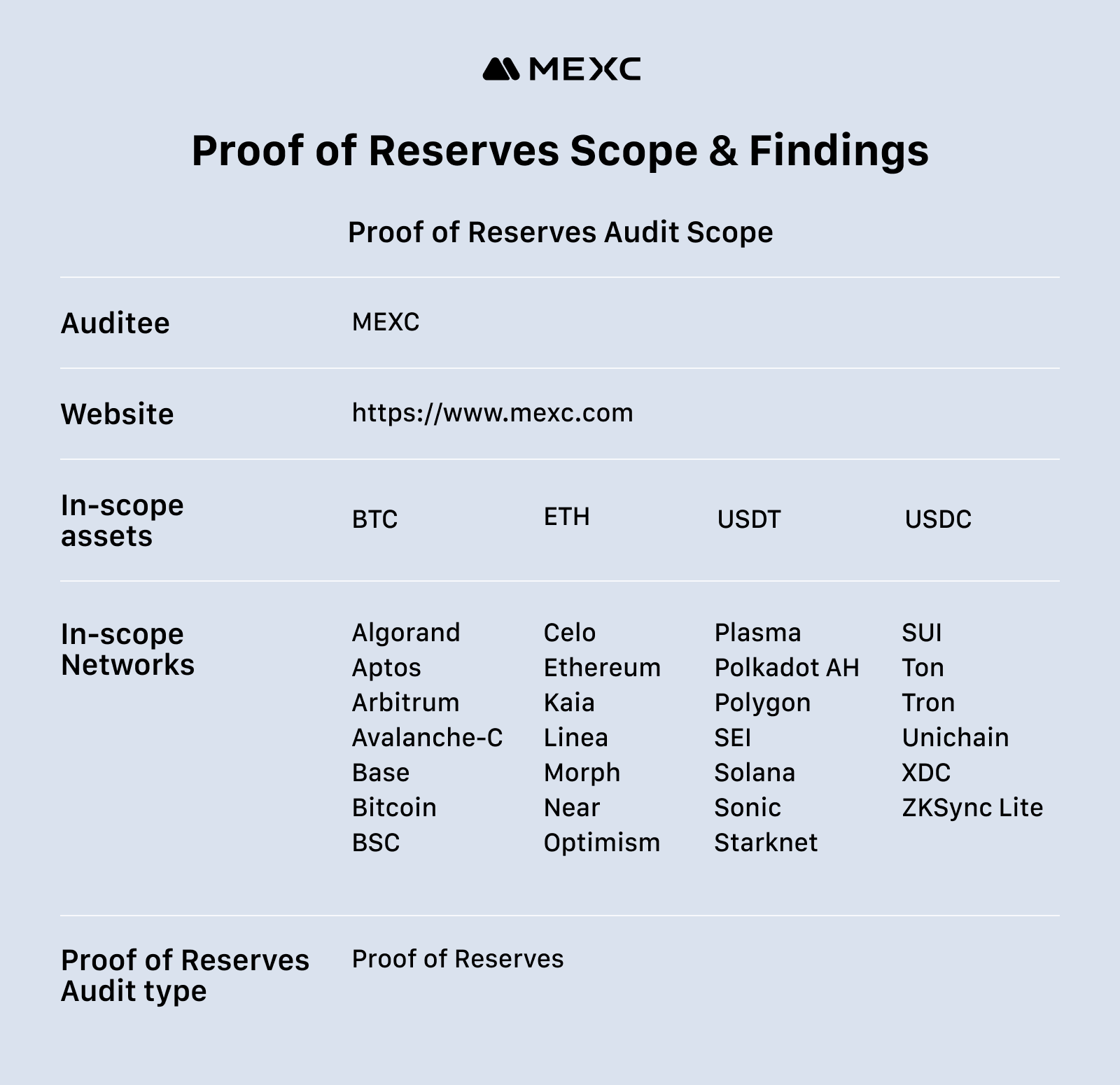

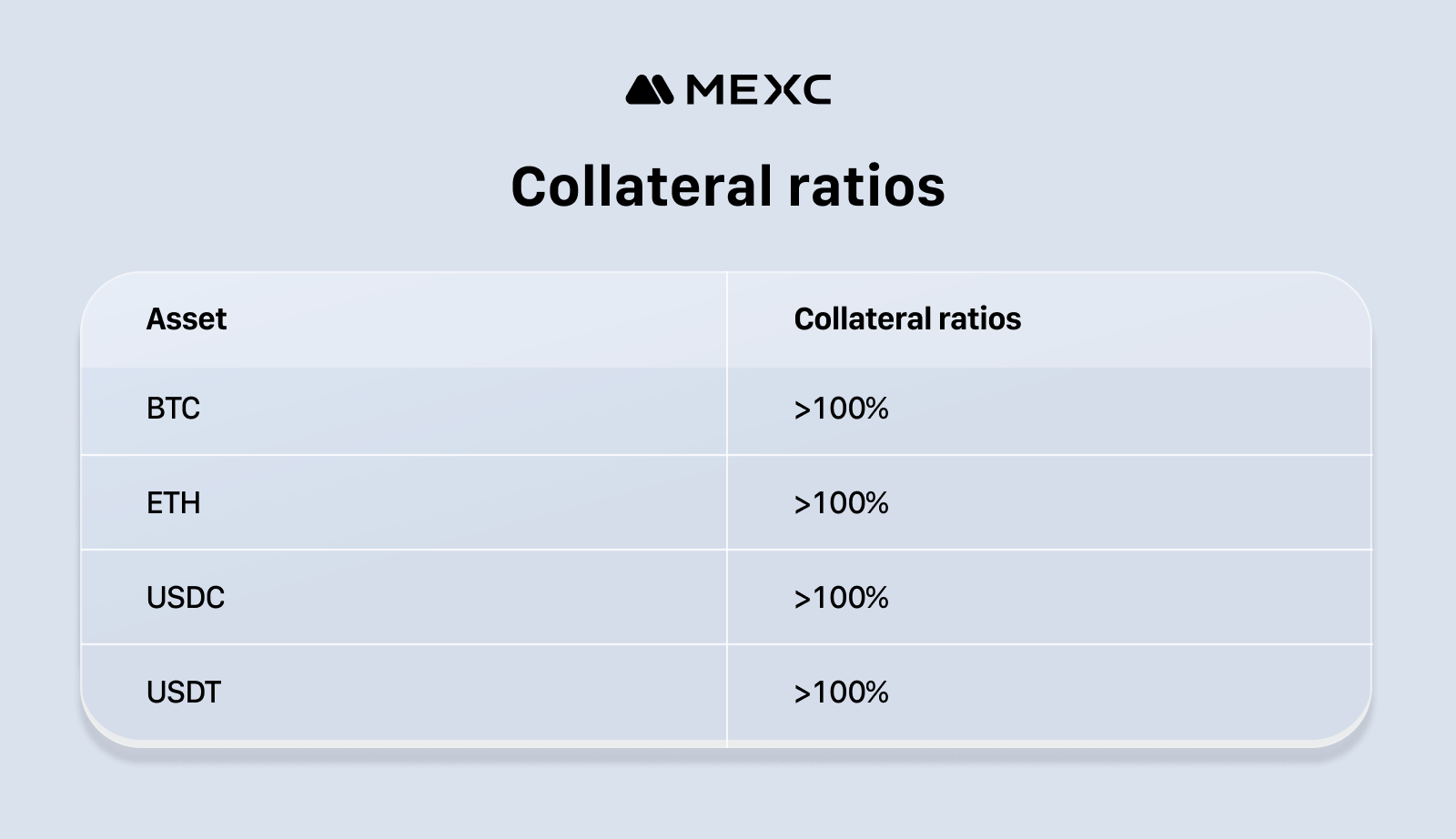

VICTORIA, Seychelles, Dec. 12, 2025 (GLOBE NEWSWIRE) -- MEXC, the fastest-growing global cryptocurrency exchange, redefining a user-first approach to digital assets through true zero-fee trading, has published its latest independent Proof of Reserves (PoR) report conducted by blockchain security and audit firm Hacken. MEXC continues to safeguard core assets while providing a fully auditable view of user balances, reinforcing our unwavering commitment to 100% fully backed user fund safety. The report, completed on November 26, 2025, confirms that MEXC holds sufficient on-chain assets to fully cover all user liabilities, with coverage ratios for major assets — including BTC, ETH, USDT, and USDC — consistently exceeding 100%.

