Projects at Braidwood, Byron nuclear plants will result in additional carbon-free electricity with capacity to power the equivalent of 100,000 homes 24/7/365

Constellation (Nasdaq: CEG), the largest producer of carbon-free energy in the U.S., said today it will invest $800 million in new equipment to increase the output of its Braidwood and Byron Generating Stations in Illinois by approximately 135 megawatts, enough to power the equivalent of 100,000 average homes around the clock every year. The additional always-on, carbon-free power generated will result in the equivalent of removing 171,000 gas-powered vehicles from the road per year, or the equivalent of adding 216 intermittent wind turbines to the grid, using Environmental Protection Agency data.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230221005582/en/

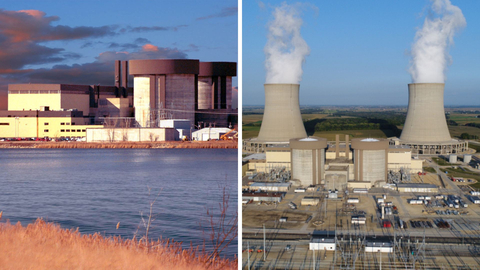

Constellation will invest $800 million in new equipment to increase the output of its Braidwood and Byron Generating Stations in Illinois by approximately 135 megawatts, enough to power the equivalent of 100,000 average homes around the clock every year (Photo: Business Wire)

The project is expected to create work for thousands of skilled union workers during construction while expanding economic activity for surrounding businesses in the plant communities. The additional jobs come on top of the 1,200 permanent workers at the two plants.

“These investments in our world class nuclear fleet will allow us to generate more zero-carbon energy with the same amount of fuel and land, and that’s a win for the economy, the environment and Illinois families and businesses who rely on our clean energy,” said Joe Dominguez, president and CEO of Constellation. “These projects will help create family-sustaining jobs and are a direct result of state and federal policies that recognize the incredible value of nuclear energy in addressing the climate crisis while keeping our grid secure and reliable.”

Braidwood and Byron were among the Illinois nuclear plants saved from premature retirement by passage of the state Climate and Equitable Jobs Act in 2021. Since then, Congress passed the Inflation Reduction Act (IRA) last year, which provides a base level of support for nuclear energy nationwide. Both pieces of legislation have enabled renewed investment in nuclear energy.

Support for nuclear in the IRA has made extending the lives of U.S. nuclear assets to 80 years more likely assuming continued support. It has caused Constellation to examine nuclear uprate opportunities that were cancelled a decade ago due to market forces. The 45Y tax credit for the production of new carbon-free electricity helps make these investments economic.

The Braidwood and Byron projects involve replacing the main turbines at the two facilities with state-of-the-art, high efficiency units that are expected to add approximately 135 carbon-free megawatts of output at the nuclear plants. Constellation expects to see increased output at the stations as early as 2026, with the full uprated output available by 2029. Work on the uprates will occur in stages during scheduled refueling outages.

The Illinois uprates come on the heels of Constellation’s announcement of significant progress at its clean hydrogen project at Nine Mile Point Generating Station in upstate New York, and the start of work on operating license renewals at the Clinton and Dresden nuclear plants in Illinois.

“It is gratifying to see new long-term projects at our nuclear facilities getting the green light. This is an exciting time for our industry as we continue our investment in the future of our plants,” said Dave Rhoades, chief nuclear officer, Constellation. “Our workers stand at the ready to welcome new employees for these projects as we continue building upon creative new efforts that provide additional clean energy to the communities we serve across the nation.”

About Constellation

Headquartered in Baltimore, Constellation Energy Corporation (Nasdaq: CEG) is the nation’s largest producer of clean, carbon-free energy and a leading supplier of energy products and services to businesses, homes, community aggregations and public sector customers across the continental United States, including three fourths of Fortune 100 companies. With annual output that is nearly 90 percent carbon-free, our hydro, wind and solar facilities paired with the nation’s largest nuclear fleet have the generating capacity to power the equivalent of 15 million homes, providing 10 percent of the nation’s clean energy. We are further accelerating the nation’s transition to a carbon-free future by helping our customers reach their sustainability goals, setting our own ambitious goal of achieving 100 percent carbon-free generation by 2040, and by investing in promising emerging technologies to eliminate carbon emissions across all sectors of the economy. Follow Constellation on LinkedIn and Twitter.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230221005582/en/

Contacts

Paul Dempsey

Constellation Communications

815-409-1260

Paul.Dempsey@constellation.com