Solana has held steady above the $200 mark, supported by strong ETF inflows and institutional backing that cement its status as a leading Layer 1 blockchain. However, behind this stability, market buzz is shifting toward Rollblock (RBLK).

With its presale raising over $11.8 million and a GameFi ecosystem featuring thousands of titles and deflationary tokenomics, Rollblock is quickly emerging as one of the most talked-about projects, tipped by analysts as a major high-upside contender.

Rollblock Solidifies Its Position as the GameFi Market Leader

Rollblock has emerged as the frontrunner in the GameFi sector, running a profitable Web3 gaming ecosystem for over a year. With more than $15 million in wagers processed, the platform demonstrates strong engagement and reliable revenue, separating it from speculative crypto projects.

The crypto gaming ecosystem spans 12,000+ titles, live-dealer casino games, AI-powered exclusives, and now live sports betting across the NFL, NBA, UFC, and global tournaments.

The crypto gaming ecosystem spans 12,000+ titles, live-dealer casino games, AI-powered exclusives, and now live sports betting across the NFL, NBA, UFC, and global tournaments.

Here are the key Rollblock features driving massive adoption:

● $15 million+ in wagers processed

● Up to 30% APY via staking rewards

● 30% of revenue dedicated to buybacks (60% burned, 40% distributed to stakers)

● Fully licensed under Anjouan Gaming with independent audits.

With $11.8 million raised at a presale price of $0.068, Rollblock is drawing thousands of investors. Analysts expect gains of up to 800% before its official launch, positioning RBLK as one of the most attractive GameFi investments of 2025.

Solana Price Eyes $260 As Institutional Treasuries Accelerate Adoption

Solana (SOL) is trading at around $221, drawing strong interest as institutional adoption continues to grow. Kristin Smith, president of the Solana Institute, revealed that more firms are using SOL as a treasury reserve, deploying tokens into staking, validators, and liquidity programs.

Nasdaq-listed SOL Strategies and Forward Industries, now holding 6.82 million SOL, highlight this trend, while new treasury funding from Helius, Pantera, and Summer Capital adds $500 million. Technically, the Solana price is testing resistance at $250. A breakout could lift SOL toward $260, provided buying pressure holds steady.

Rollblock’s Tokenomics Drive Scarcity and Investor Excitement

Rollblock has introduced a groundbreaking tokenomics model that directs up to 30% of weekly revenue into systematic RBLK buybacks, guaranteeing steady demand. Of these tokens, 40% are redistributed to holders as lucrative staking rewards, while 60% are permanently burned, tightening supply and fueling long-term value growth.

Backed by SolidProof audits and Anjouan Gaming licensing, Rollblock offers institutional-grade security and compliance. With adoption climbing and presale stages nearly complete, traders now view it as a top contender for 30x returns in 2025—solidifying its status as one of the best cryptos to buy right now.

Solana Holds Steady At $200 While Rollblock Gains Traction As 30x Prospect

The Solana price has consolidated around $200, buoyed by ETF inflows and institutional support, reinforcing its position as a dominant Layer 1 blockchain. Yet while SOL shows steady growth, traders chasing exponential upside are pivoting toward Rollblock (RBLK).

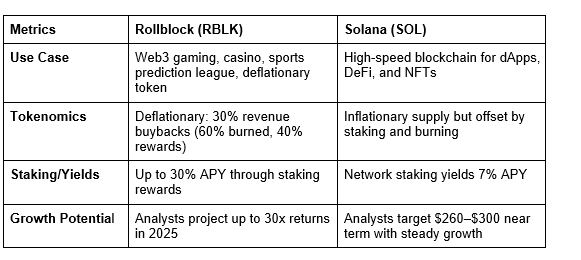

Here is a table showing how Rollblock and Solana compare:

With over $11.8 million raised in presale, a live GameFi ecosystem, and a deflationary token model, Rollblock is gathering serious momentum. Many now view RBLK as a potential 30x play, contrasting Solana’s slower, more measured trajectory.

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino