- The strategy is among a suite of equity offerings managed by Aziz V. Hamzaogullari, founder, chief investment officer and portfolio manager of the Loomis Sayles Growth Equity Strategies (GES) Team.

- Since inception, International Growth has outperformed its benchmark on an annualized basis and achieved top quintile ranking versus peers for risk-adjusted measures of return.

Loomis, Sayles & Company celebrates the five-year anniversary of the Loomis Sayles International Growth strategy. Managed by Aziz V. Hamzaogullari, founder, chief investment officer and portfolio manager of the Loomis Sayles Growth Equity Strategies (GES) Team, the $39.3 million strategy has delivered its investors strong risk-adjusted returns since inception on 1 January 2020.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250325242424/en/

The GES Team has $89.5 billion in total assets under management as of 31 December 2024 across a suite of offerings, including US domestic, global, international, and long/short growth equity strategies. A singular differentiated investment philosophy – supported by a proprietary seven-step research framework – underpins their long-term, private equity approach. The team seeks to invest in those few high-quality businesses with sustainable competitive advantages and profitable growth only when they trade at a discount to the GES estimate of intrinsic value.

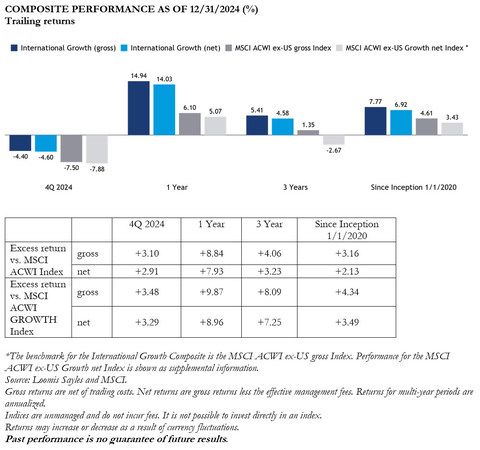

The International Growth strategy seeks to produce long-term, excess returns vs. the MSCI All Country World ex-US Index on a risk-adjusted basis over a full market cycle (at least 5 years) through bottom-up stock selection. Over the last five years since inception, the International Growth strategy has:

- Outperformed the MSCI ACWI ex US Index by 3.17% (gross), 2.31% (net) annualized. The strategy ranked in the top quintile for performance – 15th percentile (gross), 14th percentile (net) – versus peers (inception through 31 December 2024).

- Ranked top quintile versus peers for risk-adjusted measures of return including Sharpe ratio (15th percentile) and Alpha generation (12th percentile gross and net).

- Achieved up market capture since inception exceeding 110 versus benchmark, while down market capture has been in the 90s, similar to the GES Team’s longer-dated strategies.

Further, with annualized turnover of 7.5% since inception, International Growth has benefited from the GES Team’s dedication to a long investment horizon, which affords the opportunity to capture value from secular growth as well as capitalize on the stock market’s shortsightedness through time arbitrage. The high-conviction portfolio of 35 securities reflects the team’s belief that less than one percent of all businesses are able to sustain their competitive advantages beyond a decade and can generate durable and profitable long-term growth, a rare trait. With high median active share since inception of 92.0%, International Growth has exhibited the necessary condition for generating alpha and outperforming net of fees over the long term.

Learn more about the Loomis Sayles International Growth Strategy, including current performance.

“In just five years since the strategy’s inception, the GES Team has achieved an impressive performance track record for International Growth that echoes those of its longer-dated sibling strategies, including Large Cap Growth, All Cap Growth and Global Growth,” said Kevin Charleston, chief executive officer of Loomis Sayles. “This success is a testament to the team’s passion for a patient, disciplined investment process and commitment to deep fundamental research with a long-term view, a philosophy that continues to deliver value for our investors.”

“We believe the qualities that make a business great are universal in nature,” said Hamzaogullari. “Regardless of location or domicile, structural drivers for sound investment decision making and analysis such as basic business characteristics, competitive advantage, business model, financial strength, management, growth drivers and valuation remain the same.”

Learn more about the Loomis Sayles Growth Equity Strategies Team.

MSCI DISCLOSURE

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent

ABOUT LOOMIS SAYLES

Since 1926, Loomis, Sayles & Company has helped fulfill the investment needs of institutional and mutual fund clients worldwide. The firm’s performance-driven investors integrate deep proprietary research and risk analysis to make informed, judicious decisions. Teams of portfolio managers, strategists, research analysts and traders collaborate to assess market sectors and identify investment opportunities wherever they may lie, within traditional asset classes or among a range of alternative investments. Loomis Sayles has the resources, foresight and the flexibility to look far and wide for value in broad and narrow markets in its commitment to deliver attractive, risk-adjusted returns for clients. This rich tradition has earned Loomis Sayles the trust and respect of clients worldwide, for whom it manages $389.3 billion* in assets (as of 31 December 2024).

*Includes the assets of both Loomis, Sayles & Co., LP, and Loomis Sayles Trust Company, LLC. ($47.1 billion for the Loomis Sayles Trust Company). Loomis Sayles Trust Company is a wholly owned subsidiary of Loomis, Sayles & Company, L.P.

SAIF-f4tnxlxi

View source version on businesswire.com: https://www.businesswire.com/news/home/20250325242424/en/

Contacts

Kate Sheehan

(617) 960-4447

ksheehan@loomissayles.com