Pine Run Gathering LLC (“Pine Run Gathering”) announced today that it has completed a transaction to acquire Superior Midstream Appalachian, LLC (“Superior Appalachian”) for $120 million subject to customary adjustments. Pine Run Gathering is a joint venture owned by a subsidiary of Stonehenge Energy Resources III, LLC (“Stonehenge”), a portfolio company of Energy Spectrum Partners VIII LP, and UGI Corporation’s wholly owned subsidiary, UGI Energy Services, LLC (“UGIES”).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250127782348/en/

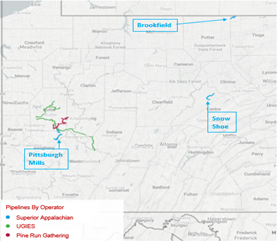

Stonehenge and UGI Acquire Superior Midstream Appalachian Pipeline Gathering Systems (Graphic: Business Wire)

Superior Appalachian owns and operates three gathering systems in Pennsylvania, namely Pittsburgh Mills, Snow Shoe, and Brookfield. The Pittsburgh Mills system is connected to UGIES’ Big Pine gathering system. All three have long-term acreage dedications and total combined daily flow of approximately 190 million cubic feet per day. The transaction was wholly financed by debt at Pine Run Gathering, in which Stonehenge and UGIES hold a 51% and 49% ownership interest, respectively, and is expected to be immediately accretive to earnings.

“Today marks an exciting day for us and our partners at UGI Energy Services,” said Patrick Redalen, President & CEO of Stonehenge. “This acquisition underscores our optimism about the future of our industry and the strength of our partnerships with UGI and Energy Spectrum. We are excited to welcome the talented team that has been supporting these assets and look forward to continuing to work closely together with the customers on all our systems as we help provide the energy needed by our country and the world.”

“We are excited to announce this investment alongside our partners at Stonehenge,” said Bob Flexon, President & CEO, UGI Corporation. “The assets are highly complementary to our existing midstream footprint and will extend our reach from producers through to end-use customers, demonstrating our commitment to explore additional growth opportunities within the Midstream business.”

Baker Botts L.L.P. and Vinson & Elkins LLP served as legal counsel to Pine Run Gathering, and BOK Financial served as the Administrative Agent on the transaction. Cadence Bank and Citizens Bank served as Joint Lead Arrangers.

About Stonehenge

Headquartered in Westminster, CO and backed by Energy Spectrum Capital, Stonehenge Energy Resources is a private energy company focused on building, owning and operating midstream facilities in the Appalachian basin to support its producer-partners in the optimum development of their resources. Formed in 2007, Stonehenge supported the early Appalachian unconventional shale gas development by gathering and processing NGL-rich gas in western Pennsylvania. With this acquisition, Stonehenge operates five natural gas gathering systems across western and central Pennsylvania. For more information about Stonehenge, visit www.stonehengeenergy.com.

About UGI Corporation

UGI Corporation (NYSE: UGI) is a distributor and marketer of energy products and services in the U.S. and Europe. UGI offers safe, reliable, affordable, and sustainable energy solutions to customers through its subsidiaries, which provide natural gas transmission and distribution, electric generation and distribution, midstream services, propane distribution, renewable natural gas generation, distribution and marketing, and energy marketing services.

Comprehensive information about UGI Corporation is available on the Internet at https://www.ugicorp.com.

About Energy Spectrum Capital

Energy Spectrum Capital is a Dallas, Texas-based infrastructure firm that makes direct investments in well-managed, lower-middle-market companies that acquire, develop and operate energy assets in North America. For more information, please visit www.energyspectrum.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250127782348/en/

Contacts

STONEHENGE

John Ha

Vice President of Business Development

(303) 991-1481

UGI

610-337-1000

Tameka Morris, ext. 6297

Arnab Mukherjee, ext. 7498