According to the audit, Hacken conducted a comprehensive evaluation of MEXC’s reserves using industry-standard methodologies, including Proof of Liabilities, Proof of Ownership, reserve sufficiency calculations, and Merkle-tree verification. MEXC’s Proof of Reserves framework aggregates anonymized user balances and maps them to publicly verifiable on-chain holdings, enabling independent validation of solvency without compromising personal information. The auditor verified that MEXC maintains operational control over all wallets included in the assessment and confirmed that user balances are fully backed based on the assets reviewed.

The examination covered a broad range of networks, with reserve wallets identified across Bitcoin, Ethereum, Solana, TON, Tron, BNB Chain, Arbitrum, Optimism, Avalanche-C, Base, Polygon, Aptos and Sui. The report also provides detailed breakdowns of wallet addresses, balances, and asset distribution. The final reserve ratio table confirms that each major asset class is supported by reserves exceeding its liabilities.

Hacken reviewed outbound transactions from selected addresses as part of its Proof of Ownership procedures and validated the integrity of the Merkle-tree structure used to compute user liabilities. These transparency efforts are underpinned by MEXC’s continuously refreshed Proof of Reserves framework and an independently maintained protection system, giving users and counterparties verified confirmation of reserve coverage, strict asset segregation, and real-time fund accessibility.

“At MEXC, we are fully committed to transparency and security, and this report once again demonstrates our unwavering dedication to 100% user fund safety,” said Vugar Usi, COO of MEXC. “Independent Proof of Reserves audits are now a continuous, core standard practice within our operational framework. We will continue working with established auditing firms such as Hacken to ensure our users have verifiable assurance that their assets are fully backed.”

Hacken concludes that MEXC’s reserve structure demonstrates full solvency, including the accounting of off-exchange obligations. The report highlights the proper implementation of the PoR methodology, the quality of the supplied data, diversified asset holdings, and the exchange’s high level of responsibility toward its users.

“We’ve seen increased transparency demand in the crypto industry over the past year, and the results of MEXC’s audit reflect this shift,” noted a spokesperson for Hacken. “Our audit confirmed that the exchange has sufficient asset reserves and a clear reserve management structure. In an environment where trust is built only through verifiable data, MEXC demonstrates its willingness to operate transparently and back up its commitments with facts, not words.”

Hacken also emphasizes that the results serve as a “testament to the responsible financial management practices employed by MEXC, as well as the company's dedication to transparency and accountability.”

Regular Proof of Reserves audits remain central to MEXC’s long-term strategy to strengthen trust and elevate industry standards. As global demand for accountability and compliance in cryptocurrency trading grows, verified reserve transparency has become essential to build user confidence and demonstrate real financial resilience. The release of the latest independent audit by Hacken powerfully reinforces MEXC’s standing as a global benchmark for trust, transparency, and resilience—setting a gold standard for accountability in the worldwide crypto ecosystem.

About MEXC

Founded in 2018, MEXC is committed to being "Your Easiest Way to Crypto." Serving over 40 million users across 170+ countries, MEXC is known for its broad selection of trending tokens, everyday airdrop opportunities, and low trading fees. Our user-friendly platform is designed to support both new traders and experienced investors, offering secure and efficient access to digital assets. MEXC prioritizes simplicity and innovation, making crypto trading more accessible and rewarding.

MEXC Official Website| X | Telegram |How to Sign Up on MEXC

About Hacken

Hacken is a trusted blockchain security auditor on a mission to make Web3 a safer place. With a team of 60+ certified engineers, it provides solutions covering all aspects of blockchain security, such as smart contract & protocol audits, bug bounties, and security assessments. Hacken has been raising the bar for blockchain security, working with more than 1,500 Web3 projects since its inception in 2017.

For more information, visit: Hacken Website|X|LinkedIn

Photo accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/bfb12236-d1b4-439a-a798-66b7766fad1f

https://www.globenewswire.com/NewsRoom/AttachmentNg/5ecf270e-a4cf-4813-a952-9f7ba788104b

https://www.globenewswire.com/NewsRoom/AttachmentNg/dc85fb9d-9209-470e-a844-c6b6634b4eff

For media inquiries, please contact MEXC PR team: media@mexc.com