Singapore, Feb. 03, 2025 (GLOBE NEWSWIRE) -- YY Group Holding Limited (NASDAQ: YYGH) (“YY Group,” “YYGH,” or the “Company”) proudly announces the successful acquisition of Property Facility Services Pte. Ltd. ("PFS"). This strategic acquisition strengthens YY Group’s position in the Integrated Facility Management (IFM) industry and lays the groundwork for a transformative approach to facility management services.

Image credit: YY Group Holding Limited.

PFS’s well-established reputation, underpinned by 24 years of industry expertise, was a key factor in YY Group’s decision. PFS operates within an IFM market that is projected to reach USD 4.25 billion in Singapore by 2030, growing at a Compound Annual Growth Rate (CAGR) of 3.1% from 2025 to 2030 (Singapore Facility Management Market Size, Mordor Intelligence, n.d.). Globally, the IFM market, valued at USD 117.7 billion in 2023, is expected to reach USD 218.6 billion by 2032 at a CAGR of 7.12% (Integrated Facilities Management (IFM) Market Size Report 2032, n.d.), driven by technological advancements, sustainability efforts, and increased outsourcing of non-core functions..

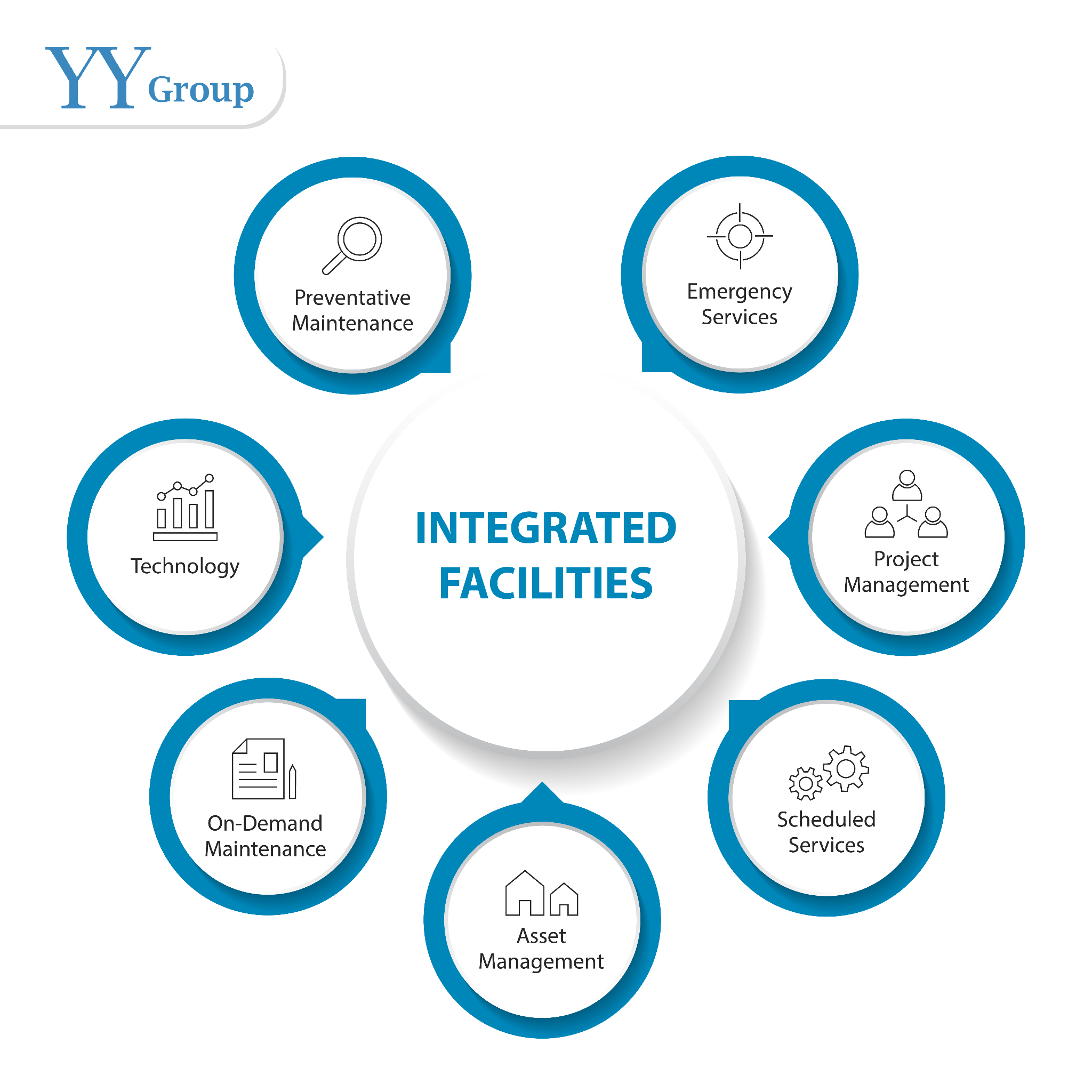

By integrating PFS with the Company’s existing cleaning division and that of Hong Ye Group Pte. Ltd., YY Group aims to create a comprehensive IFM division capable of delivering seamless, cost-effective, and sustainable solutions to its clients. The combined expertise and resources will position YY Group as a leader in Singapore’s IFM sector, offering enhanced services tailored to evolving client needs.

Image credit: Property Facility Services Pte. Ltd.

The acquisition brings significant added value to YY Group’s operations and its investors. Projections indicate that this strategic move will drive an increase in revenue by US$28 million over the next three years. This growth is attributed to the expanded service portfolio, operational efficiencies, and a strengthened market presence resulting from the integration.

Key Industry Success Metrics

To ensure the success of the new IFM division, YY Group will focus on critical performance indicators, including:

- Work Order Completion Rate: Measuring operational efficiency by tracking the percentage of timely completed tasks.

- Preventative Maintenance Compliance: Ensuring adherence to scheduled maintenance activities to minimize downtime.

- Customer Satisfaction: Regularly evaluating service quality through client feedback.

- Energy Consumption: Monitoring and optimizing energy usage to support sustainability goals.

- Space Utilization Rate: Analyzing how facilities are used to improve cost efficiency and effectiveness.

These metrics will guide YY Group’s commitment to delivering exceptional service, operational excellence, and measurable results for stakeholders.

Driving Growth Through Innovation and Value-Added Services

This acquisition aligns with YY Group’s strategy to enhance its digital and operational capabilities. Through the integration of advanced technologies and sustainable practices, YY Group is poised to meet the growing demand for intelligent and green facility management solutions.

About YY Group Holdings Limited:

YY Group Holding Limited is a Singapore-based data and technology-driven company that specializes in creating enterprise intelligent labor matching services and smart cleaning solutions. Rooted in innovation and a commitment to user-centric experiences.

For more information on the Company, please log on to https://yygroupholding.com/.

About Property Facility Services Pte Ltd:

Property Facility Services is a premier managing agent specializing in the management and maintenance of properties across Singapore. With a client-centric approach and a commitment to operational excellence, PFS has built a solid reputation for delivering efficient, reliable, and tailored property management solutions. Its extensive experience and industry knowledge make it a trusted partner for property owners and residents alike.

Investor Contact:

Phua Zhi Yong, Chief Financial Officer

YY Group

Enquiries@yygroupholding.com