental solutions utilizing its microturbine energy systems and battery storage systems, comprehensive Factory Protection Plan (FPP) service contracts that guarantee life-cycle costs, as well as aftermarket parts. Energy Generation Technologies (EGT) are driven by the Company's industry-leading, highly efficient, low-emission, resilient microturbine energy systems offering scalable solutions in addition to a broad range of customer-tailored solutions, including hybrid energy systems and larger frame industrial turbines. The Energy Storage Solutions (ESS) business line designs and installs microgrid storage systems creating customized solutions using a combination of battery technologies and monitoring software. Through Hydrogen & Sustainable Products (H2S), Capstone Green Energy offers customers a variety of hydrogen products, including the Company's microturbine energy systems.

To date, Capstone has shipped over 10,000 units to 83 countries and estimates that in FY22, it saved customers over $213 million in annual energy costs and approximately 388,000 tons of carbon. Total savings over the last four years are estimated to be approximately $911 million in energy savings and approximately 1,503,100 tons of carbon savings.

For customers with limited capital or short-term needs, Capstone offers rental systems; for more information, contact: rentals@CGRNenergy.com.

For more information about the Company, please visit www.CapstoneGreenEnergy.com. Follow Capstone Green Energy on Twitter, LinkedIn, Instagram, Facebook, and YouTube.

Cautionary Note Regarding Forward-Looking Statements

This release contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, including statements regarding expectations for green initiatives and execution on the Company's growth strategy and other statements regarding the Company's expectations, beliefs, plans, intentions, and strategies. The Company has tried to identify these forward-looking statements by using words such as "expect," "anticipate," "believe," "could," "should," "estimate," "intend," "may," "will," "plan," "goal" and similar terms and phrases, but such words, terms and phrases are not the exclusive means of identifying such statements. Actual results, performance and achievements could differ materially from those expressed in, or implied by, these forward-looking statements due to a variety of risks, uncertainties and other factors, including, but not limited to, the following: the ongoing effects of the COVID-19 pandemic; the availability of credit and compliance with the agreements governing the Company's indebtedness; the Company's ability to develop new products and enhance existing products; product quality issues, including the adequacy of reserves therefor and warranty cost exposure; intense competition; financial performance of the oil and natural gas industry and other general business, industry and economic conditions; the Company's ability to adequately protect its intellectual property rights; and the impact of pending or threatened litigation. For a detailed discussion of factors that could affect the Company's future operating results, please see the Company's filings with the Securities and Exchange Commission, including the disclosures under "Risk Factors" in those filings. Except as expressly required by the federal securities laws, the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, changed circumstances or future events or for any other reason.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230215005357/en/

Contacts

Capstone Green Energy

Investor and investment media inquiries:

818-407-3628

ir@CGRNenergy.com