TOKYO, Mar 22, 2024 - (JCN Newswire) - Japan’s only international payment brand JCB Co., Ltd. (“JCB”) has issued a white paper on the carbon impact of individual transactions made using various payment methods in Japan. The carbon emissions were calculated by Your Arbor Inc. (“Arbor”).

The Sustainable Development Goals (SDGs) and climate action outlined by the international community are gaining momentum, and are being systematically implemented in Japan. Simultaneously, there is a substantial increase in interest at the individual consumer level. However, JCB acknowledges that further discussion is needed on how this can contribute to the SDGs and climate action.

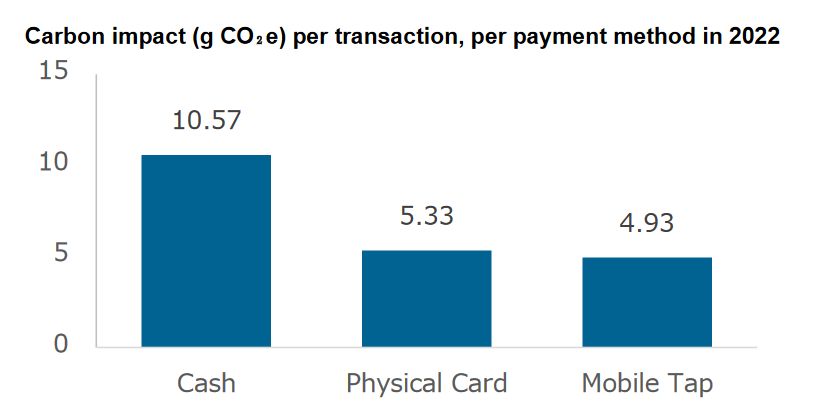

Given this, JCB believes it is important to objectively and quantitatively demonstrate how cashless payments can contribute to achieving a better society for consumers and the associated ecosystem.

As a first step in this effort, JCB and Arbor have conducted joint research to calculate and analyze the carbon dioxide (CO2e) emissions associated with consumer payment activities.

Following the recommended guidelines for the Life Cycle Assessment (LCA)*1 methodology, this white paper uses a comprehensive life cycle model for each payment method, mapping out the stages from raw material extraction to disposal, while assigning energy consumption and emission factors to each stage. The stages of the payment methods have been divided into 3 subsystems: Production phase, Operation phase, and End-of-Life (EOL) phase.

An example of the calculated result is as follows:

The white paper also includes the data and calculation logic used to determine CO2 emissions by payment method. The calculations are based on the principles and framework of the international standards ISO 14040, 14044, and 14064 on the LCA evaluation method.

![]() To read the white paper, please visit here.

To read the white paper, please visit here.

*1 LCA (Life Cycle Assessment): A widely used evaluation method for the quantitative assessment of the environmental impacts of products and services over their entire lifecycle.

About Arbor

Arbor provides carbon impact calculation technology for various businesses, including product and supply chain analysis. Arbor’s technology not only involves data analysis and calculation but also offers insights based on expert guidance. They assist businesses in visualizing CO2 emissions and providing support for reduction efforts. For more information, please visit: www.arbor.eco/

About JCB

JCB is a major global payment brand and a leading credit card issuer and acquirer in Japan. JCB launched its card business in Japan in 1961 and began expanding worldwide in 1981. Its acceptance network includes about 46 million merchants around the world. JCB Cards are issued mainly in Asian countries and territories, with more than 156 million cardmembers. As part of its international growth strategy, JCB has formed alliances with hundreds of leading banks and financial institutions globally to increase its merchant coverage and cardmember base. As a comprehensive payment solution provider, JCB commits to providing responsive and high-quality service and products to all customers worldwide. For more information, please visit: www.global.jcb/en/

Contact

Ayaka Nakajima

Corporate Communications

Tel: +81-3-5778-8353

Email: jcb-pr@jcb.co.jp

Source: JCB

Copyright 2024 JCN Newswire . All rights reserved.