More Schwab clients net bought equities than net sold, adding exposure in the Health Care and Energy sectors while net selling Information Technology and Communication Services

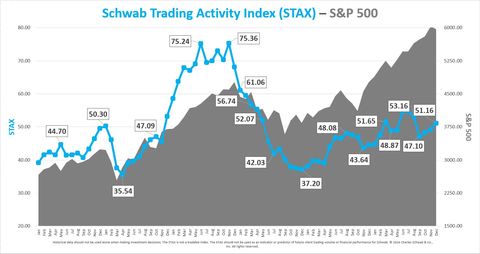

The Schwab Trading Activity Index™ (STAX) increased to 51.16 in December, up from its score of 49.22 in November. The only index of its kind, the STAX is a proprietary, behavior-based index that analyzes retail investor stock positions and trading activity from Schwab’s millions of client accounts to illuminate what investors were actually doing and how they were positioned in the markets each month.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250106221369/en/

Schwab Trading Activity Index vs. S&P 500 (Graphic: Charles Schwab)

The reading for the four-week period ending December 27, 2024, ranks “moderate low” compared to historic averages.

“Schwab clients increased their exposure to equities in December, even as major indices experienced atypical swings and turbulence,” said Joe Mazzola, Head Trading & Derivatives Strategist at Charles Schwab. “We didn’t see a significant ‘Santa Claus Rally’ this year, but investor sentiment appeared bullish, particularly at the start and end of the month. Many clients appeared to close out the year by rebalancing their portfolios, adding exposure to underperforming sectors such as Health Care and Energy and trimming positions in outperformers like Information Technology and Communication Services.”

U.S. equity markets hovered near their recent all-time highs for the first half of the December period as a muted CBOE Volatility Index (VIX) traded near 14, belying what was to come.

The U.S. Bureau of Labor Statistics released its Employment Situation Summary on December 6, which showed that non-farm payrolls rose by 227,000, more than anticipated, and the unemployment rate (4.2%) ticked higher, in line with expectations. The S&P 500’s reaction was muted, trading down slightly the following day. On December 11, the Consumer Price Index (CPI) came in as expected at 2.7% for the trailing 12 months, including a 0.3% monthly increase. On December 12, an increase in the Producer Price Index (PPI) was reported as unexpectedly hot at 0.4%. Equity markets largely shrugged this off while the yield on the 10-year Treasury Note rose by 1.73% to 4.399%.

While the Federal Open Market Committee (FOMC) statement on December 18 did not suggest a major pivot, the Committee’s 2025 outlook postulated that markets may have fewer interest rate cuts to look forward to than had been previously expected. This set off a tantrum that played out in the markets through the remainder of the period, with major indices selling off hard and the VIX spiking above 27. The 2.9% drop in the S&P 500 was its largest since August 5th and represented only the third time the index closed 2% or lower since February 21st, 2023. The S&P 500 did finish moderately lower on the month, by about 1%, though it did manage to finish 24% higher on the year and generate back-to-back years of annual returns greater than 20% for the first time since 1998.

Once the dust settled after the FOMC meeting, the VIX established a new, somewhat higher baseline, hovering just below 18 in the final days of the period and the year. The 10-year Treasury yield closed at 4.619% – a full 10% higher than where it closed last period – suggesting that markets are pricing in a “higher for longer” rate regime even as they wait for new trade and tariff policies to unfold. The U.S. Dollar Index strengthened once again, rising 2.14% to 108.00. Front month WTI Crude Oil futures rose by 2.74%, ending the period at $70.60 per contract.

Popular names bought by Schwab clients during the period included:

- NVIDIA Corp. (NVDA)

- Tesla Inc. (TSLA)

- Palantir Technologies Inc. (PLTR)

- Amazon.com Inc. (AMZN)

- MicroStrategy Inc. (MSTR)

Names net sold by Schwab clients during the period included:

- Apple Inc. (AAPL)

- AT&T Inc. (T)

- Broadcom Inc. (AVGO)

- Microsoft Corp. (MSFT)

- Walt Disney Co. (DIS)

2024 In Review

In 2024, the STAX stayed in a relatively tight range – from 44.73 in January to 54.81 in July. Clients seemed content to maintain their levels of equity market exposure as major indices repeatedly hit all-time highs throughout the year, perhaps waiting on a clear trend to develop so they might trade on that momentum. On the buy side, technologies including Artificial Intelligence, semiconductors, cloud computing and electric vehicles consistently grabbed investors’ attention this year, while on the sell side, the Consumer Discretionary, Telecommunications, Industrial and Energy sectors were most popular. In a year with dramatic shifts in Fed policy, clients demonstrated sensitivity not necessarily by rotating out of growth and into value stocks but rather by awaiting better opportunities in the growth and technology names they favored.

The five most popular names net bought by Schwab clients throughout the year were:

- NVIDIA Corp. (NVDA)

- Advanced Micro Devices Inc. (AMD)

- Amazon.com Inc. (AMZN)

- Microsoft Corp. (MSFT)

- Palantir Technologies Inc. (PLTR)

The five most popular names net sold throughout the year by clients included:

- Walt Disney Co. (DIS)

- Bank of America Corp. (BAC)

- Apple Inc. (AAPL)

- Tesla Inc. (TSLA)

- PayPal Holdings Inc. (PYPL)

About the STAX

The STAX value is calculated based on a complex proprietary formula. Each month, Schwab pulls a sample from its client base of millions of funded accounts, which includes accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly STAX.

For more information on the Schwab Trading Activity Index, please visit www.schwab.com/investment-research/stax. Additionally, Schwab clients can chart the STAX using the symbol $STAX in either the thinkorswim® or thinkorswim Mobile platforms.

Investing involves risk, including loss of principal. Past performance is no guarantee of future results. Content intended for educational/informational purposes only. Not investment advice, or a recommendation of any security, strategy, or account type.

Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The STAX is not a tradable index. The STAX should not be used as an indicator or predictor of future client trading volume or financial performance for Schwab.

About Charles Schwab

At Charles Schwab, we believe in the power of investing to help individuals create a better tomorrow. We have a history of challenging the status quo in our industry, innovating in ways that benefit investors and the advisors and employers who serve them, and championing our clients’ goals with passion and integrity.

More information is available at aboutschwab.com. Follow us on X, Facebook, YouTube, and LinkedIn.

0125-ELME

View source version on businesswire.com: https://www.businesswire.com/news/home/20250106221369/en/

Contacts

At the Company

Margaret Farrell

Director, Corporate Communications

(203) 434-2240

margaret.farrell@schwab.com