DigitalOwl, a pioneer in AI-driven medical data analysis, has announced significant enhancements to their award-winning product, Case Notes. Plus, the company unveiled a groundbreaking In-Depth Analysis Chat feature, engineered to revolutionize medical data analysis and the user’s ability to interact with the data.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250430734370/en/

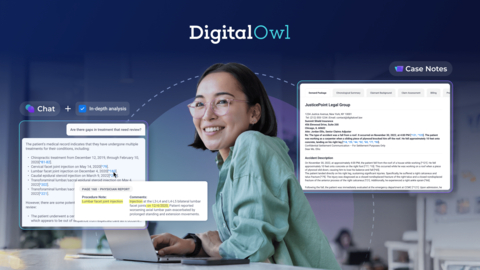

Introducing DigitalOwl’s latest AI tools—In-Depth Analysis Chat and enhanced Case Notes—built to transform how medical records are reviewed, questioned, and summarized.

Together, these updates represent a major step forward for life underwriters, claims adjusters, and legal professionals—each of whom faces unique challenges in reviewing, summarizing, and interpreting medical records.

Originally built to support Life insurance underwriting, Case Notes has been expanded to address the evolving needs of P&C claims professionals and legal teams—while continuing to provide valuable insights for life underwriters. Utilizing the industry's first AI agents crafted for insurance-related medical record analysis, Case Notes goes beyond simple summarization. It acts as a digital detective, weaving together scattered data points, using business logic, and delivering crucial insights about a case or claim, such as the progression or improvement of a condition.

Case Notes now includes advanced demand package analysis capabilities, enabling a thorough examination of demand letters with medical data and billing information. It identifies and highlights inconsistencies, such as mismatches between reported pain levels and treatment adherence, for more accurate analyses. Additionally, it examines other relevant reports, enhancing decision-making regarding medical information and associated costs.

The latest update enhances demand letter tools by analyzing medical data and billing information to spotlight crucial evidence, such as deteriorating conditions and potential inability to return to work. It extracts relevant quotes from medical records, like physician statements about a claimant’s work limitations, and integrates these with detailed billing and cost information. Case Notes also automates demand letter drafting, using these insights to produce accurate, high-quality documents. This boosts accuracy and saves time for attorneys and paralegals, enhancing case preparation.

Users can also access detailed chronological summaries, comprehensive claimant backgrounds, in-depth claim assessments, and thorough breakdowns of billing and provider information. Additionally, the inclusion of evidence related to pain and suffering enriches the data set provided, enabling more precise and actionable insights.

Simultaneously, DigitalOwl has introduced its innovative In-Depth Analysis ‘Chat’ feature, designed to elevate the investigative capabilities. This innovative tool allows insurance and legal professionals to pose complex, reasoning-based questions and receive tailored, context-rich responses. Going beyond mere question and response, this feature comprehensively understands inquiries, explores further, applies logic, and provides detailed responses that incorporate all relevant information in the user's desired format.

Register now for early access to DigitalOwl’s live launch event, where we’ll showcase how these features empower life underwriters, claims professionals, and legal teams to make faster, more confident decisions.

About DigitalOwl

DigitalOwl is the leading InsurTech platform empowering insurance and legal professionals to transform complex medical data into actionable insights. With DigitalOwl’s platform, insurance and legal professionals can more efficiently assess risk and make more informed decisions with greater confidence. For more information about DigitalOwl, visit www.digitalowl.com and follow DigitalOwl on LinkedIn.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250430734370/en/

Together, these updates represent a major step forward for life underwriters, claims adjusters, and legal professionals—each of whom faces unique challenges in reviewing, summarizing, and interpreting medical records.

Contacts

Alex Kane

press@digitalowl.com