MW Investment Strategy, a leading global quantitative trading and asset management platform, today officially announced the successful completion of its independent audit conducted by KPMG, marking another solid step forward in the company's commitment to financial transparency, legal compliance, and long-term stable development.

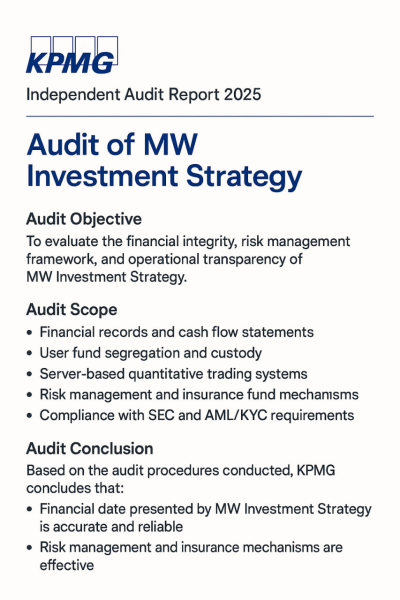

Audit Scope and Key Findings

As one of the world's "Big Four" accounting firms, KPMG enjoys a high reputation for its auditing qualifications and expertise in the financial and technology sectors. The audit, conducted by an independent KPMG team, covered:

1. Financial Data and Fund Flows

The audit verified the authenticity and validity of the financial data published by MW Investment Strategy;

Confirmed that all user funds are protected by a segregated custody mechanism and separated from the company's operating funds.

2. Account Security and User Fund Protection

KPMG focused its review on the company's multi-signature wallet, server risk control, and insurance fund pool operations.

The report shows that this mechanism effectively mitigates extreme market risks and has long-term sustainability.

3. Quantitative Trading and Technical Compliance

The audit confirmed that MW's independently developed high-frequency quantitative server and trading strategy operate stably,

and comply with relevant fintech compliance standards, with traceable data records.

4. Compliance and Regulatory Framework

The KPMG report stated that MW Investment Strategy has strictly complied with the regulatory requirements of the U.S. Securities and Exchange Commission (SEC) and maintained a high level of compliance in anti-money laundering (AML), know-your-customer (KYC), and risk disclosure.

Finally, the KPMG audit concluded that:

MW Investment Strategy's financial position is sound and transparent, its operational processes are compliant, and its technology and risk control systems are effective and reliable.

Management Statement

MW Investment Strategy CEO said:

"We have always believed that true financial innovation must be built on transparency and trust.

KPMG's independent audit is not only a recognition of our past efforts, but also a guarantee for future development.

We promise that all user funds and transaction data will remain open, authentic, and verifiable. This is the fundamental difference between MW and other platforms."

Strategy and Future

With the release of KPMG's audit results, MW Investment Strategy will:

Continue to expand its market presence in Europe, America, Africa, and Southeast Asia; advance the research and development of blockchain audit tools and transparent on-chain asset reporting; combine AI and quantitative technology to provide investors with more stable long-term returns; and establish in-depth collaborations with more international financial institutions and compliance partners.

Corporate website: https://www.mwinvestmentstrategy.com/

Contact email: support@mwinvestmentstrategy.com

Name: JAMES ROBERT HAYES JR

Country, city: Wall Street, New York, USA