The median home price increased 2.7% in February over last year. Increases were concentrated in Northeast and Midwest markets.

Homes.com, a CoStar Group leading online residential marketplace, today released a new report looking at housing prices for the month of February based on information collected to date. The preliminary analysis yielded key insights on home prices, which are still rising but at a slower rate than previous months, what the price growth moderation means for homebuyers, and what regions of the country the highest price appreciation rates are coming from.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250307092266/en/

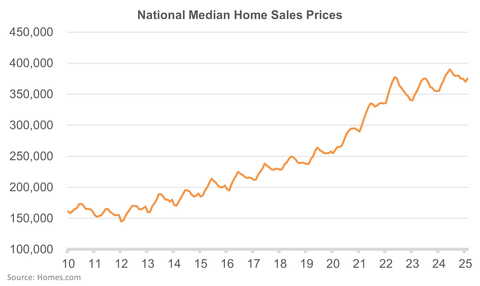

Chart 1 Home Prices (Graphic: Business Wire)

Preliminary prices increased 2.7% in February over the prior year, and for the second straight month, the rate of increase has declined. Prices were up 4.1% in January and 5.6% in December. In dollar terms, the median home price went up $10,000 from February of last year to February of this year, going from $365,000 to $375,000. Year over year prices have been increasing for 20 consecutive months and annual price increases got as high as 5.6% in December.

In addition to the rate of price appreciation declining, February also saw an increase in the number of homes for sale. This moderation in pricing and increase in the supply of for-sale homes means more leverage for homebuyers, and could tilt market conditions towards a buyer’s market and away from a seller’s market.

Highest price appreciation concentrated in the Northeast and Midwest, lowest in the South. Of the 10 markets with the largest price increases, 4 were in the Northeast, and 4 were in the Midwest. New York led the way with prices increasing over 11% in the past year, followed by Detroit, Providence and Chicago. By contrast, the South only had one market, Miami, in the 10 biggest price increases, but had 8 of the 10 lowest price increases. There were 4 markets where prices declined. San Francisco saw prices drop over 11%, while Norfolk, Tampa and Charlotte also saw price declines.

The data shared in this report could experience a slight shift once all home sales are accounted for. Melina Duggal, Senior Director of Market Analytics at CoStar Group and Homes.com, is available for interviews to provide expert insights on this data and the residential real estate market in general. For more information and insight on the latest home buying and selling market trends visit: Homes.com

About Homes.com

Homes.com is the fastest-growing residential real estate marketplace and the second largest portal in the United States. Homes.com is a brand of CoStar Group (NASDAQ: CSGP), a global leader in commercial real estate information, analytics, and online marketplaces, which acquired the platform in 2021.

Homes.com is the first major U.S. real estate portal to focus first on helping homeowners and their agents leverage the marketing power of the internet to bring more potential buyers to their listings. Homes.com’s unparalleled content and search capabilities bring millions of buyers and sellers to the site where they can seamlessly connect with agents. On average, Homes.com’s Members are winning 58% more listings* because they offer the home sellers a real estate portal that works for them not against them.

The Homes.com Network reached an audience of 110 million average monthly unique visitors in the fourth quarter ending December 31, 2024.** Consumer brand awareness skyrocketed from 4% to 33% in just one year since CoStar Group launched the industry’s largest marketing campaign to date in February 2024, reintroducing the platform to the market. For more information, visit Homes.com.

*Based on internal analyses comparing Members to non-Members on Homes.com.

** Homes.com Network (which includes Homes.com, the Apartments Network, and the Land Network) average monthly unique visitors for the quarter ended December 31, 2024, according to Google Analytics.

About CoStar Group, Inc.

CoStar Group (NASDAQ: CSGP) is the global leader in commercial real estate information, analytics, and online marketplaces. Founded in 1986, CoStar Group is dedicated to digitizing the world’s real estate, empowering all people to discover properties, insights, and connections that improve their businesses and lives.

CoStar Group’s major brands include CoStar, a leading global provider of commercial real estate data, analytics and news; LoopNet, the most trafficked commercial real estate marketplace; Apartments.com, the leading platform for apartment rentals; and Homes.com, the fastest-growing residential real estate marketplace. CoStar Group’s industry-leading brands include STR, a global leader in hospitality data and benchmarking, Ten-X, an online platform for commercial real estate auctions and negotiated bids and OnTheMarket, a leading residential property portal in the United Kingdom.

CoStar Group’s websites attracted over 163 million average monthly unique visitors in the third quarter of 2024, serving clients worldwide. Headquartered in Arlington, Virginia, CoStar Group is committed to transforming the real estate industry through innovative technology and comprehensive market intelligence. From time to time, we plan to utilize our corporate website as a channel of distribution for material company information. For more information, visit CoStarGroup.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250307092266/en/

Contacts

News Media Contact

Matthew Blocher

CoStar Group

(202) 346-6775

mblocher@costargroup.com