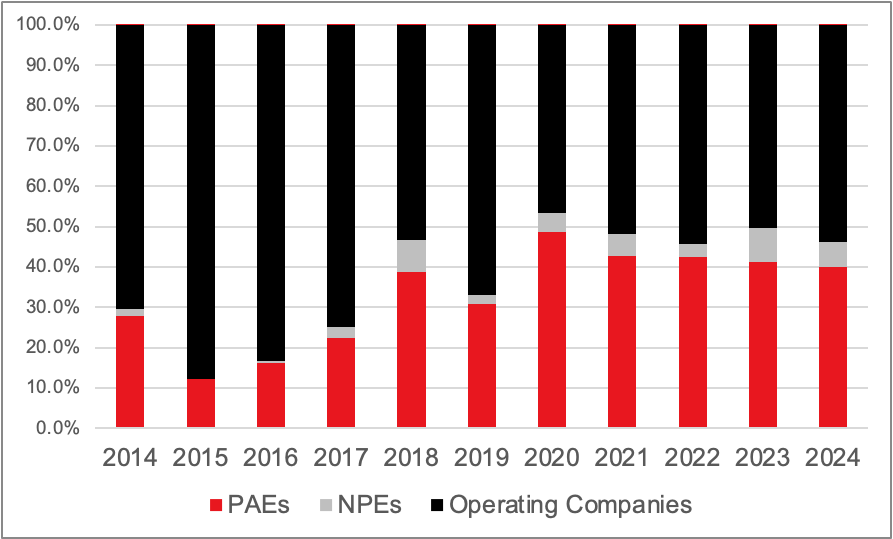

NEW YORK, Aug. 27, 2025 (GLOBE NEWSWIRE) -- LexisNexis® Legal & Professional, a leading global provider of AI-powered analytics and decision tools, today announced the release of its U.S. SEP Litigation Report 2025, showing that litigation cases involving standard-essential patents (SEPs) has risen from 118 in 2014 to 223 in 2024. With more than 200 cases a year now being filed, a growing share is driven by Patent Assertion Entities (PAEs), which account for more than 40% of recent disputes—nearly double their share from a decade ago.

This surge is fueled by rapid adoption of 4G/5G, Wi-Fi, video and audio codecs, and Qi wireless charging, alongside policy uncertainty. While no definitive federal guidance on SEP enforcement has emerged, evolving case law around injunctions, FRAND royalties, and venue dynamics continues to shape litigation strategies.

“SEP litigation in the U.S. has entered a phase of sustained volume and complexity,” said Tim Pohlmann, Managing Director Americas and Director SEP Analytics for LexisNexis® Intellectual Property Solutions. “With PAEs driving filings and AI reshaping portfolio analysis, IP professionals must transition from reactive defense to proactive, data-driven portfolio management.”

Annual U.S. SEP litigation cases by filing year and plaintiff type’s share

(PAE, NPE, Operating Company), 2014 – 2024)

The U.S. SEP Litigation Report 2025 leverages AI-powered analytics quantifying portfolio shares, and benchmarking FRAND rates to help bring clarity to U.S. patent litigation patterns.

Key Findings from the Report

- PAEs Share in SEP Disputes Increases: Almost half of all U.S. SEP litigation involves PAEs, many focused on narrow technology areas such as Wi-Fi or cellular SEPs.

- Venue Concentration: The Eastern District of Texas remains the most active forum, followed by Delaware and the Western District of Texas. The ITC is also seeing more SEP investigations, offering plaintiffs potent exclusion remedies.

- Standards in Dispute: The most litigated standards include cellular, Wi-Fi, video and audio codecs, and Qi wireless charging—impacting industries from smartphones and streaming to automotive and medical devices.

- Key Parties and Law Firms: On the plaintiff side, Devlin Law Firm and Farnan are the most active representatives, while Fish & Richardson and Gillam & Smith are among the leading defense firms. Defendants include major handset makers (Samsung, Apple, Google), computer OEMs (Dell, Lenovo, HP), and carriers (Verizon, T-Mobile, AT&T).

For licensors, the report highlights how to benchmark portfolios, track competitor enforcement, and leverage data-driven analytics to strengthen FRAND positions. For licensees, it offers visibility into litigation waves, plaintiff activity, and venue trends to better anticipate risks and prepare defense strategies. By presenting both perspectives, the U.S. SEP Litigation Report 2025 helps reduce information asymmetry in FRAND negotiations, enabling more transparent, predictable, and efficient outcomes for all parties.

The LexisNexis® U.S. SEP Litigation Report 2025 draws on data from LexisNexis® IPlytics™ and the Global Patent Litigation Database, analyzing U.S. cases from 2014–2024 across cellular, Wi-Fi, video, and audio codecs, IETF, JEDEC, and Qi wireless charging standards.

The report provides a breakdown of SEP litigation by filing date and plaintiff type (PAE, NPE, operating company) and includes detailed rankings of the top 50 SEP plaintiffs and defendants by total case count and by standard. It also profiles the top 50 law firms representing plaintiffs and defendants, ranked by overall caseload and standard-specific activity, and highlights the top 10 courts by average annual SEP case volume and growth rates. Methodological notes on AI-enhanced essentiality estimates are included, along with strategic guidance for SEP stakeholders on applying data-driven portfolio management, objective FRAND benchmarks, venue-specific tactics, transparency initiatives like Cellular Verified, and ongoing refinement of essentiality assessments.

For more details and to access the full premium report, visit: www.lexisnexisip.com/us-sep-litigation-trends

About LexisNexis Legal & Professional

LexisNexis® Legal & Professional provides legal, regulatory, and business information and analytics that help customers increase their productivity, improve decision-making, achieve better outcomes, and advance the rule of law around the world. As a digital pioneer, the company was the first to bring legal and business information online with its Lexis® and Nexis® services. LexisNexis Legal & Professional, which serves customers in more than 150 countries with 11,800 employees worldwide, is part of RELX, a global provider of information-based analytics and decision tools for professional and business customers.

LexisNexis® Intellectual Property Solutions brings clarity to innovation for businesses worldwide. We enable innovators to accomplish more by helping them make informed decisions, be more productive, comply with regulations, and ultimately achieve a competitive advantage for their business. Our broad suite of workflow and analytics solutions (LexisNexis® PatentSight+™, LexisNexis® Classification, LexisNexis® TechDiscovery, LexisNexis® IPlytics™, LexisNexis PatentOptimizer®, LexisNexis PatentAdvisor®, and LexisNexis TotalPatent One®, LexisNexis® IP DataDirect), enables companies to be more efficient and effective at bringing meaningful innovations to our world. We are proud to directly support and serve these innovators in their endeavors to better humankind.

The shares of RELX PLC, the parent company, are traded on the London, Amsterdam and New York Stock Exchanges using the following ticker symbols: London: REL; Amsterdam: REN; New York: RELX.

The market capitalization is approximately £72.6bn, €83.2bn, $97.5bn.

*Note: Current market capitalization can be found at http://www.relx.com/investors

Media Contact

Andrew Weinstein

Andrew.Weinstein@LexisNexis.com

LexisNexis | Intellectual Property Solutions

Bringing clarity to innovation

Name: Andrew Weinstein Email: Andrew.Weinstein@LexisNexis.com Job Title: PR Consultant