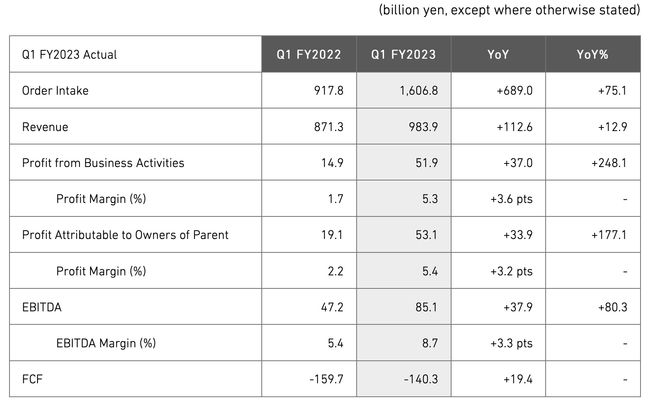

TOKYO, Aug 4, 2023 - (JCN Newswire) - Mitsubishi Heavy Industries (TSE Code: 7011) announced that order intake rose 75.1% year-over-year to YEN1,606.8 billion in the quarter ended June 30, 2023. Revenue rose 12.9% to YEN983.9 billion year-over-year, resulting in profit from business activities (business profit) of YEN51.9 billion, a 248.1% increase from the previous fiscal year, which represents a profit margin of 5.3%. Profit attributable to owners of parent (net income) was YEN53.1 billion, an increase of 177.1% year-over-year, with a profit margin of 5.4%. EBITDA was YEN85.1 billion, an 80.3% increase from Q1 FY2022, with an EBITDA margin of 8.7%, up 3.3 percentage points year-over-year.

|

|

|

|

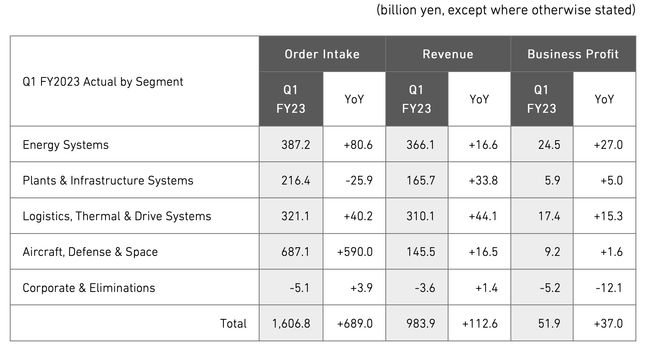

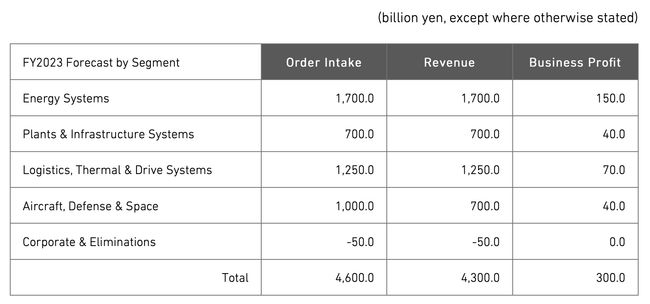

Large orders growth in Energy Systems was driven by Gas Turbine Combined Cycle (GTCC), which continues to see strong demand for both new builds and after-sales services. Business profit in the segment increased by YEN27.0 billion YoY due to a reduction in one-time charges in the Thermal Power businesses as well as revenue growth and improved project margins in GTCC.

In Plants & Infrastructure Systems, revenue increased by YEN33.8 billion YoY due to contributions from Metals Machinery and Engineering, while business profit improved by YEN5.0 billion resulting from increased revenue in Metals Machinery as well as positive developments in Engineering and Machinery Systems' project mix.

In Logistics, Thermal & Drive Systems, successful passthrough of cost inflation to sales prices mainly in Logistics Systems and Heating, Ventilation & Air Conditioning (HVAC) led to 14.3% and 16.6% YoY increases in order intake and revenue, respectively. Cost passthroughs in these businesses also helped to raise the segment's business profit by YEN15.3 billion YoY.

Most notable this quarter is the striking growth in Aircraft, Defense & Space order intake, specifically in Defense & Space, which saw orders rise by YEN584.1 billion YoY. This is due to large orders for missile defense systems from Japan's Ministry of Defense as the country seeks to improve its capabilities in this area.

CFO Message:

"MHI had a strong first quarter this fiscal year, achieving large year-over-year increases especially in order intake and profit," Hisato Kozawa, MHI Chief Financial Officer commented.

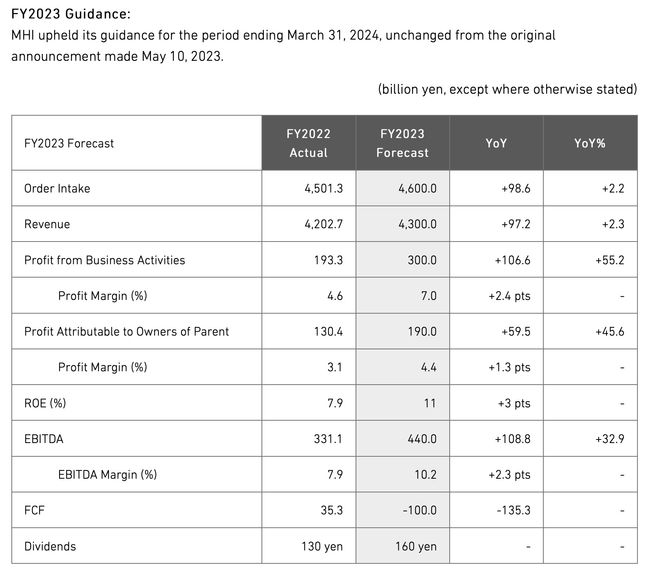

Kozawa continued, "We are leveraging key market positions and robust capabilities in many important product areas to grow our order book, and we are particularly pleased with our gains in GTCC and Defense & Space. In parallel, we are improving revenue mix and executing on cost passthroughs among other profitability improvement initiatives. During the first quarter, the yen traded more weakly against foreign currencies than initially forecast, which in some cases gave a boost to our earnings. However, depreciation of the yen has proved to be a double-edged sword, leading to increased energy and other costs within Japan. As such, we will continue to monitor global market conditions closely. Finally, we have maintained our initial guidance for the full fiscal year, and we are confident in our ability to deliver on these commitments over the coming quarters."

About MHI Group

Mitsubishi Heavy Industries (MHI) Group is one of the world's leading industrial groups, spanning energy, smart infrastructure, industrial machinery, aerospace and defense. MHI Group combines cutting-edge technology with deep experience to deliver innovative, integrated solutions that help to realize a carbon neutral world, improve the quality of life and ensure a safer world. For more information, please visit www.mhi.com or follow our insights and stories on spectra.mhi.com.

Note regarding forward looking statements:

Forecasts regarding future performance as outlined in these materials are based on judgments made in accordance with information available at the time they were prepared. As such, these projections include risk and uncertainty. Investors are recommended not to depend solely on these projections when making investment decisions. Actual results may vary significantly due to a number of factors, including, but not limited to, economic trends affecting the Company's operating environment, fluctuations in the value of the yen to the U.S. dollar and other foreign currencies, and Japanese stock market trends. The results projected here should not be construed in any way as a guarantee by the Company.

Source: Mitsubishi Heavy Industries, Ltd.

Copyright 2023 JCN Newswire . All rights reserved.