RESTON, Va., March 31, 2025 (GLOBE NEWSWIRE) -- Tax season is a prime time for criminals to exploit weak identity security and commit fraud. Millions of Americans still rely on their Social Security Number (SSN) to file taxes, leaving them vulnerable. To protect taxpayers, Regula has launched the Tax Fraud Awareness Guide.

Image: Tax season is a prime opportunity for fraudsters, and it’s important to understand the risks a taxpayer faces.

To help individuals and organizations stay ahead of evolving threats, Regula, global developer of identity verification solutions, has launched the Tax Fraud Awareness Guide – a comprehensive kit for recognizing scams, securing identities, and understanding why SSN verification alone is no longer enough.

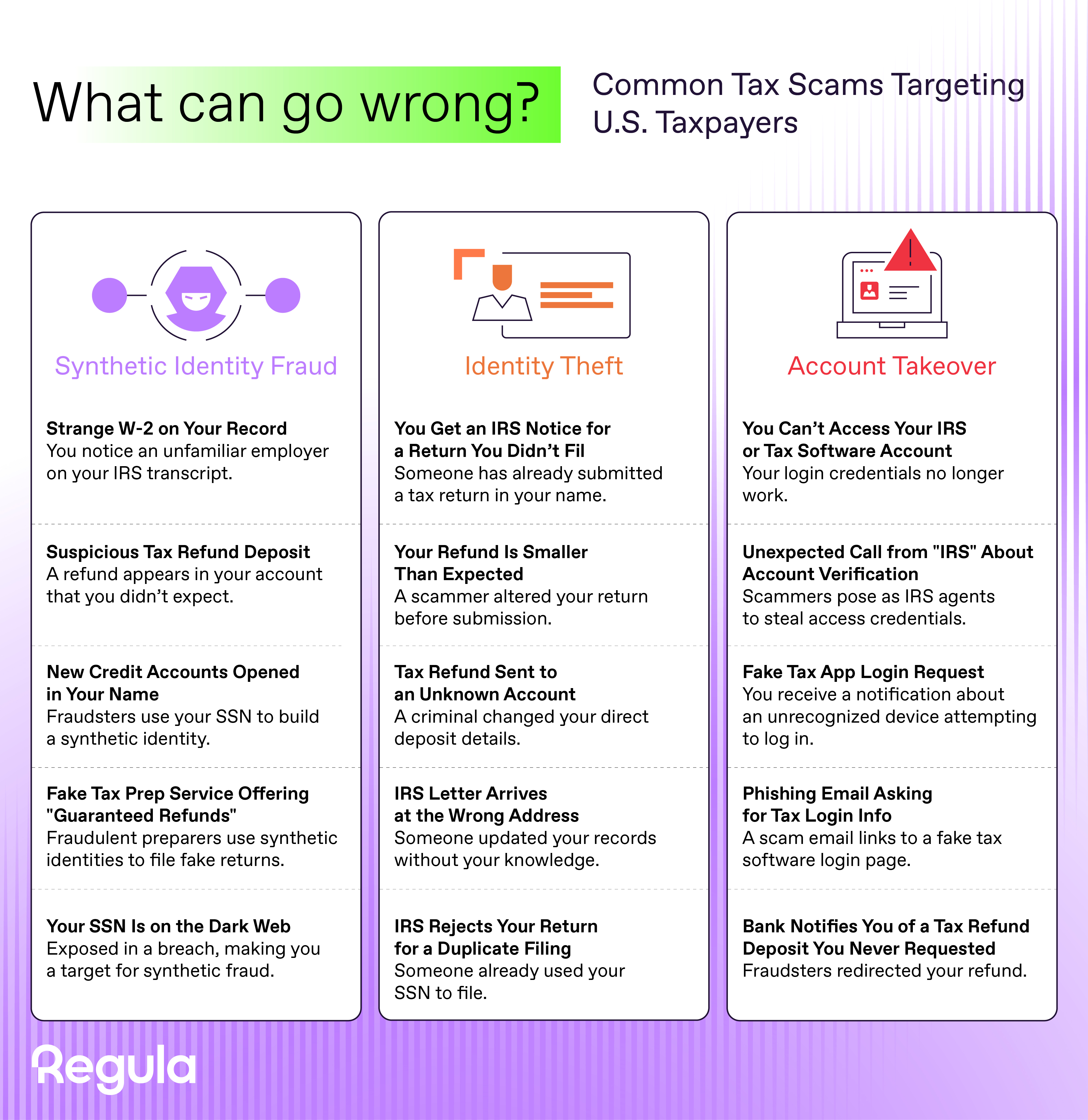

What can go wrong?

U.S. residents have seen a notable rise in "smishing" scams – SMS text messages impersonating the IRS to steal personal and financial information. While this trend, which became particularly prominent in late 2020, continues to threaten taxpayers, it’s far from the only scam they face.

The most common threats include:

- Identity Theft – Scammers use stolen personal information to submit tax returns in someone else’s name. (Read more: Identity Theft & How to Prevent It)

- Synthetic Identity Fraud – Criminals create fake identities using stolen SSNs, filing fraudulent tax returns and claiming refunds. (Read more: The Weakness of SSNs)

- Account Takeover – Hackers gain control of IRS or tax software accounts to manipulate filings and reroute refunds. (Read more: How Account Takeovers Happen)

Why SSNs are failing as a security measure

The SSN was never designed as a secure identity verification method, yet it remains central to tax filings. This has led to increased fraud risks, including:

- SSNs Are Easily Stolen – Data breaches have exposed millions of SSNs, making them readily available on the dark web.

- SSNs Are Static – Unlike passwords, SSNs can’t be changed, meaning once they’re compromised, they remain a lifelong risk.

- SSN-Based Verification is Outdated – Many tax-related services still rely on SSNs for authentication, making it easy for criminals to assume a stolen identity.

Beyond SSNs: How Identity Verification (IDV) Strengthens Tax Security

