Launch of XBIL continues success of US Benchmark Series

F/m Investments (“F/m”), a $4 billion multi-boutique investment advisor based in Washington DC, is proud to announce the launch today of the US Treasury 6 Month Bill ETF (Ticker “XBIL”). F/m and its affiliates are part of The Diffractive Managers Group, a multi-affiliate asset manager and centralized distribution platform of the 1251 Capital Group, supporting managers with collective AUM over $22.9 Billion.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230307005390/en/

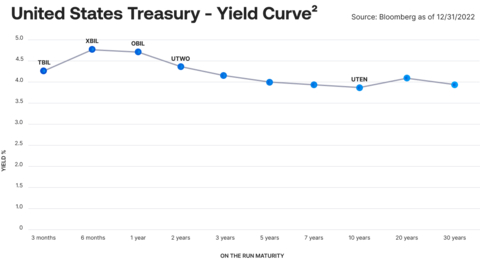

XBIL is the latest addition to F/m’s fast growing US Benchmark Series – a suite of ETFs designed to simplify access to the US Treasury market. Each ETF in the US Benchmark Series holds the most current (“on the run”) US Treasury security that corresponds to its tenor. Each ETF tracks an ICE index specific to its stated tenor. (For more information on the indices, please visit Index Platform | Home (theice.com)).

XBIL joins the other four ETFs in the US Benchmark Series, which now give investors direct access to the US Treasury market at five points along the yield curve:

- US Treasury 10 Year ETF (Ticker: UTEN);

- US Treasury 2 Year ETF (Ticker: UTWO);

- US Treasury 12 Month Bill ETF (Ticker: OBIL);

- US Treasury 6 Month Bill ETF (Ticker: XBIL); and

- US Treasury 3 Month Bill ETF (Ticker: TBIL).

Since the initial launch of the US Benchmark Series last August, the ETFs have raised over $700 million of combined AUM.

“With this launch of XBIL, we’re responding to investor demand for simplified access to the highest yielding US Treasury security today, with 6-month Treasuries yielding over 5%,” said Alexander Morris, F/m’s President, CIO and Co-Creator of the US Benchmark Series. “Investors want an easy, tax-efficient way to obtain yields that have not been seen in a low-risk, liquid investment in a very long time.”

The Yield Curve is the foundation for nearly all investing. The US Benchmark Series offers investors the following:

- Simplified access to the current benchmark tenor US Treasury securities.

- Monthly dividends, providing a more frequent and regular interest payment than holding the underlying securities.

- Automatic rolls that provide constant benchmark exposure without hassle or added expense.

- At $50 per share, the ability to transact in fractions of traditional bond sizing.

-

The other benefits and operational efficacies of the Funds:

- Tax efficiency

- Intraday liquidity with equity trading and settlement

- Access to shorting, and options, facilitating expression of a variety of views on US rates

Lead market maker for XBIL will be Jane Street Capital (“Jane Street”), a leading global liquidity provider that trades more than 5,000 ETFs worldwide. XBIL will be listed on the NASDAQi, and will be housed with The RBB Fund, Inc., the series trust provider for all ETFs in the US Benchmark Series.

About The US Benchmark Series

The US Benchmark Series allows investors of all sizes to own each of the “Benchmark” US Treasuries in a single-security ETF. Each ETF holds the most current (“on the run”) US Treasury security that corresponds to its stated tenor. For more information, please visit (www.ustreasuryetf.com).

About F/m Investments

F/m is a $4 billion multi-boutique investment advisor platform, designed to support 100% of non-investment responsibilities of an asset management firm. F/m empowers growth and independence for boutiques, lift-outs and overseas asset managers looking to access the US market. F/m provides portfolio managers with institutional-grade investment systems, business operations and marketing and sales support, enabling talented managers to focus on what they do best: managing investments and delivering performance. For more information, please visit www.fm-invest.com.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Fund, please call (888)123-4589 or visit our website at www.ustreasuryetf.com Read the prospectus or summary prospectus carefully before investing.

Investments involve risk. Principal loss is possible.

Quasar Distributors, LLC

i National Association of Securities Dealers Automated Quotations Stock Market

View source version on businesswire.com: https://www.businesswire.com/news/home/20230307005390/en/

Contacts

For The US Benchmark Series and F/m Investments Lyceus Group

Tucker Slosburg 206.652.3206

tslosburg@lyceusgroup.com