Hourly earnings growth for small business workers slows to lowest level since May 2021

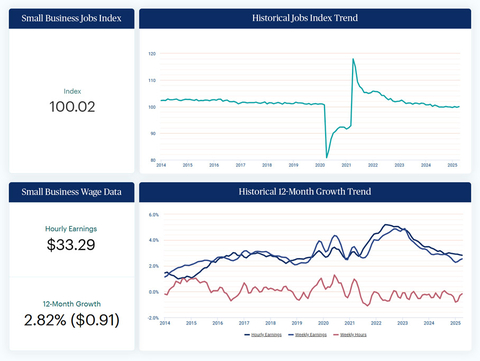

According to the Paychex Small Business Employment Watch, job growth in U.S. small businesses with fewer than 50 employees ticked up slightly in April, gaining 0.27 percentage points to an index level of 100.02. The Small Business Jobs Index, a primary component of the Employment Watch report, has averaged 99.99 over the past 12 months, indicating little change in small business labor market over the last year. Hourly earnings growth for U.S. small business workers, meanwhile, slowed to its lowest level since May 2021 at 2.82%.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250429223174/en/

The Paychex Small Business Employment Watch for April reveals a small business labor market that remains consistent as owners of U.S. businesses with fewer than 50 employees navigate an ever-changing microenvironment.

“Our April jobs data signals a small business labor market that remains stable as business owners navigate the evolving macroenvironment,” said John Gibson, Paychex president and CEO. “We are seeing no signs of a recession in our data as many small business owners are keeping their workforce levels consistent. Many leaders appear to be taking a wait-and-see approach to hiring until the macroenvironment settles and they have a better understanding of how any changes will impact their short and long-term growth.”

“As businesses continue to face new and ongoing challenges, we remain steadfast in our mission to help them succeed,” Gibson added. “Our recent acquisition of Paycor unlocks even more opportunities for us to help organizations of all sizes manage their workforce during an uncertain time.”

Jobs Index and Wage Data Highlights

- The Small Business Jobs Index gained 0.27 percentage points to 100.02 in April and has averaged an index level of 99.99 over the past 12 months.

- Hourly earnings growth for workers slowed to its lowest level (2.82%) since May 2021.

- Weekly hours worked growth (-0.17%) remained negative in April despite one-month annualized growth of 2.62%.

- All four regional jobs indexes improved in April, led by a 0.81 percentage-point gain in the Midwest. The Midwest remains the top region for small business job growth for the 11th-straight month.

- Ohio spiked 2.24 percentage points to an index level of 101.94 in April. Ranked first among states for the first time since reporting began in 2014, significant job growth gains in Trade, Transportation, and Utilities in the state helped push Ohio to the leader position.

- With an index level of 102.35, Minneapolis reported strong job gains again in April and topped the state rankings for the second consecutive month.

- Professional and Business Services improved 0.82 percentage points to a jobs index level of 100.36, marking the best one-month gain among sectors in April.

More Information

For more information about the Paychex Small Business Employment Watch, visit the website and sign up to receive monthly Employment Watch alerts.

*Information regarding the professions included in the industry data can be found at the Bureau of Labor Statistics website.

About the Paychex Small Business Employment Watch

The Paychex Small Business Employment Watch is released each month by Paychex, Inc. Focused exclusively on businesses with fewer than 50 workers, the monthly report offers analysis of national employment and wage trends and examines regional, state, metro, and industry sector activity. Drawing from the payroll data of approximately 350,000 Paychex clients, this powerful industry benchmark delivers real-time insights into the small business trends driving the U.S. economy. The jobs index is scaled to 100, which represents no year-over-year change in job growth among same store businesses. Index values above 100 represent new jobs being added, while values below 100 represent jobs being lost.

About Paychex

Paychex, Inc. (Nasdaq: PAYX) is the digitally driven HR leader that is reimagining how companies address the needs of today’s workforce with the most comprehensive, flexible, and innovative HCM solutions for organizations of all sizes. Offering a full spectrum of HR advisory and employee solutions, Paychex pays 1 out of every 11 American private sector workers and is raising the bar in HCM for nearly 800,000 customers in the U.S. and Europe. Every member of the Paychex team is committed to fulfilling the company’s purpose of helping businesses succeed. Visit paychex.com to learn more. Visit paychex.com to learn more.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250429223174/en/

Contacts

Media Contacts

Tracy Volkmann

Paychex, Inc.

Manager, Public Relations

(585) 387-6705

tvolkmann@paychex.com

@Paychex

Emily Walsh

Highwire Public Relations

Account Executive

(914) 815-8846

paychex@highwirepr.com