EVR™ Allows Manufacturers to Change Ratios Without Changing Equipment

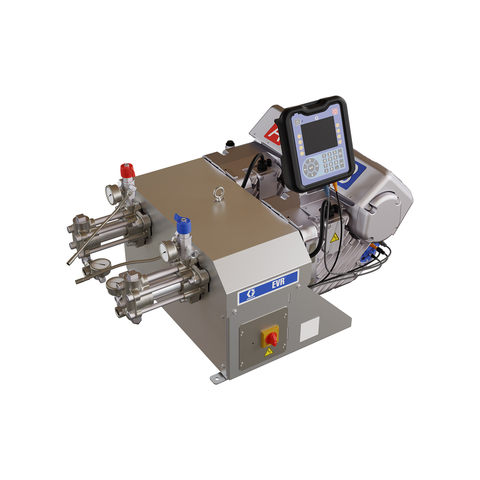

Graco Inc. (NYSE: GGG), a leading manufacturer of fluid handling equipment, introduces the Electric Variable Ratio Metering System. Now available for customization, the EVR™ allows manufacturers to change ratios as they mix, meter and dispense two component (2K) material – all with the same equipment.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230615862687/en/

Now available for customization, the Graco Electric Variable Ratio Metering (EVR™) system allows manufacturers to change ratios as they mix, meter and dispense two component (2K) material – all with the same equipment. To learn more about the Electric Variable Ratio System, visit graco.com/EVR. (Photo: Business Wire)

“For many industrial manufacturers, honing certain material compositions means putting production on hold to swap out hardware or pumps,” said Robert Delgado, global strategist and product manager for eMobility in Graco’s Industrial Division. “This is especially problematic for electric vehicle (EV) battery assembly and other applications, with constantly changing process requirements and technical specifications.”

While developing EVR technology, Graco also worked with material suppliers about the need to try different ratios and viscosities for research and development purposes, for example, when design engineers write product specifications.

“Whether it’s thermal interface material, epoxy, silicone, urethane or acrylic; two component material uses and requirements are always changing,” said Delgado. “To keep up, manufacturers and suppliers must make adjustments ‘on the fly’ and with minimal capital reinvestment.”

The high flow EVR can move up to 6,400 cubic centimeters (ccs) per minute, while flexing dispense ratios anywhere between 1:1 to 5:1 or 2:1 to 10:1.

When it’s time to try different material, the EVR’s base purge feature conserves the amount of solvent used to clean out the system by independently driving either material side. It also keeps old material from curing, so that there’s no need to replace a static or dynamic mixer because of fast curing materials or intermittent production runs.

To learn more about the Electric Variable Ratio System, visit graco.com/EVR.

ABOUT GRACO

Graco Inc. supplies technology and expertise for the management of fluids and coatings in both industrial and commercial applications. It designs, manufactures and markets systems and equipment to move, measure, control, dispense and spray fluid and powder materials. A recognized leader in its specialties, Minneapolis-based Graco serves customers around the world in the manufacturing, processing, construction and maintenance industries. For more about Graco Inc., please visit graco.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230615862687/en/

Contacts

FOR FURTHER INFORMATION:

Carrie Cotch, 612-623-6460

ccotch@graco.com