This cyber weekend provided little for bargain hunters to celebrate as the vast majority of items were priced higher on Black Friday than they had been previously this year

Online shoppers spent nearly four times as much on Black Friday as on a typical day this year, driving ecommerce sales up 5% over last year, data from commerce protection company Signifyd showed.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241130904538/en/

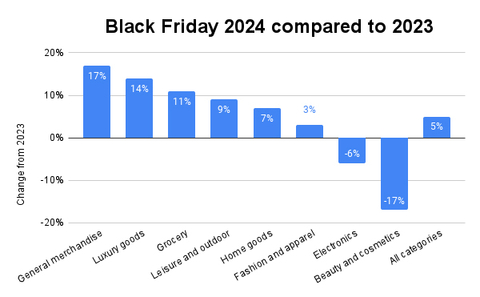

Black Friday 2024 ecommerce sales compared to 2023 (Graphic: Business Wire)

While ecommerce spending on Black Friday is reliably record-breaking every year, this year’s shopping frenzy exposed emerging trends that will be worth watching for the rest of the holiday season and beyond. Signifyd Holiday Season Pulse data for Black Friday in North America showed:

- Retailers might be reaching their limit on the Black Friday deals they can offer to draw in shoppers. Only 31% of products sold were selling at their lowest price of the year on Black Friday. Have door busters gone bust?

- Consumers continued their cautious ways, trading down by spending less for more items. The trend was best illustrated in the luxury goods category. Sales in the category were up 14%, but the average price per item sold dropped 13% compared to last year.

- Shoppers increased their reliance on discounts, applying them to 40% of orders, up from 38% in 2023.

- Retailers were only slightly more generous with discounts than a year ago. The average discount was up two percentage points from a year ago, reaching 29.3%.

“Consumers are staying true to form this Cyber Five. Overall online sales are up, but shoppers continue to focus on value and hunt for deals and discounts,” Signifyd Senior Data Analyst Phelim Killough said. “Retailers on the other hand are showing signs they are nearing the limit of the value they can offer. Good deals are out there, but Signifyd’s data shows that only a third or so of items sold on Black Friday sold at their lowest price of the year.”

The Black Friday 2024 performance underscores a narrative that has been building for years: The holiday shopping season has expanded well beyond the confines of the last six weeks of the year. Nearly a third of consumers told Gartner they would start their holiday shopping between July and October this year.

Signifyd data shows that ecommerce sales for the week before Thanksgiving were up 15.2% over the same week last year. And the company’s Cyber 5 Live Globe tracker shows that leading up to Black Friday, consumers spent twice as much online as they would have on a typical day.

While it’s premature to declare the death of Black Friday — shoppers did spend nearly $12 billion online this year, according to Adobe — it’s clear that the shopping holiday calendar has become crowded year-round with shopping events from Walmart, Target, Amazon and others.

Black Friday this year was powered by especially strong showings in general merchandise sales, also known as department store sales, and luxury goods, according to Signifyd data. General merchandise sales were up 17% year-over-year and luxury sales increased 14%. Other winners this Black Friday included the leisure and outdoor category and home goods. Electronics and the beauty and cosmetics categories had a disappointing day, falling below last year’s sales by 6% and 17% respectively.

Black Friday 2024 ecommerce sales compared to 2023 |

General merchandise |

17% |

Luxury goods |

14% |

Grocery |

11% |

Leisure and outdoor |

9% |

Home goods |

7% |

Fashion and apparel |

3% |

Electronics |

-6% |

Beauty and cosmetics |

-17% |

All categories |

5% |

The day’s overall 5% increase in spending means Signifyd’s original Cyber Five projection that sales would increase 8% annually was likely optimistic. However, Signifyd’s prediction that sales for the holiday season overall would increase by 7% remains on target. In fact, Signifyd’s Holiday Season Pulse Tracker indicates that sales for the season are up 7% as of today.

Methodology

Signifyd’s Ecommerce Holiday Season Pulse Tracker data is derived from transactions on Signifyd’s Commerce Network of thousands of ecommerce retailers and brands. Commerce Network intelligence also powers Signifyd’s Commerce Protection Platform, which leverages AI-driven machine learning models and data from billions of transactions to detect and block fraudulent activity while increasing the number of good orders approved. Signifyd has seen more than 650 million unique shopper wallets1 globally, meaning that 98% of the time when a shopper comes to a Signifyd-protected site, Signifyd’s machine-learning models recognize the shopper instantly.

About Signifyd

Signifyd provides an end-to-end Commerce Protection Platform that leverages its Commerce Network to maximize conversion, automate customer experience and eliminate fraud and consumer abuse risk for retailers. Signifyd, which is the leading provider of payment security and fraud prevention for the Digital Commerce 360 Top 1000 Retailers, is headquartered in San Jose, CA, with locations in Denver, New York, Mexico City, São Paulo, Belfast and London.

1digital wallet is a distinct combination of signals present in an online transaction.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241130904538/en/

Online shoppers spent nearly four times as much on Black Friday as on a typical day this year, driving ecommerce sales up 5% over last year, data from commerce protection company Signifyd showed.

Contacts

Mike Cassidy

Signifyd head of PR & storytelling

mike.cassidy@signifyd.com