Mortgage Servicers Lag Far Behind Originators on Customer Engagement

With the average 30-year mortgage rate in the United States continuing to hover near recent highs of 6.8%,1 homeowners might be expected to feel some tension with their mortgage company. However, high rates alone do not explain why customer satisfaction scores for mortgage servicers are significantly lower—and declining—than they are for mortgage originators. According to the J.D. Power 2025 U.S. Mortgage Servicer Satisfaction Study,SM released today, customer satisfaction with mortgage servicers has plummeted in 2025, with an average satisfaction score that is now 131 points (on a 1,000-point scale) lower than the average score for mortgage originators. Increasingly, the difference between the two comes down to effective communication and customer service.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250724173342/en/

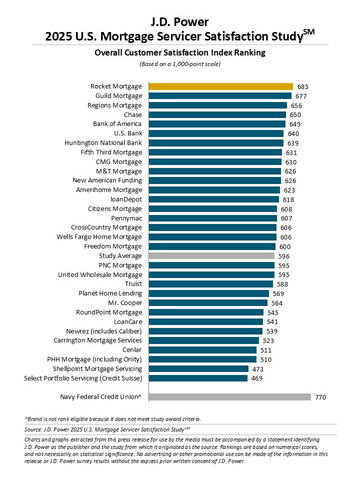

J.D. Power 2025 U.S. Mortgage Servicer Satisfaction Study

“There is a significant disconnect in the mortgage customer journey that’s reflected in the fact that satisfaction with mortgage origination is reaching record highs at the same time that satisfaction with mortgage servicing is reaching all-time lows,” said Bruce Gehrke, senior director of lending intelligence at J.D. Power. “Part of this is driven by the economy. Rates are still high, volumes are down, consumer financial health is strained and the industry is struggling to maintain high levels of customer engagement and personalization throughout the servicing experience. However, without delivering on important loyalty and advocacy metrics, servicers could be headed for some challenges down the road when volumes pick back up again.”

Key findings of the 2025 study:

- A fragmented customer journey: Overall customer satisfaction with mortgage servicers is 596, which is down 10 points from the 2024 study. Customer satisfaction with mortgage servicers declines across all dimensions year over year. This decline stands in stark contrast to customer satisfaction with mortgage originators, which reached a score of 727 in the J.D. Power 2024 U.S. Mortgage Origination Satisfaction Study.SM

- Service quality and responsiveness play major role in customer loyalty: While better interest rates and lower costs and fees are cited most frequently by customers as a reason to switch mortgage providers, service quality and responsiveness can be equally powerful drivers of customer loyalty and retention. Customers cite better/improved customer service (51%); easy access to loan information (36%); and flexible ways to make a mortgage payment (27%) among the top reasons to switch mortgage companies.

- Communication breakdown: Despite industry efforts to deliver more effective communications, just 31% of mortgage servicer customers gave an excellent or perfect rating to their servicer for messaging that got their attention. Attention-getting is rated higher when there is a level of personalization added to the communication. Among those who have received personalized communications, account alerts are the most frequently recalled form of communication at 46%. Just 32% of customers give their mortgage servicer a high overall communication rating, down 5 percentage points from 2022.

- Satisfaction decreases as escrow costs rise: Escrow costs—the fees typically rolled into a mortgage to pay annual property tax and homeowners insurance bills—are rising nationwide, with 57% of mortgage servicer customers experiencing an increase in escrow costs this year. Overall satisfaction is 67 points lower, on average, among those who experienced an escrow cost increase than among those who experienced no change.

Study Ranking

Rocket Mortgage ranks highest among mortgage servicers with a score of 685. Guild Mortgage (677) ranks second and Regions Mortgage (656) ranks third.

The U.S. Mortgage Servicer Satisfaction Study measures customer satisfaction with the mortgage servicing experience in six dimensions (in order of importance): level of trust; makes it easy to do business with; keeps me informed and educated; people; resolving problems or questions; and digital channels. The study is based on responses from 15,912 customers who have been with their current mortgage loan servicer for at least one year. The study was fielded from May 2024 through May 2025.

For more information about the U.S. Mortgage Servicer Satisfaction Study, visit https://www.jdpower.com/business/mortgage-servicer-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2025078.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

____________________ |

1 Source: Bankrate, July 10, 2025

View source version on businesswire.com: https://www.businesswire.com/news/home/20250724173342/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com