Hourly earnings growth for workers reports below three percent for 11 of the last 12 months

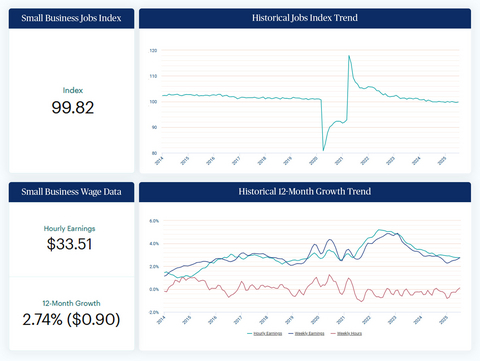

Job growth among U.S. small businesses with fewer than 50 employees is holding steady, according to the Paychex Small Business Employment Watch for July. The national Small Business Jobs Index, a primary component of the report that measures the pace of small business job growth across the country, has increased 0.17 percentage points to 99.82 in July. Meanwhile, hourly earnings growth for small business workers has maintained a consistent trend, remaining below three percent (2.74%) for the ninth consecutive month.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250729059374/en/

Job growth among U.S. small businesses with fewer than 50 employees is holding steady in July, according to the Paychex Small Business Employment Watch.

“Our latest employment data points to a small business labor market that has remained consistent, including wages continuing below three percent, while workers have begun to see an increase in hours worked in July for the first time since August 2024,” said John Gibson, Paychex president and CEO. “We enter the back half of 2025 in a very similar position as we started, which speaks to the resiliency of small businesses given the amount of uncertainty they faced so far this year.”

Jobs Index and Wage Data Highlights

- The national Small Business Jobs Index in July (99.82) matches the 2025 year-to-date index level, showing modest month-to-month movement and signaling a consistent trend of stability for U.S. small businesses.

- Hourly earnings growth has continued to trend below three percent for 11 of the last 12 months, marking a return to the historical average seen from 2014-2020.

- Since hitting a six-year low in January 2025 (2.27%), weekly earnings growth among U.S. small business workers has steadily increased during the past six months to 2.76% in July.

- Weekly hours worked have shown positive growth in July (0.11%) for the first month since August 2024, and the one month annualized weekly hours worked jumped to 2.31% in July.

- The Midwest has been the top region for small business employment growth for the past 14 months. Bolstering the region, Ohio (101.09) continues to lead states for small business job growth in July, followed closely by Indiana (100.89).

- Education and Health Services leads sectors for small business job growth for the 14th-straight month.

- Leisure and Hospitality remains last among sectors for job growth (98.35) in July, but its jobs index represents the largest one-month gain (0.59 percentage points) among industries.

More Information

For more information about the Paychex Small Business Employment Watch, visit the website and sign up to receive monthly Employment Watch alerts.

About the Paychex Small Business Employment Watch

The Paychex Small Business Employment Watch is released each month by Paychex, Inc. Focused exclusively on businesses with fewer than 50 workers, the monthly report offers analysis of national employment and wage trends and examines regional, state, metro, and industry sector* activity. Drawing from the payroll data of approximately 350,000 Paychex clients, this powerful industry benchmark delivers real-time insights into the small business trends driving the U.S. economy. The jobs index is scaled to 100, which represents no year-over-year change in job growth among same store businesses. Index values above 100 represent new jobs being added, while values below 100 represent jobs being lost.

*Information regarding the professions included in the industry data can be found at the Bureau of Labor Statistics website.

About Paychex

Paychex, Inc. (Nasdaq: PAYX) is the digitally driven HR leader that is reimagining how companies address the needs of today’s workforce with the most comprehensive, flexible, and innovative HCM solutions for organizations of all sizes. Offering a full spectrum of HR advisory and employee solutions, Paychex pays 1 out of every 11 American private sector workers and is raising the bar in HCM for nearly 800,000 customers in the U.S. and Europe. Every member of the Paychex team is committed to fulfilling the company’s purpose of helping businesses succeed. Visit paychex.com to learn more.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250729059374/en/

Contacts

Media Contacts

Tracy Volkmann

Paychex, Inc.

Manager, Public Relations

(585) 387-6705

tvolkmann@paychex.com

@Paychex

Erin McAward

ICR, Inc.

Account Director

paychexpr@icrinc.com