Strategic Expansion Designed to Maximize Revenue, Increase Margins, and Enhance Shareholder Value

Venu Holding Corporation ("VENU" or the “Company”) (NYSE American: VENU), a developer, owner, and operator of upscale live music venues and premium hospitality destinations, today announced its launch of its multi-season venue configuration model for its new amphitheaters, a transformative shift that extends operational capacity from seasonal schedules to year-round operations and revenue potential. With this initiative, VENU-owned venues that are under construction or planned in McKinney, TX; El Paso, TX; Broken Arrow, OK; and Oklahoma City, OK will include design features and enhancements that allow them to operate and host events throughout each calendar year, increasing the number of events hosted annually at each venue and enhancing operational efficiency.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250218837957/en/

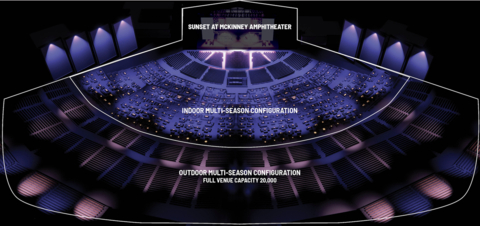

VENU's Rendering of Multi-Season Configuration Model in McKinney, TX (Photo: Business Wire)

Expanding Revenue & Profitability

By integrating climate-controlled environments, adaptable staging, and premium guest accommodations, VENU expects that when its new amphitheaters open it will be able to operate and monetize these venues year-round, reducing downtime and optimizing earnings potential. This strategy is expected to drive higher ticket sales, increased sponsorships, stronger food and beverage revenues, and additional revenue from parking and premium experiences, resulting in higher margins and long-term financial sustainability all while maintaining VENU’s signature premium ambiance.

“It’s simple math—more shows mean more revenue—but this isn’t just about quantity, it’s about a complete transformation,” Said J.W. Roth Founder, Chairman, and CEO of VENU. “We’re not just extending our schedule; we’re turning every season into peak season and unlocking millions in additional revenue potential. From increased ticket sales and sponsorships to high-end hospitality and premium guest experiences, we’re ensuring every aspect of our venues is optimized for profitability, while balancing risk and maximizing margins. VENU is proving that our business model isn’t just sustainable—it’s a game-changer in the live entertainment industry."

Capitalizing on a Booming Live Entertainment Market

VENU’s expansion aligns with strong industry growth projections. The ticket revenue segment of the live entertainment industry is expected to reach $65.2 billion by 2030, growing at a 16.4% compound annual growth rate (CAGR), while sponsorship revenues are forecasted to grow at 15.1% CAGR over the same period (Research And Markets). As consumer demand for premium live entertainment experiences surges, VENU’s ability to operate year-round strengthens its market position, enhances revenue predictability, and reinforces its long-term growth potential.

VENU’s Business Model: Seven Revenue Streams Driving Growth

VENU’s innovative business model leverages seven distinct revenue streams, reinforcing its position as a disruptive force in the live entertainment industry. The Company generates income through sponsorships and brand partnerships, including naming rights and in-venue sponsorship activations. Ticket sales and associated fees play a crucial role in revenue generation, further amplified by VENU’s expanded multi-season operating capacity. In addition, food and beverage sales from upscale dining and beverage service enhance revenue across VENU’s facilities. The Company also benefits from parking fees and venue rentals, generating further revenue from event-driven demand. Fee income, derived from strategic partnerships, licensing agreements, and premium hospitality services, provides an additional high-margin revenue stream. This diversified approach strengthens VENU’s financial stability by reducing reliance on any single revenue source while optimizing profitability across its entertainment campuses.

About Venu Holding Corporation

Venu Holding Corporation ("VENU") (NYSE American: VENU), founded by Colorado Springs entrepreneur J.W. Roth, is a premier hospitality and live music venue developer dedicated to crafting luxury, experience-driven entertainment destinations. VENU’s campuses in Colorado Springs, Colorado, and Gainesville, Georgia, each feature Bourbon Brothers Smokehouse and Tavern, The Hall at Bourbon Brothers, and unique to Colorado Springs, Notes Eatery and the 8,000-seat Ford Amphitheater. Expanding with new Sunset Amphitheaters in Oklahoma and Texas, VENU’s upcoming large-scale venues will host between 12,500 and 20,000 guests, continuing VENU’s vision of redefining the live entertainment experience.

VENU has been recognized nationally by The Wall Street Journal, The New York Times, Denver Post, Billboard, VenuesNow, and Variety for its innovative and disruptive approach to live entertainment. Through strategic partnerships with industry leaders such as AEG Presents and NFL Hall of Famer and Founder of EIGHT Elite Light Lager, Troy Aikman, VENU continues to shape the future of the entertainment landscape. For more information, visit venu.live

Forward-Looking Statements

Certain statements in this press release constitute "forward-looking statements" within the meaning of the federal securities laws. Words such as "may," "might," "will," "should," "believe," "expect," "anticipate," "estimate," "continue," "predict," "forecast," "project," "plan," "intend" or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. While the Company believes these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based on information available to us on the date of this release. These forward-looking statements are based upon current estimates and assumptions and are subject to various risks and uncertainties, including without limitation those set forth in the Company's filings with the SEC, not limited to Risk Factors relating to its business contained therein. Thus, actual results could be materially different. The Company expressly disclaims any obligation to update or alter statements whether as a result of new information, future events or otherwise, except as required by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250218837957/en/

Contacts

Media Relations

Chloe Hoeft

Venu Holding Corporation (“VENU”)

719-895-5470

choeft@venu.live

Investor Relations

Dave Gentry

RedChip Companies, Inc.

1-407-644-4256

VENU@redchip.com