“With modern fraud tactics evolving rapidly, relying on SSNs alone is no longer enough to safeguard taxpayers,” said Henry Patishman, Executive Vice President, Identity Verification Solutions at Regula. “For example, recent SSA’s plans to strengthen identity proofing measures are a step in the right direction, but more needs to be done. Financial institutions, tax agencies, and businesses must embrace advanced identity verification solutions that go beyond static credentials.”

Advanced Identity Verification (IDV) solutions offer a range of tools to safeguard personal and financial data. Biometric verification, including facial recognition or document authentication, confirms real identities. Multi-layered security combines ID document verification, biometric checks, and fraud detection to prevent identity misuse.

Proactive Security for Taxpayers

Regula’s Tax Fraud Awareness Guide is designed to help individuals and organizations recognize and prevent fraud, going beyond SSN-based security to offer actionable solutions. The guide includes:

- An In-Depth Look at Tax Scams – How fraudsters use SSNs, fake tax documents, and phishing schemes to steal refunds.

- Why SSN Verification is No Longer Enough – Data breaches have exposed millions of SSNs, making them readily available on the dark web. (Read more: The Weakness of SSNs)

- What is the solution? – How modern identity verification (IDV) solutions provide stronger protection (Read more: How to Build an IDV System)

- Interactive Tax Fraud Bingo – A fun, educational tool to help taxpayers recognize common scam tactics.

Regula’s Tax Fraud Awareness Guide is available for free. Check the full Guide here.

About Regula

Regula is a global developer of forensic devices and identity verification solutions. With our 30+ years of experience in forensic research and the most comprehensive library of document templates in the world, we create breakthrough technologies for document and biometric verification. Our hardware and software solutions allow over 1,000 organizations and 80 border control authorities globally to provide top-notch client service without compromising safety, security, or speed. Regula has been repeatedly named a Representative Vendor in the Gartner® Market Guide for Identity Verification.

Learn more at www.regulaforensics.com.

Contact:

Kristina – ks@regulaforensics.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/eba84af5-c9c4-46bf-be21-a805611eb9cf