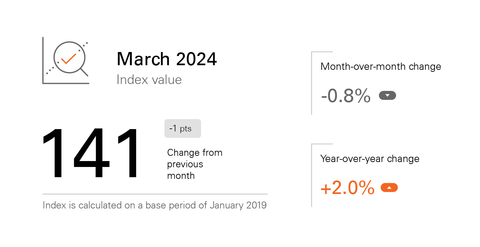

Fiserv Small Business Index reflects one point decline from February 2024

Small business sales grew +2.0% year-over-year, while declining -0.8% month-over-month

Fiserv, Inc. (NYSE: FI), a leading global provider of payments and financial services technology, has published the Fiserv Small Business Index™ for March 2024. The Fiserv Small Business Index is an indicator of the performance of small businesses in the United States at national, state, and industry levels.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240404737908/en/

March 2024 Fiserv Small Business Index Values (Graphic: Business Wire)

Nationally, the seasonally adjusted Fiserv Small Business Index decreased one point to 141. Small business sales grew +2.0% year-over-year, while declining -0.8% month-over-month.

“Consumer spending fluctuated throughout March, with Spring Break travel boosting sales and the Easter holiday contributing to a slow finish as many small businesses closed on the month’s final day,” said Prasanna Dhore, Chief Data Officer at Fiserv. “Restaurants were a particularly bright spot in March, with small businesses in this subsector seeing a +4.0% increase in spending over February and a +5.8% increase over March 2023. As in the past few months, consumers again devoted the biggest share of their spending at small businesses to dining out.”

Retail Spotlight

Nationally, sales at retail small businesses were soft compared to February (-1.6%) but trended well ahead of March 2023 (+5.1%). Some of the month-over-month slowdown can be attributed to the fact that many small businesses opted to close in observance of the Easter holiday on March 31. While most subsectors within the Retail sector experienced a month-to-month deceleration in sales, every subsector was ahead of its 2023 results. The strongest performer among the Retail subsectors was Clothing, Accessories, Shoes, and Jewelry, which delivered growth of +0.4% over February.

Additional Small Business Insights

Spring Break travel and celebrations also contributed to sizeable sales increases in the Accommodation subsector encompassing hotels and short-term vacation rentals, which grew +3.5% month-over-month and the Amusement, Gambling, and Recreational Industries subsector, which grew +4.1% month-over-month and +10.5% year-over-year.

Food Manufacturing was the most active small business subsector in March, with its index increasing 9 points to 175. Sales for small businesses in this subsector grew +5.2% from February 2024, and +14.0% over 2023.

Other growing subsectors in March included: Web Search Portals, Libraries, Archives, and Other Information Services (+5.6% month-over-month, +16.1% year-over-year), Personal and Laundry Services (+3.1% month-over-month, +3.2% year-over-year), and Performing Arts, Spectator Sports, and Related Industries (+2.3% month-over-month, +1.8% year-over-year).

About the Fiserv Small Business Index™

The Fiserv Small Business Index is published during the first week of every month and differentiated by its direct aggregation of consumer spending activity within the U.S. small business ecosystem. Rather than relying on survey or sentiment data, the Fiserv Small Business Index is derived from point-of-sale transaction data, including card, cash, and check transactions in-store and online, across approximately 2 million U.S. small businesses.

Benchmarked to 2019, the Fiserv Small Business Index provides a numeric value measuring consumer spending, with an accompanying transaction index measuring customer traffic. Through a simple interface, users can access data by region, state, and/or across business types categorized by the North American Industry Classification System (NAICS). Computing a monthly index for 16 sectors and 34 sub-sectors, the Fiserv Small Business Index provides a timely, reliable and consistent measure of small business performance even in industries where large businesses dominate.

To access the full Fiserv Small Business Index visit fiserv.com and click on “Fiserv Small Business Index” or visit fiserv.com/FiservSmallBusinessIndex.

About Fiserv

Fiserv, Inc. (NYSE: FI), a Fortune 500 company, aspires to move money and information in a way that moves the world. As a global leader in payments and financial technology, the company helps clients achieve best-in-class results through a commitment to innovation and excellence in areas including account processing and digital banking solutions; card issuer processing and network services; payments; e-commerce; merchant acquiring and processing; and the Clover® cloud-based point-of-sale and business management platform. Fiserv is a member of the S&P 500® Index and has been recognized as one of Fortune® World’s Most Admired Companies™ for 9 of the last 10 years. Visit fiserv.com and follow on social media for more information and the latest company news.

FISV-G

View source version on businesswire.com: https://www.businesswire.com/news/home/20240404737908/en/

Contacts

Media Relations:

Chase Wallace

Director, Communications

Fiserv, Inc.

+1 470-481-2555

chase.wallace@fiserv.com

Additional Contact:

Ann S. Cave

Vice President, External Communications

Fiserv, Inc.

+1 678-325-9435

ann.cave@fiserv.com