Cushman & Wakefield releases report examining current trends and behavioral changes

Five years after the COVID-19 pandemic reshaped global markets, commercial real estate is navigating a transformed landscape. Cushman & Wakefield’s (NYSE: CWK) latest report explores the lasting shifts in how businesses, employees, and consumers interact with physical spaces, identifying key trends that continue to shape the industry today.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250402988846/en/

Cities are "cool" again

“The pandemic forced a dramatic reevaluation of how we use and value the built environment and commercial spaces,” said David Smith, Head of Americas Insights. “While some changes have reverted to pre-2020 norms, others have become permanent fixtures in how we live, work and play.”

Key Trends Shaping the Future

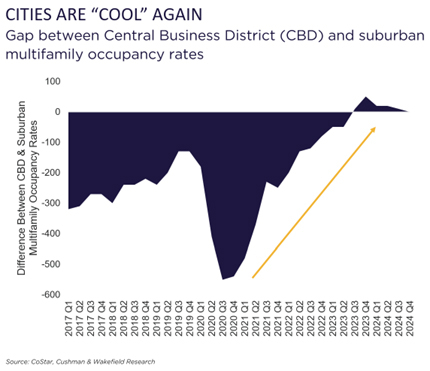

Cities Are Rebounding

After an initial exodus, cities are experiencing a resurgence, particularly among younger demographics. Multifamily occupancy rates returned to and even exceeded pre-pandemic levels by late 2021. Manhattan, for example, saw a 9% increase in its 15–29-year-old population between 2022 and 2023. Additionally, Class A office leasing in central business districts (CBDs) has rebounded to its historical 41% market share, signaling renewed corporate confidence in urban centers.

The Commute Remains a Challenge

Remote and hybrid work models continue to impact office attendance, with proximity playing a major role in workplace participation. Employees living within a mile of their workplace are returning to the office at over 90% of pre-pandemic levels, while those more than three miles away are at just 70%. This shift underscores the growing preference for workplace flexibility and the challenges of long commutes.

Consumer Behavior is Normalizing

Many pandemic-driven changes in consumer habits—such as the surge in e-commerce and the decline in restaurant and travel spending—have stabilized. While online shopping spiked by 44% in 2020, it has since returned to its pre-pandemic growth trajectory of 15% annually. International tourism, which collapsed to just 10% of its 2019 level, has also recovered significantly.

A Slowdown in New Construction

Higher interest rates, material inflation, and labor costs have curbed new development across all sectors. Industrial and multifamily construction pipelines have dropped below Q1 2020 levels by 17% and 8%, respectively. Meanwhile, retail construction has remained consistently low for seven years, contributing to tight vacancy rates despite store closures in 2024. Office development, at record highs in 2020, has declined significantly, from 135 million square feet to under 30 million, creating potential future supply shortages.

The Experience Economy is Expanding

A key takeaway from the report is the increasing importance of experiential spaces in urban environments. Two-thirds of foot traffic in walkable urban centers now comes from visitors rather than residents or employees. However, only 12–15% of city real estate is dedicated to “Play” spaces—such as retail, hotels, entertainment, and cultural institutions—far below the optimal 25% mix. Neighborhoods with a stronger emphasis on experience-driven spaces have demonstrated higher GDP growth, more resilient property values, and stronger foot traffic recovery.

Looking Ahead: Reimagining Cities for the Future

The findings emphasize the need for cities and real estate developers to create more balanced portfolios that integrate living, working and experiential spaces. Mixed-use developments that prioritize convenience, social engagement and entertainment will be key to urban success moving forward.

“As cities continue to evolve, the commercial real estate sector must adapt by designing spaces that foster community and experience,” added Smith. “Investors and developers who embrace these changes will be best positioned for long-term success.”

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in nearly 400 offices and 60 countries. In 2024, the firm reported revenue of $9.4 billion across its core service lines of Services, Leasing, Capital markets, and Valuation and other. Built around the belief that Better never settles, the firm receives numerous industry and business accolades for its award-winning culture. For additional information, visit www.cushmanwakefield.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250402988846/en/

Contacts

Media Contact:

Mike Boonshoft

212-841-7505

michael.boonshoft@cushwake.com